Choosing the right mortgage lender can be a daunting task, especially with so many options available. You want to find a lender who offers competitive rates, transparent fees, and exceptional customer service, all while making the process as smooth as possible. This is where our comprehensive guide to Top Mortgage Lenders Compared comes in. We’ve done the research and analyzed the market to present you with the leading lenders in the industry, outlining their strengths and weaknesses to help you make an informed decision.

Whether you’re a first-time homebuyer, looking to refinance your existing mortgage, or seeking a loan for a new construction project, our guide provides valuable insights into key factors like interest rates, loan types, closing costs, and customer satisfaction. We’ll walk you through the important considerations for each lender, empowering you to select the perfect fit for your individual needs and financial goals.

Understanding Different Mortgage Types: Fixed-Rate, ARM & More

Choosing the right mortgage is a crucial step in the home buying process. Understanding the different types available can help you find the best fit for your financial situation and goals. Two of the most common types are fixed-rate mortgages and adjustable-rate mortgages (ARMs).

Fixed-rate mortgages offer consistent monthly payments for the entire loan term. Your interest rate remains the same, providing predictability and financial stability. This option is ideal for borrowers seeking predictable payments and wanting to avoid potential interest rate fluctuations.

Adjustable-rate mortgages (ARMs) typically have a lower introductory rate than fixed-rate mortgages. However, the interest rate adjusts periodically, usually every year or every five years, based on a specific index. This can lead to lower payments in the early years, but it also carries the risk of higher payments later on if interest rates rise.

Other mortgage types include:

- Jumbo mortgages: These loans are larger than conforming loan limits and are often used for high-value properties.

- FHA loans: Backed by the Federal Housing Administration, these loans have more lenient qualifying requirements and lower down payments, making homeownership more accessible.

- VA loans: Available to eligible veterans, active military personnel, and surviving spouses, these loans offer no down payment and competitive interest rates.

The best mortgage type for you depends on your individual circumstances and financial goals. Consider your budget, risk tolerance, and the length of time you plan to stay in the home. Consulting with a mortgage lender can provide personalized guidance and help you choose the option that aligns with your needs.

Factors to Consider When Choosing a Lender

Securing a mortgage is a significant financial commitment, and choosing the right lender is crucial for a smooth and successful process. With numerous lenders available, it’s essential to consider several factors to ensure you find the best fit for your needs.

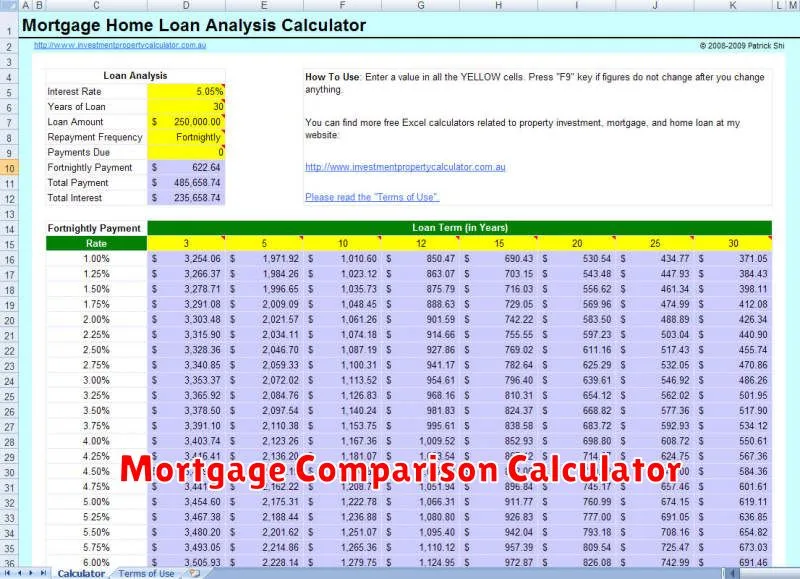

Interest Rates and Fees: Interest rates are a primary consideration. Compare rates from multiple lenders to find the most competitive offer. Remember to factor in origination fees, closing costs, and any other associated fees.

Loan Programs: Different lenders offer various loan programs, such as conventional, FHA, VA, or USDA loans. Evaluate your financial situation and choose a program that aligns with your eligibility and goals.

Loan Terms: Consider the loan term, which determines the repayment period. A longer term may result in lower monthly payments but lead to higher overall interest costs. Shorter terms lead to faster repayment but higher monthly payments.

Customer Service and Reputation: Research lenders’ customer service reputation and online reviews. Look for lenders known for their responsiveness, transparency, and overall customer satisfaction.

Technology and Convenience: Modern lenders often offer online platforms, mobile apps, and other digital tools for convenient mortgage management. Evaluate the digital capabilities and user-friendliness of potential lenders.

Pre-approval: Before shopping for a home, obtain pre-approval from a lender. Pre-approval demonstrates your financial readiness to potential sellers and can give you a better idea of your borrowing power.

Ultimately, choosing a mortgage lender involves a careful evaluation of your individual needs and financial situation. By considering these factors, you can increase your chances of finding a lender that provides a competitive mortgage and a positive borrowing experience.

Interest Rates and APR: Decoding the Numbers

When you’re looking for a mortgage, interest rates and Annual Percentage Rate (APR) are two key figures to understand. While they seem similar, they have distinct meanings and can significantly impact your overall borrowing cost.

Interest rate is the percentage charged on the principal amount of your mortgage loan. It’s a fixed or variable rate that determines how much interest you pay over the life of the loan.

APR, on the other hand, incorporates the interest rate plus other fees and charges associated with your loan, such as origination fees, mortgage insurance premiums, and closing costs. It represents the true cost of borrowing money.

For example, a mortgage with a 5% interest rate might have an APR of 5.5%. The difference is due to the additional fees factored into the APR calculation. This means that while the interest rate seems low, you’ll be paying a higher overall cost due to the additional fees included in the APR.

When comparing mortgages, it’s essential to focus on the APR rather than just the interest rate. A lower APR indicates a more affordable loan, even if the interest rate itself appears lower. By understanding the difference between interest rates and APR, you can make a more informed decision about your mortgage financing.

Loan Fees and Closing Costs: Know What to Expect

When you’re shopping for a mortgage, it’s important to understand the various fees and closing costs you’ll be responsible for. These costs, which can add up to thousands of dollars, are often lumped into the “closing costs” category. The fees can seem daunting, but understanding what they are and why you’re paying them can help ease the process.

Origination fees are charged by the lender to process your loan application. They are typically a percentage of the loan amount and cover administrative costs. Appraisal fees are charged to get an independent assessment of the home’s value. Title search fees are used to ensure that the seller has clear ownership of the property. Title insurance protects you from financial losses if there are any issues with the title, such as liens or encumbrances.

In addition to these common fees, you might also encounter recording fees, survey fees, prepaid interest, escrow fees, and mortgage insurance premiums. Some of these fees are negotiable, so it’s worth asking your lender if they can be lowered.

It’s important to factor in these closing costs when you’re budgeting for your mortgage. Make sure to ask your lender for a complete breakdown of all the fees before you sign any loan documents.

Customer Service and Reputation: Reviews & Ratings

When choosing a mortgage lender, it’s crucial to consider their customer service and reputation. A positive experience during the loan process can make a huge difference, especially when navigating a complex financial transaction.

One way to assess a lender’s customer service and reputation is by checking online reviews and ratings. Websites like Zillow, Bankrate, and NerdWallet offer valuable insights from real customers.

Pay attention to:

- Response times: How quickly does the lender respond to inquiries?

- Communication clarity: Is the lender transparent and easy to understand?

- Problem resolution: How effectively does the lender address customer issues?

- Overall satisfaction: What is the general sentiment of customers towards the lender?

Remember that reviews can be subjective. It’s wise to read a variety of reviews to get a balanced perspective. Additionally, consider looking at the lender’s Better Business Bureau (BBB) rating, which provides an objective assessment of their track record.

By carefully considering customer service and reputation, you can select a lender that not only provides a competitive interest rate but also offers a smooth and stress-free experience.

Online vs. Traditional Lenders: Weighing the Pros and Cons

The mortgage market is overflowing with options, ranging from established banks to online lenders. Each has its unique advantages and drawbacks, so choosing the right lender depends on your individual needs and preferences.

Online lenders often excel in speed and convenience. Their digital platforms allow for quick applications and transparent communication. They may offer competitive rates and flexible terms, sometimes exceeding those of traditional banks. However, they might lack the personalized service and expertise of a physical branch.

Traditional lenders, like banks and credit unions, often have a wider range of products and services, including personalized advice and local expertise. They may be better equipped to handle complex mortgage situations and offer more flexible payment options. However, their application process can be slower and more cumbersome compared to online lenders.

Ultimately, choosing between online and traditional lenders comes down to personal priorities. If you value speed, convenience, and competitive rates, an online lender might be the ideal choice. But if you prefer personalized advice, local expertise, and a wider range of products, a traditional lender may be more suitable.

Comparing Loan Options: Pre-Qualification vs. Pre-Approval

When you’re ready to buy a home, it’s important to understand the differences between pre-qualification and pre-approval for a mortgage. Both can help you get a better idea of how much you can borrow, but they offer different levels of commitment.

Pre-Qualification

A pre-qualification is a quick estimate of how much you can borrow, based on your self-reported financial information. This process is usually done online or over the phone and can take just a few minutes. Pre-qualification does not involve a credit check, so it won’t impact your credit score. However, it’s not a guarantee of approval for a loan.

Pre-Approval

A pre-approval, on the other hand, is a more formal process that requires a credit check and a review of your financial documents. It involves a hard inquiry, which can slightly lower your credit score. The lender will analyze your income, debts, and credit history to determine your eligibility and the loan amount you qualify for. A pre-approval is more likely to be accepted by sellers, as it demonstrates your serious intent to purchase a home.

Which One Is Right For You?

If you’re just starting to explore your homebuying options, a pre-qualification can give you a general idea of your affordability. If you’re ready to make an offer on a home, a pre-approval is a crucial step to show sellers that you’re a serious buyer.

Ultimately, the best choice for you depends on your individual circumstances. If you’re unsure, it’s always best to consult with a mortgage lender to get personalized advice.

Government-Backed Loans: FHA, VA & USDA Options

Government-backed loans are a great option for borrowers who may not meet the stringent requirements of conventional loans. These loans are insured or guaranteed by the government, making them more appealing to lenders and often offering more flexibility to borrowers. Let’s delve into the three main types of government-backed loans: FHA, VA, and USDA.

FHA Loans, insured by the Federal Housing Administration, are designed to make homeownership accessible to a wider range of borrowers. FHA loans typically require lower credit scores and down payments compared to conventional loans. They also offer flexible income guidelines and allow for the financing of certain closing costs.

VA Loans, guaranteed by the Department of Veterans Affairs, are specifically for eligible veterans, active-duty military personnel, and surviving spouses. These loans offer no down payment requirement, competitive interest rates, and no private mortgage insurance (PMI) requirements.

USDA Loans, backed by the United States Department of Agriculture, are geared towards borrowers in rural areas. These loans offer low interest rates, minimal down payment requirements, and flexible credit score guidelines. The USDA program aims to promote homeownership and economic development in rural communities.

While each program has its unique advantages, it’s crucial to understand the eligibility requirements, loan terms, and specific program guidelines. It’s always wise to consult with a mortgage professional to determine which program best suits your individual financial situation and circumstances.

Getting Pre-Approved: A Smart First Step

Before you start house hunting, getting pre-approved for a mortgage is a crucial first step. It’s like having a shopping budget in hand—you know exactly what you can afford. Pre-approval gives you a clear idea of your buying power, allowing you to set realistic expectations and focus your search on properties within your reach. Not only that, but it also demonstrates to sellers that you’re a serious buyer, making your offer more competitive.

The pre-approval process involves providing your financial information to a lender, who will then assess your creditworthiness and determine how much they’re willing to loan you. This process typically involves a soft credit inquiry, which won’t affect your credit score. It’s a relatively quick and easy process, and it can give you a significant advantage in the competitive housing market.

So, before you step foot in an open house, consider getting pre-approved. It’s a smart move that can save you time, stress, and ultimately, help you secure your dream home.

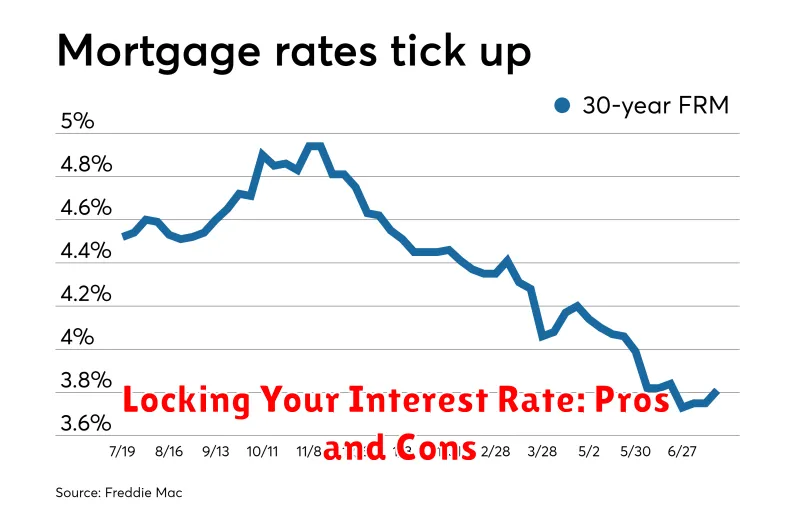

Locking Your Interest Rate: Pros and Cons

When you’re getting a mortgage, one of the most important decisions you’ll make is whether or not to lock in your interest rate. Locking your rate means securing a specific interest rate for a set period of time, typically 30 to 60 days. This can be a smart move, especially if you’re concerned about rising interest rates. However, it’s not always the best option, and there are some potential downsides to consider.

Here are some of the pros of locking your interest rate:

- Rate certainty: You know exactly how much your monthly mortgage payments will be, which can be reassuring and help with budgeting.

- Protection from rising rates: If interest rates go up, you’ll be protected from those higher rates.

- Peace of mind: You can relax knowing that your rate is secure, and you won’t have to worry about shopping around for a new loan.

Here are some of the cons of locking your interest rate:

- Cost: Locking your rate typically comes with a fee, and you might miss out on a potentially lower rate if rates drop.

- Flexibility: Once you lock your rate, you’re committed to that rate, even if rates go down.

- Time commitment: Locking your rate ties you down for a set period of time, and you may not be able to close your loan on time.

Ultimately, the decision of whether or not to lock your interest rate is a personal one. There’s no right or wrong answer, and it depends on your individual circumstances and risk tolerance. If you’re concerned about rising interest rates, locking your rate might be a good option. However, if you’re willing to take a chance and see if rates might go down, you might be better off waiting.

It’s always a good idea to talk to a mortgage lender or financial advisor to discuss your options and decide what’s best for you.