Are you considering selling your investment properties? It’s a big decision that requires careful consideration, especially when it comes to the tax implications. Understanding the tax landscape is crucial to maximizing your profits and minimizing your tax liability. Whether you’re a seasoned real estate investor or just starting, this comprehensive guide will equip you with the knowledge you need to navigate the complexities of selling investment properties and unlock the financial benefits.

From capital gains taxes to depreciation recapture, we’ll delve into the key tax implications associated with selling your investment properties. We’ll provide practical advice on how to structure your sales, utilize tax-saving strategies, and optimize your tax outcomes. This guide is designed to empower you with the necessary insights to make informed decisions and achieve your financial goals.

Understanding Capital Gains Tax on Real Estate

When you sell a real estate investment property, you’re likely to face capital gains tax. This is a tax on the profit you make from the sale, and it can be a significant expense. Understanding how capital gains tax works is crucial for maximizing your returns on your investment property.

Capital gains are calculated by subtracting your adjusted cost basis from the selling price. Your adjusted cost basis includes the original purchase price, any improvements made to the property, and any closing costs. Any expenses related to the sale, such as real estate commissions, are deducted from the selling price to calculate the actual profit.

The tax rate you pay on capital gains depends on your tax bracket and how long you’ve owned the property. If you’ve held the property for more than a year, it’s considered a long-term capital gain and taxed at a lower rate than short-term capital gains, which are taxed at your ordinary income tax rate. The long-term capital gains rate can vary from 0% to 20%, depending on your income level.

It’s important to note that there are several exemptions and deductions that can help reduce your capital gains tax liability. For example, you may be able to deduct certain expenses related to the sale, such as advertising costs and legal fees. There’s also the 1031 exchange, which allows you to defer capital gains tax by reinvesting the proceeds from the sale into another like-kind property.

Understanding the intricacies of capital gains tax can be overwhelming. It’s always advisable to consult with a qualified tax professional who can provide personalized guidance based on your specific circumstances. They can help you strategize to minimize your tax burden and maximize your profits from selling your investment property.

Depreciation Recapture: What You Need to Know

When you sell an investment property, you’ll likely encounter a tax implication known as depreciation recapture. This occurs because you’ve been deducting depreciation expenses on your taxes, which effectively reduced your taxable income. Now, when you sell, the IRS wants a portion of those savings back.

Think of it like this: you’ve been claiming a lower taxable income due to depreciation, so when you sell, the IRS will tax the “recaptured” depreciation as ordinary income, potentially at a higher rate than your capital gains tax.

Here’s the breakdown:

- You’ve been deducting depreciation on your rental property throughout its ownership.

- The depreciation expense reduced your taxable income.

- When you sell, the IRS will tax a portion of that depreciation as ordinary income.

- The amount of depreciation recaptured depends on the difference between the sale price and your adjusted basis in the property, accounting for depreciation.

Why does this happen?

Depreciation is a non-cash expense, meaning you didn’t actually pay anything out of pocket. However, it allowed you to reduce your tax burden. By recapturing the depreciation, the IRS ensures you don’t get a tax advantage from deducting a non-cash expense.

Example: Let’s say you bought a rental property for $200,000, and you’ve been deducting depreciation on the building’s value for $10,000 per year for 5 years. This means you’ve deducted a total of $50,000 in depreciation. When you sell the property, you’ll likely have to recapture that $50,000 of depreciation as ordinary income. This could affect your overall tax liability.

Understanding depreciation recapture is crucial for navigating the tax implications of selling your investment property. If you’re uncertain, consulting a tax professional is always a good idea.

Strategies to Minimize Capital Gains Taxes

Selling an investment property can be a significant financial event, but it’s crucial to understand the tax implications. Capital gains taxes can take a considerable chunk out of your profits, but there are strategies to minimize their impact. Here’s a breakdown of effective approaches:

1. Utilize the Long-Term Capital Gains Rate: Holding your investment property for over a year qualifies you for the long-term capital gains rate, which is generally lower than the short-term rate. This simple strategy can significantly reduce your tax burden.

2. Capital Losses: If you experience a capital loss on the sale of an investment property, you can offset it against other capital gains, reducing your overall tax liability. This strategy is particularly helpful if you have realized capital gains from other investments in the same year.

3. Tax-Deferred Exchanges: Consider a 1031 exchange, which allows you to defer paying capital gains taxes by reinvesting the proceeds from the sale of your investment property into a similar property of equal or greater value. This strategy can be beneficial if you plan to continue investing in real estate.

4. Depreciation Recapture: Remember that depreciation deductions you claimed on your investment property will be recaptured as ordinary income at the time of sale. This means you’ll pay taxes on the depreciation amount at your regular income tax rate. However, you can minimize this impact by strategically using the depreciation deductions during your ownership period.

5. Consult a Tax Professional: Navigating tax implications can be complex, especially when dealing with investment properties. A qualified tax professional can help you determine the most effective strategies to minimize your capital gains taxes, based on your individual circumstances.

1031 Exchange: Deferring Taxes Through Property Swaps

One strategy for investors looking to sell their investment properties is the 1031 exchange, also known as a like-kind exchange. This IRS code section allows you to defer capital gains taxes when selling investment property by reinvesting the proceeds into a new, similar property. Essentially, you can swap one investment property for another of equal or greater value without having to pay taxes on the capital gains until you eventually sell the new property.

To qualify for a 1031 exchange, the properties must be considered “like-kind,” meaning they must be similar in nature and used for similar purposes. This doesn’t mean the properties have to be identical, but they should fall within the same asset class. For example, you could exchange a commercial building for another commercial building, or an apartment complex for a retail center. The exchange must be completed within a specific timeframe outlined by the IRS.

There are several benefits to utilizing a 1031 exchange:

- Tax Deferral: By deferring capital gains taxes, you can reinvest more of your proceeds into a new property, potentially increasing your overall returns.

- Growth Potential: You can potentially acquire a property with greater appreciation potential or a better location.

- Flexibility: The 1031 exchange allows you to upgrade, downgrade, or even expand your investment portfolio.

However, it’s crucial to remember that a 1031 exchange is not a tax avoidance strategy but a deferral method. You’ll still eventually have to pay taxes on the capital gains, but you’ll do so when you finally sell the replacement property. It is important to consult with a qualified tax professional to ensure you understand the intricacies and eligibility requirements for a 1031 exchange before proceeding.

Tax Benefits of Opportunity Zones

Opportunity Zones are a powerful tool for investors looking to unlock tax benefits while contributing to economically distressed communities. Established by the Tax Cuts and Jobs Act of 2017, these zones provide substantial tax advantages to investors who reinvest capital gains into designated areas.

Here’s a breakdown of the key tax benefits associated with Opportunity Zones:

- Deferred Capital Gains Tax: Investors can defer paying capital gains tax until the earlier of the sale of the Opportunity Zone investment or December 31, 2026. This provides a valuable opportunity to postpone tax liabilities and potentially reinvest the deferred gains into other ventures.

- Step-Up in Basis: If an investment is held within the Opportunity Zone for at least 10 years, investors can benefit from a step-up in basis. This effectively reduces the capital gains tax liability upon eventual sale.

- Permanent Exclusion of Capital Gains: Investors can permanently exclude up to 15% of their capital gains if they hold their Opportunity Zone investment for at least 10 years. This provides a significant tax savings opportunity for long-term investments.

It’s important to note that Opportunity Zone investments require careful planning and consideration. There are specific eligibility requirements and holding periods to meet, and the tax benefits are not automatic. Consult with a qualified tax advisor to determine if Opportunity Zones align with your investment goals and strategies.

Reporting the Sale of Your Investment Property

When you sell an investment property, you’ll need to report the sale on your tax return. This involves calculating your capital gain or loss and reporting it on the appropriate form. The good news is that you can often reduce your tax liability by taking advantage of various deductions and exemptions.

Here’s a breakdown of how to report the sale of your investment property:

1. Determine Your Capital Gain or Loss

Your capital gain or loss is the difference between the sale price and your adjusted basis in the property. Your adjusted basis includes your original purchase price, plus any improvements or additions you made to the property, minus any depreciation you claimed on the property.

2. Report Your Capital Gain or Loss

You’ll need to report your capital gain or loss on Form 8949 and Schedule D of your tax return. If you’re selling a property you’ve owned for less than a year, the gain or loss is considered short-term and taxed at your ordinary income tax rate. If you’ve owned the property for more than a year, the gain or loss is considered long-term and taxed at preferential rates.

3. Deduct Selling Expenses

You can deduct certain expenses related to the sale of your investment property from your capital gain, which can help to reduce your taxable income. These expenses include:

- Real estate commissions

- Legal fees

- Advertising and marketing costs

- Closing costs

4. Keep Accurate Records

It’s crucial to keep detailed records of all your expenses and income related to your investment property. This includes documentation of your purchase price, improvements, depreciation claimed, selling expenses, and any income received from renting the property. Keeping meticulous records helps you accurately calculate your capital gain or loss and ensure you’re taking advantage of all available deductions.

Common Tax Forms for Real Estate Transactions

Navigating the tax implications of selling investment properties can feel overwhelming, but understanding the common tax forms involved can provide clarity and help you prepare for your tax obligations. Here’s a breakdown of key forms you’ll likely encounter:

Form 1099-S: Proceeds From Real Estate Transactions: This form details the gross proceeds from the sale of your property, including the sale price and any expenses associated with the sale. The buyer is responsible for issuing this form to you, and it’s crucial for reporting your capital gains or losses on your tax return.

Schedule D: Capital Gains and Losses: This schedule is used to report any capital gains or losses from the sale of your investment property. It incorporates information from Form 1099-S and other relevant documentation to calculate your taxable gains or losses.

Form 4797: Sales of Business Property: If your investment property was used in a business, you’ll need to file Form 4797. This form details the details of the sale, including the cost basis, depreciation deductions claimed, and any resulting gain or loss.

Form 8949: Sales and Other Dispositions of Capital Assets: This form accompanies Schedule D and provides a detailed breakdown of each individual sale, including the date of acquisition, the sale price, and the realized gain or loss.

Additional Forms: Depending on your specific circumstances, you may also need to file other forms related to your property sale, such as:

- Form 8582: Passive Activity Loss Limitations – if your property was used in a passive activity, you may need to file this form.

- Form 4562: Depreciation and Amortization – if you claimed depreciation deductions on your property.

Understanding these forms is crucial for accurate tax reporting and can help you optimize your tax obligations. Consult with a tax professional if you have any questions or need assistance navigating these forms.

Working with a Tax Professional for Optimal Results

Navigating the tax implications of selling investment properties can be complex. While it’s possible to manage some aspects of the process yourself, consulting with a qualified tax professional offers numerous advantages.

Here’s why working with a tax professional is crucial for achieving optimal results:

- Expert Guidance: Tax laws are constantly evolving, and a tax professional stays up-to-date on the latest regulations. They can provide tailored advice specific to your situation, ensuring you comply with all relevant requirements.

- Tax Minimization Strategies: A tax professional can identify potential deductions, credits, and exemptions that may be available to you, helping you minimize your tax liability and maximize your net proceeds.

- Capital Gains Calculation: Determining capital gains or losses on the sale of an investment property is crucial. A tax professional can accurately calculate these figures, ensuring proper reporting on your tax return.

- Investment Property Depreciation: If you’ve been claiming depreciation on your investment property, understanding the tax implications of this deduction upon sale is vital. A tax professional can guide you through the process.

- Tax Planning for Future Investments: Selling an investment property might trigger tax consequences that impact your future investment strategies. A tax professional can help you plan for these potential outcomes.

By working with a tax professional, you’ll gain peace of mind knowing you’re taking advantage of all available tax benefits and avoiding potential penalties. Their expertise ensures a smooth and financially advantageous experience when selling your investment properties.

Case Studies: Analyzing Different Sale Scenarios

Let’s dive into some real-world examples to understand how tax implications can vary depending on your investment property selling scenario. We’ll focus on the capital gains tax, which is the tax you pay on profits made from selling an asset.

Case 1: Selling a Long-Term Investment Property

Imagine you bought a rental property 10 years ago for $200,000 and sold it today for $350,000. Your capital gain is $150,000 ($350,000 – $200,000). This gain is considered long-term because you held the property for over a year. You’ll need to report this gain on your tax return and pay capital gains tax on it.

Case 2: Selling a Property with Depreciation Deductions

Let’s say you purchased a rental property for $300,000 and claimed depreciation deductions of $50,000 over the years. When you sell the property for $400,000, your adjusted cost basis is $250,000 ($300,000 – $50,000). This means your capital gain is $150,000 ($400,000 – $250,000). The depreciation recapture portion (the $50,000 you claimed) is taxed at a higher rate.

Case 3: Selling a Property Inherited from a Loved One

If you inherited a property from a deceased relative, your cost basis is the fair market value of the property on the date of death. Let’s say your inheritance was valued at $250,000, and you sell it for $325,000. Your capital gain is $75,000 ($325,000 – $250,000). The capital gains tax will depend on how long you held the property after inheritance.

These are just a few examples, and every situation is unique. It’s crucial to consult with a tax professional to determine the specific tax implications of your individual sale scenario. They can help you understand your tax obligations and strategies to minimize your tax burden.

Tips for a Smooth and Tax-Efficient Sale Process

Selling an investment property can be a complex process, especially when it comes to taxes. To ensure a smooth and tax-efficient sale, here are some key tips to consider:

1. Consult with a Tax Professional: Before you start the selling process, seek advice from a qualified tax professional. They can help you understand the potential tax implications of your sale, including capital gains taxes, depreciation recapture, and other relevant deductions.

2. Proper Documentation: Maintaining meticulous records is crucial. Gather all documentation related to your property, including purchase price, improvements, expenses, and any other relevant financial details. This will help you accurately calculate your capital gains and losses.

3. Explore Tax-Saving Strategies: There are various strategies to minimize your tax burden. Consider utilizing deductions for selling expenses, depreciation recapture, and capital losses from other investments to offset your gains.

4. Timing is Key: Strategically choosing the timing of your sale can impact your tax liability. Consult with your tax professional to determine the most advantageous time to sell, taking into account current market conditions and potential changes in tax laws.

5. Seek Professional Guidance: Engaging a real estate professional who is familiar with tax implications can help you navigate the process effectively. They can provide insights on market trends, pricing strategies, and potentially identify tax-efficient selling techniques.

By following these tips, you can significantly enhance the efficiency and tax optimization of your investment property sale. Remember, seeking expert advice from a qualified professional is paramount to ensuring a successful and financially advantageous outcome.

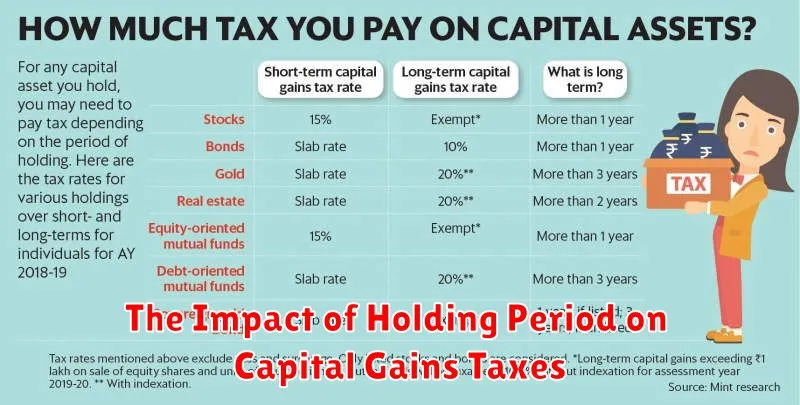

The Impact of Holding Period on Capital Gains Taxes

When you sell an investment property, you’ll likely face capital gains taxes, which are taxes on the profit you make from the sale. The amount of capital gains tax you owe can vary depending on how long you’ve held the property, a factor known as the holding period.

In the United States, there are two main holding periods for capital gains tax purposes:

- Short-term capital gains: These apply if you hold the property for less than a year. Short-term capital gains are taxed at your ordinary income tax rate, which can be significantly higher than long-term capital gains rates.

- Long-term capital gains: These apply if you hold the property for a year or more. Long-term capital gains are taxed at lower rates, generally 0%, 15%, or 20%, depending on your income level.

The holding period is a crucial consideration when deciding when to sell an investment property. It’s important to factor in the potential tax implications before making any decisions. If you hold a property for a longer period, you may be able to qualify for the lower long-term capital gains rates, which could save you a significant amount of money.

Tax Implications of Selling Inherited Property

When you inherit real estate, it comes with a stepped-up basis. This means the property’s cost basis is adjusted to its fair market value at the time of the deceased’s death. This can significantly impact your tax obligations when you sell the property.

The stepped-up basis eliminates any capital gains from the original purchase price. For example, if your deceased relative purchased a property for $100,000 and it’s now worth $300,000, your cost basis becomes $300,000. When you sell, you’ll only be taxed on the gain above $300,000, not the gain from the original purchase price.

However, it’s important to note that inherited property is still subject to capital gains taxes. If you sell the property for more than your stepped-up basis, you’ll owe capital gains taxes on the difference.

Here are some key considerations:

- Holding Period: Inherited property is treated as if you held it from the day your relative acquired it. This can impact the long-term capital gains rate, which applies to assets held for more than one year.

- Inheritance Tax: There is no federal inheritance tax in the United States. However, some states may have their own inheritance taxes, so it’s essential to check your state’s regulations.

- Selling Expenses: Expenses related to selling the property, such as real estate commissions, closing costs, and legal fees, can be deducted from your capital gains.

It’s highly recommended to consult with a tax professional to understand the specific tax implications of selling inherited property. They can provide personalized guidance based on your circumstances and help you make informed decisions.