The real estate market is constantly shifting, making it challenging for buyers, sellers, and investors to navigate. As we head into 2024, several key market trends are shaping the landscape, influencing everything from pricing and inventory to mortgage rates and buyer demand. Understanding these trends is crucial for anyone involved in real estate, whether you’re looking to buy your first home, sell your existing property, or simply stay informed about the market’s direction. In this comprehensive guide, we will delve into the most significant trends shaping the real estate landscape in 2024 and provide insights into how these trends might impact your decisions.

From the ongoing effects of rising interest rates and inflation to the evolving preferences of buyers and the emergence of new technologies, the real estate market is facing a dynamic year ahead. By staying abreast of these market trends, you can position yourself for success in this evolving market and make informed decisions that align with your individual goals. Whether you’re a seasoned investor or a first-time buyer, this guide will equip you with the knowledge to confidently navigate the complexities of the real estate landscape in 2024.

Understanding the Current Market Dynamics

The real estate market is constantly evolving, driven by a complex interplay of economic, social, and demographic factors. In 2024, several key dynamics will shape the landscape, presenting both opportunities and challenges for buyers, sellers, and investors alike.

One of the most significant factors is the ongoing interest rate environment. The Federal Reserve’s efforts to combat inflation have led to rising interest rates, which have a direct impact on mortgage affordability. As rates rise, the cost of borrowing increases, making it more expensive for potential homebuyers to secure financing. This has a cooling effect on the market, slowing down price growth and potentially leading to a decline in demand.

Another key factor is the inventory levels. The housing market has been characterized by a persistent inventory shortage in recent years, which has fueled price growth. While some regions are experiencing an increase in inventory, the overall market is still considered tight. The availability of homes for sale will continue to influence price trends, with a larger inventory potentially putting downward pressure on prices.

Finally, it’s crucial to consider the economic outlook. The global economy is facing numerous challenges, including geopolitical uncertainty, rising inflation, and potential recessions. These factors can impact consumer confidence and spending habits, ultimately affecting demand for housing.

Understanding these dynamic forces is essential for navigating the real estate landscape in 2024. By closely monitoring these key indicators, buyers, sellers, and investors can make informed decisions and adjust their strategies accordingly.

Projected Growth Areas in 2024

While the real estate market is dynamic and subject to fluctuations, certain areas are expected to experience continued growth in 2024. Here are some key sectors to watch:

1. Affordable Housing: As affordability remains a major concern, the demand for reasonably priced homes will persist. This trend is likely to fuel growth in the development of affordable housing units, especially in urban and suburban areas experiencing rapid population growth.

2. Technology-Enabled Real Estate: Innovation is transforming the industry, with proptech companies playing a significant role. Expect continued growth in areas like virtual home tours, AI-powered property valuation, and smart home technology integration, enhancing the buyer and seller experience.

3. Sustainable Development: The focus on environmental sustainability is influencing real estate decisions. The demand for green buildings, energy-efficient homes, and sustainable infrastructure is expected to increase, contributing to the growth of this segment.

4. Rural and Suburban Markets: The rise of remote work and a desire for more space is driving growth in rural and suburban areas. These locations offer a more affordable lifestyle, attracting buyers seeking a change of pace.

5. Rental Market: The rental market remains strong, particularly in major metropolitan areas. As housing affordability challenges persist, renting continues to be a viable option for many, leading to consistent demand and growth in this sector.

These projected growth areas represent exciting opportunities within the real estate landscape. Staying informed about these trends can help both investors and homebuyers navigate the market strategically and make informed decisions in 2024 and beyond.

Impact of Interest Rates on Home Buying

Interest rates play a pivotal role in the housing market, significantly influencing affordability and demand. As interest rates rise, the cost of borrowing money increases, making homeownership more expensive. This is because a higher interest rate leads to higher monthly mortgage payments, reducing the amount of money a buyer can afford to borrow.

In 2024, interest rates are anticipated to remain elevated, posing challenges for potential homebuyers. As the Federal Reserve continues to combat inflation, interest rates are likely to stay higher than they were in recent years. This means buyers need to carefully consider their financial situation and budget accordingly.

The impact of rising interest rates on home buying can be significant:

- Reduced purchasing power: Higher interest rates make it harder for buyers to qualify for a mortgage or afford their desired home.

- Slower sales pace: Increased borrowing costs can lead to fewer buyers in the market, resulting in a slower pace of home sales.

- Potential for price adjustments: As demand cools due to higher interest rates, there might be downward pressure on home prices in some areas.

While the impact of rising interest rates can be challenging, it’s important to remember that the housing market is complex and constantly evolving. For buyers, it’s crucial to seek professional advice, research thoroughly, and adjust their expectations based on current market conditions.

The Rise of Sustainable and Smart Homes

In 2024, the real estate market is witnessing a surge in demand for sustainable and smart homes. As concerns about climate change and energy efficiency grow, buyers are prioritizing homes that minimize their environmental footprint and offer technological convenience.

Sustainable features like solar panels, energy-efficient appliances, and water-saving fixtures are becoming increasingly common. These features not only reduce utility bills but also contribute to a greener lifestyle. Smart home technology is also gaining traction, with features such as automated lighting, thermostats, and security systems that enhance comfort and safety.

This growing trend is driven by several factors, including:

- Rising energy costs: Homeowners are seeking ways to cut down on their energy bills, and sustainable homes offer significant savings.

- Environmental awareness: Consumers are increasingly conscious of the environmental impact of their choices, and opting for sustainable homes is one way to make a difference.

- Technological advancements: Smart home technology is becoming more affordable and accessible, making it a desirable feature for many buyers.

As demand for sustainable and smart homes continues to grow, we can expect to see even more innovative solutions emerge in the market. This trend presents exciting opportunities for both developers and homebuyers, as it allows for a more sustainable and technologically advanced future for the real estate industry.

Emerging Trends in Rental Markets

The rental market is constantly evolving, and 2024 is poised to see several significant shifts. With the global economic landscape in flux, renter preferences and investor strategies are undergoing transformations. Here are some key emerging trends:

1. Growing Demand for Flexibility: Short-term rentals and flexible lease terms are becoming increasingly popular, appealing to a generation seeking more adaptable living arrangements. This trend is driven by the rise of remote work, digital nomadism, and a desire for greater freedom in lifestyle choices.

2. Rise of Co-living and Shared Housing: As affordability concerns persist, shared housing models like co-living are gaining traction. These spaces offer communal living experiences with shared amenities and a sense of community, appealing to budget-conscious renters and young professionals.

3. Focus on Sustainability: Sustainability is taking center stage in the rental market. Landlords are incorporating eco-friendly features like energy-efficient appliances, green building materials, and renewable energy sources to attract environmentally conscious renters.

4. Technological Advancements: Technology is revolutionizing the rental experience. Proptech innovations like virtual tours, online applications, and automated lease management systems are streamlining the process for both landlords and tenants.

5. Shifting Investor Priorities: Investors are increasingly seeking opportunities in the rental market, driven by attractive returns and long-term stability. This trend is leading to a greater emphasis on rental property management, maintenance, and tenant satisfaction.

Understanding these emerging trends is crucial for navigating the ever-changing real estate landscape. By adapting to these shifts, landlords and tenants alike can optimize their rental experiences and secure successful outcomes.

Investing in a Post-Pandemic World

As we navigate the post-pandemic world, the real estate market continues to evolve, presenting both challenges and opportunities for investors. The pandemic significantly altered our lifestyles and preferences, driving changes in demand for various property types and locations. Understanding these shifts is crucial for making informed investment decisions in 2024 and beyond.

One of the most prominent trends is the rise of remote work. With many companies adopting flexible work arrangements, demand for spacious homes with dedicated workspaces in suburban and rural areas has increased. This has led to a surge in home prices and a shift in the focus away from traditional city centers.

Another important factor is the changing demographics. As the population ages, demand for senior living facilities, assisted living, and retirement communities is expected to rise. This presents opportunities for investors seeking to capitalize on this growing segment of the market.

Furthermore, the pandemic has highlighted the importance of sustainable and resilient infrastructure. This includes investments in energy-efficient buildings, renewable energy sources, and improved transportation systems. Investors seeking long-term value should prioritize projects that address these needs.

Finally, the ongoing inflationary pressures and rising interest rates are impacting the real estate market. Investors need to carefully assess their risk tolerance and consider the impact of these factors on property valuations and returns.

In conclusion, the post-pandemic world presents a dynamic and evolving real estate landscape. By understanding the key trends shaping the market, investors can position themselves for success in 2024 and beyond. Adaptability, a focus on emerging needs, and careful risk management are essential for navigating this evolving environment.

Key Factors Influencing Property Values

The real estate market is a dynamic entity, constantly shifting based on a myriad of factors. In 2024, understanding these influential elements is crucial for both buyers and sellers. Here are some of the key factors shaping property values:

Interest Rates: The Federal Reserve’s monetary policy directly impacts mortgage rates. As interest rates rise, borrowing becomes more expensive, potentially slowing down demand and causing prices to stabilize or even decline.

Economic Conditions: A strong economy typically fuels job growth and higher incomes, boosting demand for housing and pushing up prices. Conversely, economic downturns can lead to unemployment and reduced purchasing power, affecting property values negatively.

Inventory Levels: The number of homes available for sale plays a significant role. When supply outpaces demand, prices tend to fall. Conversely, low inventory in a strong market can lead to bidding wars and higher prices.

Local Market Dynamics: Factors specific to individual areas, such as job opportunities, school quality, and amenities, can influence property values. Desirable locations with strong local economies and desirable lifestyles tend to command higher prices.

Inflation: Rising inflation can erode purchasing power and lead to increased construction costs, potentially impacting property values. However, inflation can also drive appreciation in certain asset classes, including real estate.

Government Policies: Regulations, tax incentives, and zoning laws can all influence the real estate market. For example, tax breaks for homebuyers or changes in zoning regulations can impact demand and pricing.

Technological Advancements: Technology is reshaping the real estate industry. Online platforms, virtual tours, and data analytics are influencing how properties are bought, sold, and valued.

Expert Predictions for the Coming Year

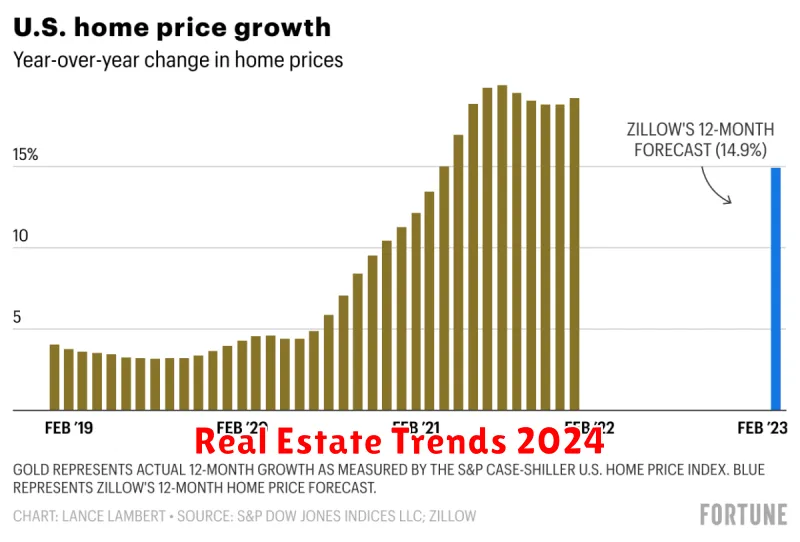

While 2023 saw a cooling off from the frenzied market of 2021 and 2022, 2024 promises to be a year of more measured growth, marked by a delicate balance between buyers and sellers. Experts predict a continued slowdown in price growth, with some even forecasting modest declines in certain areas. This slowdown is attributed to factors such as rising interest rates, lingering inflation, and concerns about a potential recession.

Despite the cooling market, demand for housing is expected to remain strong. Limited inventory will continue to be a challenge, particularly in desirable locations, leading to continued competition among buyers. This dynamic could push prices up, but experts believe the increases will be more moderate and localized.

The mortgage market will be a key factor to watch. With interest rates expected to remain elevated for the foreseeable future, affordability will continue to be a concern for many potential buyers. This could lead to a shift in demand towards less expensive properties or a renewed focus on alternative financing options.

Overall, 2024 is anticipated to be a more balanced and less volatile real estate market compared to recent years. While challenges remain, the underlying fundamentals remain strong. Adaptability and careful planning will be key for buyers and sellers navigating this landscape. Staying informed about market trends, working with experienced professionals, and understanding individual financial situations will be essential for making sound real estate decisions in the year ahead.

Strategies for Success in a Changing Market

The real estate market is constantly evolving, and 2024 is poised to be a year of significant change. Adapting to these shifts is crucial for both buyers and sellers, as the market dynamics will shape opportunities and challenges. Here are key strategies for success in this evolving landscape:

1. Stay Informed about Market Trends: The first step to success is understanding the market conditions. Track interest rates, inventory levels, and local economic indicators. Engage with real estate professionals to gain insights into current trends and anticipate potential shifts.

2. Embrace Flexibility and Adaptability: In a dynamic market, rigid strategies can be detrimental. Be prepared to adjust your plans and be flexible in your negotiations. Consider exploring diverse property types and locations to expand your options.

3. Leverage Technology and Data: Technology plays an increasingly significant role in real estate. Utilize online platforms, data analytics, and virtual tools to research properties, connect with agents, and make informed decisions. Harness data to identify emerging trends and gain a competitive advantage.

4. Focus on Value and Investment: In a changing market, focus on the long-term value of your property. Consider factors like location, infrastructure, and potential for appreciation. Invest in upgrades and improvements that enhance the property’s overall appeal and market value.

5. Build Strong Relationships: Networking and establishing connections with real estate professionals, lenders, and other industry players can be invaluable. These relationships can provide access to valuable information, support, and potential opportunities.

6. Seek Professional Guidance: Navigating a changing market requires expert advice. Collaborate with a reputable real estate agent who can guide you through the complexities of buying or selling, provide insights into market conditions, and negotiate effectively on your behalf.

Navigating Real Estate Market Volatility

The real estate market is constantly in flux, and 2024 promises to be no different. While predicting the future with certainty is impossible, understanding current trends and potential market shifts is crucial for navigating this dynamic landscape. Volatility is likely to remain a key factor, driven by a complex interplay of economic forces, interest rates, and consumer confidence.

One of the biggest challenges for both buyers and sellers will be navigating the ever-changing interest rate environment. As the Federal Reserve continues to adjust rates, mortgage rates are likely to fluctuate, impacting affordability and borrowing costs. This uncertainty can make it difficult to plan for long-term investments.

Another key factor to consider is the impact of inflation on housing prices. While rising prices have been a significant factor in the recent boom, it’s possible that inflation could begin to cool, impacting demand and potentially leading to a slowdown in price growth.

Despite these challenges, the real estate market remains a complex and diverse ecosystem. Understanding current trends, staying informed about market developments, and consulting with experienced real estate professionals can empower you to make informed decisions in this dynamic environment.