Are you a business owner looking to secure the perfect office space for your company’s growth? Navigating the complex world of office space leasing can be daunting, but with the right strategies, you can find the ideal environment to foster productivity and success. From understanding your needs to negotiating favorable lease terms, this guide will empower you with the knowledge and tools to master the office space leasing process and secure a space that meets your business objectives.

Whether you’re a startup seeking a flexible workspace or an established company in need of a long-term lease, the key to success lies in a well-defined strategy. This article will delve into the essential aspects of office space leasing, providing practical advice on identifying your needs, evaluating potential spaces, negotiating lease agreements, and optimizing your space for maximum productivity. By following these strategies, you can confidently navigate the office space market and secure a winning location that propels your business forward.

Defining Your Business Needs: Space, Location & Amenities

Before embarking on the office space leasing journey, it’s crucial to define your business needs. This involves assessing your space requirements, ideal location, and essential amenities.

Space requirements should consider your current workforce size, anticipated growth, and the nature of your business operations. Do you need private offices, open floor plans, or a combination of both? How much collaborative space is required? Are there specific technical infrastructure needs, like server rooms or high-speed internet?

Location plays a significant role in attracting talent, accessing clients, and maintaining business operations. Consider factors like proximity to public transportation, accessibility to key clients and partners, and overall neighborhood appeal. Think about the cost of living in the area and its impact on your budget and employee retention.

Amenities are crucial to enhancing employee well-being and productivity. Evaluate essential amenities like on-site parking, break rooms, fitness centers, conference rooms, and collaborative spaces. Think about whether amenities like childcare or pet-friendly policies align with your company culture and employee needs.

By carefully defining your needs in terms of space, location, and amenities, you’ll be well-equipped to navigate the office space leasing process and find the perfect location for your business to thrive.

Setting a Realistic Budget: Rent, Utilities & Hidden Costs

Before you start hunting for the perfect office space, it’s crucial to establish a realistic budget. This involves more than just the monthly rent. Here’s a breakdown of key factors to consider:

Rent: This is your biggest expense, so research average rates in your desired location. Factor in square footage and amenities like parking, common areas, and building security. Remember to negotiate the best possible rate.

Utilities: Don’t forget the often overlooked costs of electricity, water, gas, and garbage. Determine if these are included in the rent or if they are additional expenses. Consider if your business will need significant energy consumption.

Hidden Costs: Be prepared for additional fees like security deposits, cleaning fees, insurance, and property taxes. These costs can quickly add up, so factor them into your budget early on.

Other Expenses: Don’t forget to budget for furniture, office supplies, technology, and potential renovations or repairs. It’s also wise to consider professional services like cleaning, maintenance, and landscaping if they’re not included in your lease.

By carefully analyzing and factoring in all of these expenses, you can develop a truly realistic budget that sets you up for success in your office space search.

Exploring Different Lease Types: Gross, Net, & Modified Gross

Understanding the different lease types is crucial when leasing office space. Each type comes with its own set of responsibilities and financial implications, impacting your overall cost and control over your space. Here’s a breakdown of three common lease types: Gross, Net, and Modified Gross.

Gross Lease: This type offers the most straightforward arrangement. The landlord covers all operating expenses associated with the property, such as property taxes, insurance, and maintenance. You only pay a fixed monthly rent, making budgeting easier. However, you have less control over these expenses. The landlord might increase rent in the future to cover rising expenses.

Net Lease: In a Net lease, you share responsibility for certain operating expenses with the landlord. These expenses are typically outlined in the lease agreement and can include property taxes, insurance, and maintenance. The rent structure can be either a fixed amount or a base rent plus pro-rata share of the operating expenses. This gives you some control over expenses but requires more involvement in managing the property.

Modified Gross Lease: This lease type sits between a Gross and Net Lease. It combines elements of both, where you pay a base rent plus a portion of the operating expenses. This structure often allows for flexibility in negotiating the specific expenses included and their distribution. You gain some control over expenses while still enjoying a relatively simplified rent structure.

The most suitable lease type for you depends on your specific needs and financial situation. Carefully analyze your budget, risk tolerance, and desire for control over expenses. Consider the long-term implications of each type, as your requirements may change over time. Consulting with a commercial real estate broker can provide valuable insights and help you navigate the complex world of lease agreements.

The Art of Negotiation: Tips for Securing the Best Deal

Negotiation is an essential aspect of office space leasing, and mastering this skill can save your company a significant amount of money. The key is to approach the process strategically and confidently. Here are some tips to help you secure the best deal:

Know your market: Before entering negotiations, thoroughly research office space availability in your desired location. Understand average rental rates, lease terms, and incentives offered in the market. This will give you a strong baseline for comparison.

Define your needs: Clearly outline your company’s specific requirements, including square footage, amenities, location, and budget. This will help you prioritize during negotiations and avoid unnecessary compromises.

Prepare a strong offer: Before making an offer, consider your budget and leverage your market research. Present a well-structured offer that is both competitive and reflects your company’s needs.

Be flexible but assertive: During negotiations, be prepared to compromise on certain aspects, but remain assertive on your core needs. Find a balance between being accommodating and ensuring your company’s interests are met.

Consider all costs: Don’t overlook hidden costs, such as utilities, building maintenance, and taxes. Factor these into your overall budget and negotiate these expenses as well.

Seek professional guidance: Consulting with a commercial real estate broker can be invaluable. Their experience and knowledge of the market can provide valuable insights and negotiate on your behalf.

By following these tips, you can navigate office space negotiations effectively and secure a lease that aligns with your company’s needs and budget. Remember, a successful negotiation requires preparation, confidence, and a focus on achieving the best possible outcome for your business.

Understanding Key Lease Clauses: Renewal Options, Subleasing & More

Navigating the world of office space leasing can be a complex endeavor. While securing the right space is crucial, understanding the intricacies of your lease agreement is equally important. One key aspect lies in recognizing and understanding critical clauses that can significantly impact your business’s long-term success. This section delves into some of the most crucial lease clauses, focusing on renewal options, subleasing, and more.

Renewal Options: Securing Your Future

Renewal options grant tenants the right, but not the obligation, to extend their lease for a specific period under predetermined terms. These clauses are particularly vital for businesses seeking long-term stability. Here’s what you need to know:

- Duration and Terms: Understand the duration of the renewal option and any changes to rent, operating expenses, or other terms that may apply upon renewal.

- Notice Period: Pay close attention to the timeframe within which you need to exercise your renewal option, as failing to do so could forfeit your right to renew.

- Market Rates: Be aware of the potential for rent increases to market rates upon renewal. This can be a significant factor in your decision-making process.

Subleasing: Flexibility and Cost Management

Subleasing allows tenants to transfer all or part of their leasehold interest to a third party. This can be a valuable strategy for businesses seeking flexibility or cost-saving measures. Here are some points to consider:

- Lease Restrictions: Check if your lease prohibits or restricts subleasing. Landlords often have specific requirements regarding subtenants.

- Liability: Understand that you may still bear some liability for the subtenant’s performance, so it’s crucial to screen potential subtenants carefully.

- Rent and Expenses: Determine how rent and other expenses will be allocated between you and the subtenant.

Additional Key Clauses to Consider

Beyond renewal options and subleasing, several other crucial clauses can significantly impact your lease arrangement. These include:

- Base Rent and Operating Expenses: Clearly understand how rent is structured and which operating expenses you are responsible for.

- Landlord’s Right of Entry: Know the circumstances under which your landlord can enter your leased space. This can impact your business operations.

- Default and Termination: Familiarize yourself with the terms surrounding lease defaults and potential termination.

- Assignment: Understand the restrictions or requirements for assigning your lease to a third party. This can be crucial for future business transactions.

By carefully reviewing and understanding these key lease clauses, you can make informed decisions that best suit your business’s needs and ensure a smooth and successful office space leasing experience.

Working with a Tenant Rep Broker: Benefits & Considerations

When it comes to securing the perfect office space, a tenant representative (Tenant Rep) broker can be a valuable asset. They act as your advocate throughout the entire leasing process, working to ensure you get the best possible deal. However, it’s essential to weigh the benefits and considerations before deciding if a Tenant Rep is the right fit for you.

Benefits of Working with a Tenant Rep:

- Expert Market Knowledge: Tenant Reps have extensive knowledge of the local market, including available properties, rental rates, and lease terms. They can help you identify the best options based on your specific needs and budget.

- Negotiation Power: A Tenant Rep is an experienced negotiator who can leverage their relationships with landlords and other brokers to secure favorable lease terms on your behalf.

- Time Savings: The leasing process can be time-consuming and complex. A Tenant Rep handles much of the legwork, allowing you to focus on your business.

- Access to Exclusive Listings: Tenant Reps often have access to off-market properties and exclusive listings that may not be publicly advertised.

- Cost Savings: While Tenant Reps charge a fee, they can often save you more in the long run by securing favorable lease terms and avoiding costly mistakes.

Considerations When Working with a Tenant Rep:

- Fees: Tenant Reps typically charge a percentage of the total lease value, which is usually paid at the end of the lease term.

- Compatibility: It’s crucial to find a Tenant Rep who understands your business needs and works well with your team.

- Due Diligence: Ensure you thoroughly research the Tenant Rep’s experience and reputation before engaging their services.

- Contract Terms: Carefully review the contract with your Tenant Rep to understand their fees and responsibilities.

Ultimately, the decision of whether to work with a Tenant Rep depends on your specific circumstances and budget. However, for businesses seeking to optimize their lease negotiations and secure the best possible deal, a skilled Tenant Rep can be an invaluable partner.

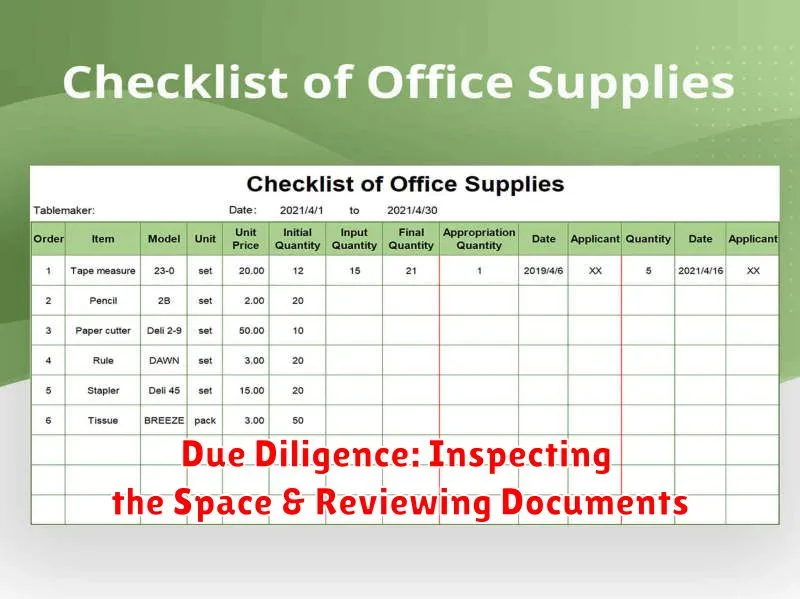

Due Diligence: Inspecting the Space & Reviewing Documents

Once you’ve found a space that seems like a good fit, it’s time for due diligence. This crucial step involves carefully inspecting the space and reviewing the relevant documents to ensure everything aligns with your expectations and needs.

Inspecting the Space:

- Walk through the space with a critical eye. Assess the condition of the building, the layout, and any existing fixtures and equipment.

- Consider the lighting, ventilation, and temperature control. These factors can significantly impact employee comfort and productivity.

- Check the accessibility of the space for people with disabilities.

- Look for any potential problems, such as water damage, mold, or structural issues.

Reviewing Documents:

- Lease Agreement: Scrutinize the lease agreement thoroughly, paying close attention to the lease term, rent payments, renewal options, and any clauses that might impact your business.

- Building Plans: Review the building plans to ensure that the space meets your specific requirements, including square footage, layout, and ceiling heights.

- Building Codes and Regulations: Ensure the space complies with all applicable building codes and regulations.

- Insurance Policies: Review the landlord’s insurance policies to understand your liability and coverage in case of any incidents.

By diligently inspecting the space and reviewing the relevant documents, you can minimize potential surprises and ensure that your new office space meets your business needs and budget.

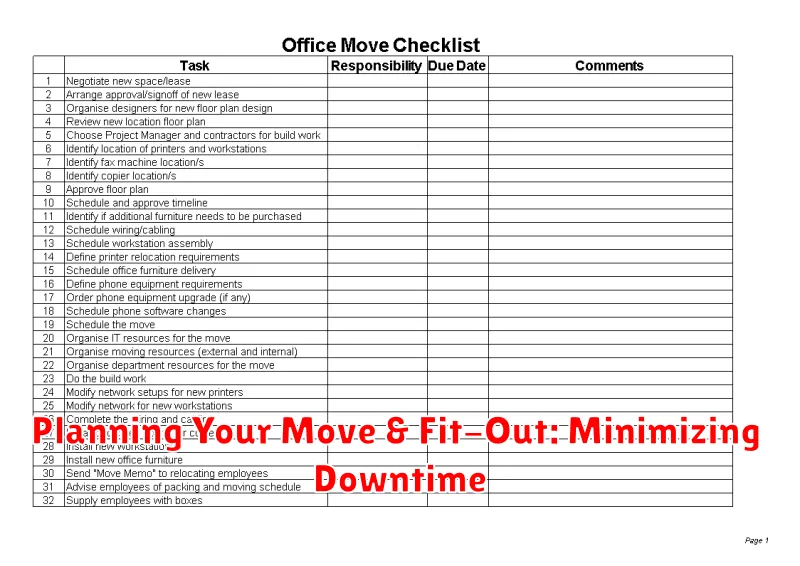

Planning Your Move & Fit-Out: Minimizing Downtime

Moving offices can be a disruptive process, leading to lost productivity and potential delays in your operations. Minimizing downtime is crucial to a successful transition, and effective planning is key.

Start early: The earlier you begin planning, the more time you have to address potential challenges and find solutions. Engage with your landlord, contractors, and IT professionals well in advance to ensure a smooth move-in process.

Develop a detailed timeline: Outline each stage of the move, including the fit-out process, and set realistic deadlines. Allocate sufficient time for each step, considering potential delays and unexpected issues.

Prioritize fit-out efficiency: Streamline your fit-out process by choosing a design that maximizes functionality and efficiency. Consider pre-designed or modular solutions for quicker assembly and installation.

Leverage technology: Utilize tools like project management software and virtual tours to track progress, manage communication, and ensure everyone is on the same page.

Prepare your team: Communicate clearly with employees about the move, including timelines, expectations, and any necessary training. Provide them with resources and support to ensure a seamless transition.

By following these strategies, you can minimize downtime during your office move and fit-out, ensuring a smooth transition and allowing your team to focus on what matters most: your business.

Negotiating Tenant Improvements: Customizing the Space

Tenant improvements, often referred to as TI allowances, are a crucial aspect of office space leasing. They allow tenants to customize the space to their specific needs, enhancing functionality and productivity. Negotiating these improvements is a key strategy in securing a favorable lease agreement.

Understanding the basics of TI allowances is paramount. They represent a financial contribution from the landlord towards the tenant’s desired modifications. This contribution can cover various upgrades, including:

- Building out walls and partitions

- Installing electrical and data systems

- Adding flooring, lighting, and ceilings

- Customizing HVAC systems

Negotiating these improvements effectively requires a strategic approach. Tenants should:

- Assess Needs: Clearly define the essential improvements necessary for optimal workspace functionality.

- Research Market Rates: Gather data on typical TI allowance amounts in the local market for similar spaces.

- Prepare a Detailed Scope: Create a comprehensive list of desired improvements with specific details and costs.

- Prioritize Improvements: Determine which upgrades are essential and which are optional, allowing for flexibility during negotiations.

- Negotiate Effectively: Be prepared to discuss and negotiate the scope and budget of the TI allowance with the landlord.

Effective negotiation can lead to a lease agreement that benefits both parties. The tenant secures a workspace tailored to their needs, while the landlord attracts desirable tenants and maintains a competitive advantage in the market.

The Importance of a Strong Lease Agreement

When it comes to leasing office space, a strong lease agreement is crucial for both landlords and tenants. It serves as the foundation of the entire relationship, outlining the terms and conditions of the agreement, including the rent, lease duration, permitted uses, and responsibilities of each party.

A well-drafted lease agreement protects both parties by clearly defining their rights and obligations. For landlords, it safeguards their investment by ensuring timely rent payments, adherence to the terms of the lease, and proper maintenance of the property. For tenants, it provides assurance of a secure and suitable workspace for their business operations, allowing them to plan and operate with confidence.

Some key elements that a strong lease agreement should include are:

- Detailed description of the leased premises, including the size, location, and any specific features or amenities

- Rent amount and payment schedule, including any potential escalations or adjustments

- Lease term and renewal options, outlining the duration of the agreement and any provisions for renewal

- Permitted uses of the space, ensuring that the tenant’s business operations align with the landlord’s expectations

- Responsibilities for maintenance and repairs, outlining who is responsible for different aspects of the property

- Insurance requirements, ensuring that both parties have appropriate coverage

- Termination clauses, detailing the conditions under which either party can terminate the lease

A comprehensive and clearly written lease agreement can prevent misunderstandings and disputes later on. It is essential for both parties to thoroughly review and understand the terms before signing. Seeking legal counsel from a real estate attorney can help ensure that the agreement is fair, legally sound, and tailored to the specific needs of each party.

Long-Term Planning: Growth & Flexibility Considerations

When securing office space, long-term planning is crucial for success. It’s not just about finding the right space today; it’s about anticipating future needs. Growth and flexibility are key considerations.

Think about your company’s projected growth trajectory. Will you need more space in the next few years? If so, consider leasing options that allow for expansion, such as spaces with contiguous units or the ability to add on.

Flexibility is equally important. The modern workplace is dynamic, with evolving needs and work styles. Look for office spaces that offer modular layouts, adaptable furniture, and technology infrastructure that can be easily scaled. This ensures your space can adapt to your business’s changing requirements.

Remember, a well-planned office space that anticipates your future needs can foster growth, productivity, and long-term success.