The financial world is constantly in flux, and one of the key drivers of change is interest rate fluctuations. These changes can have a profound impact on a variety of sectors, and the commercial real estate market is no exception. When interest rates rise, borrowing money becomes more expensive, which can deter potential buyers and investors. Conversely, falling interest rates can make financing more accessible, leading to increased demand and potentially higher property values. Understanding the complex relationship between interest rate fluctuations and the commercial real estate market is crucial for both investors and business owners.

This article will delve into the intricate ways interest rate fluctuations affect commercial properties. We will explore how rising and falling rates impact financing options, property values, and overall market activity. We will also examine strategies that investors and businesses can employ to navigate these fluctuations and position themselves for success in the dynamic world of commercial real estate. By gaining a deeper understanding of these dynamics, you can make informed decisions that maximize your investment returns and minimize risks.

The Relationship Between Interest Rates and Commercial Real Estate

The relationship between interest rates and commercial real estate is deeply intertwined and has a significant impact on market dynamics. When interest rates rise, borrowing costs for commercial property investments increase, making it more expensive to finance acquisitions and developments. This, in turn, can lead to a decrease in demand for commercial properties, resulting in slower property appreciation or even price declines.

Conversely, when interest rates fall, borrowing costs decrease, making it more attractive and affordable for investors to acquire or develop commercial properties. This increased demand can fuel property price appreciation and boost the overall market activity.

Understanding this relationship is crucial for investors, developers, and lenders alike. It allows them to anticipate market trends, adjust their strategies, and make informed decisions in a dynamic real estate environment.

How Rising Interest Rates Affect Property Values

Rising interest rates can have a significant impact on property values, particularly for commercial real estate. When interest rates rise, borrowing money becomes more expensive, making it less attractive for investors to purchase commercial properties. This can lead to a decrease in demand, which can ultimately drive down property values.

One of the primary ways rising interest rates affect property values is through the cost of financing. Higher interest rates mean higher monthly mortgage payments, which can make it more difficult for investors to afford a property. This can lead to fewer offers being made on properties, which can ultimately result in lower selling prices.

Another factor is the impact on the overall economy. When interest rates rise, it can slow down economic growth, which can lead to reduced demand for commercial space. This can further reduce the value of properties, as investors may become less confident in the market.

The impact of rising interest rates on property values can also vary depending on the type of property and the location. For example, properties in high-demand areas may be less affected than those in less desirable locations. Similarly, properties with strong cash flow may be more resilient to interest rate changes.

In conclusion, rising interest rates can have a significant impact on property values, particularly for commercial real estate. It is important for investors to understand the potential consequences of rising interest rates and to carefully consider their investment strategies.

Impact on Financing Costs for Commercial Properties

Interest rate fluctuations have a direct and significant impact on the financing costs for commercial properties. When interest rates rise, the cost of borrowing money increases, making it more expensive to finance a property. This can lead to higher monthly mortgage payments, reduced cash flow, and potentially lower returns on investment for property owners.

Conversely, when interest rates fall, the cost of borrowing money decreases, making it more affordable to finance a property. This can lead to lower monthly mortgage payments, increased cash flow, and potentially higher returns on investment. Property owners may also find it easier to refinance their existing loans at a lower interest rate, further reducing their financing costs.

The impact of interest rate fluctuations on financing costs can vary depending on several factors, including the type of loan, the loan term, and the creditworthiness of the borrower. For example, a commercial property owner with a variable-rate loan will see their monthly payments fluctuate directly with interest rates. Conversely, a property owner with a fixed-rate loan will have a consistent monthly payment regardless of interest rate fluctuations. It is essential for commercial property owners to understand the potential risks and opportunities associated with interest rate fluctuations and to develop strategies to mitigate their impact on financing costs.

Interest Rate Changes and Investment Decisions

Interest rate fluctuations have a profound impact on investment decisions, particularly in the commercial real estate market. When interest rates rise, borrowing costs increase, making it more expensive to finance a property purchase. This can lead to a decrease in demand for commercial properties, as investors may be less willing to take on higher debt burdens. Conversely, when interest rates fall, borrowing costs decrease, making it more attractive to invest in commercial real estate. This can lead to an increase in demand and potentially higher property values.

The impact of interest rate changes on investment decisions is further influenced by factors such as the type of property, the location, and the current market conditions. For example, properties in high-demand locations may be less affected by interest rate changes than properties in more marginal areas. Similarly, properties with strong cash flow potential may be more attractive to investors even when interest rates are high.

Investors need to carefully consider the implications of interest rate changes when making investment decisions. This includes analyzing the potential impact on financing costs, the potential impact on property values, and the overall market conditions. By carefully evaluating these factors, investors can make informed decisions that align with their investment objectives and risk tolerance.

Analyzing the Effects on Different Commercial Property Types

Interest rate fluctuations have a significant impact on the commercial real estate market, influencing investment decisions, property values, and overall market activity. The effects vary depending on the specific type of commercial property, as each sector has unique characteristics and sensitivities to economic conditions.

Office Buildings

Rising interest rates can make office buildings less attractive to investors, as the cost of financing increases, impacting profitability. Moreover, the current trend of hybrid work models and remote work may lead to lower demand for office space, further affecting valuations. On the other hand, well-located, modern, and energy-efficient office buildings may be more resilient, attracting tenants seeking high-quality, sustainable work environments.

Retail Properties

Retail properties are often more vulnerable to interest rate fluctuations than other commercial real estate types. Increased borrowing costs can make it difficult for retailers to expand or renovate, impacting their competitiveness. Furthermore, rising inflation can lead to decreased consumer spending, potentially harming retail sales and impacting property values. However, essential retail categories like grocery stores and pharmacies may see more stable demand even during economic downturns.

Industrial Properties

Industrial properties, including warehouses and distribution centers, are generally less affected by interest rate fluctuations than other commercial real estate types. The strong demand for logistics and e-commerce facilities, driven by ongoing supply chain challenges and online shopping growth, can buffer the impact of rising interest rates. However, high construction costs and limited supply may limit new development, keeping values relatively high.

Multifamily Properties

Multifamily properties can be both positively and negatively affected by interest rate fluctuations. Rising interest rates may make it more expensive for renters to obtain mortgages, potentially increasing demand for rental properties. On the other hand, higher borrowing costs may discourage new multifamily construction, impacting supply and potentially pushing rents upwards. The impact on multifamily property values depends on the local market dynamics and the specific characteristics of the property.

Understanding the specific effects of interest rate fluctuations on different commercial property types is crucial for investors, developers, and landlords. Adapting to changing market conditions and identifying investment opportunities within specific sectors can help navigate the complexities of a dynamic real estate landscape.

Strategies for Mitigating Interest Rate Risks

Interest rate fluctuations can significantly impact the profitability and value of commercial properties. Rising interest rates can lead to higher borrowing costs, making financing more expensive and potentially reducing the attractiveness of investment opportunities. To navigate these challenges, property owners and investors can employ several strategies to mitigate interest rate risks.

Fixed-Rate Financing is a cornerstone of risk mitigation. By securing a loan with a fixed interest rate, borrowers lock in their borrowing cost for the duration of the loan term, shielding them from potential rate increases. This strategy provides predictability and stability in cash flow, ensuring consistent debt service payments even if market rates rise. While fixed-rate financing may come with higher initial interest rates compared to variable-rate options, the long-term protection against rate fluctuations can outweigh this initial cost.

Interest Rate Caps offer a flexible approach to manage interest rate risk. These financial instruments provide a safety net by setting a maximum interest rate that a borrower will pay on a loan. Should interest rates rise above the pre-determined cap, the borrower’s interest rate remains capped, limiting their exposure to rate volatility. This strategy allows for potential benefits from lower rates while providing protection against adverse rate movements.

Short-Term Loans can be advantageous in a rising interest rate environment. By opting for a shorter loan term, borrowers can potentially benefit from lower initial interest rates and a quicker repayment period, minimizing their exposure to long-term rate increases. While this strategy requires a larger principal payment, it may be a prudent choice for those who anticipate a shorter holding period or believe that interest rates will decline in the future.

Debt-to-Equity Ratio Management plays a crucial role in managing interest rate risk. By maintaining a conservative debt-to-equity ratio, property owners can reduce their financial leverage and improve their ability to weather interest rate fluctuations. A lower debt burden provides a cushion against rising interest rates, as the impact on cash flow will be less significant.

Strategic Asset Allocation can also help mitigate interest rate risk. Diversifying investments across various property types or locations can reduce the overall impact of interest rate changes on a portfolio. By spreading risk across different markets and asset classes, investors can potentially offset losses in one area with gains in another, providing greater resilience to market fluctuations.

Understanding and proactively managing interest rate risks is essential for success in the commercial real estate market. By implementing these strategies, property owners and investors can enhance their financial stability, protect their investment values, and navigate the complexities of a dynamic interest rate environment.

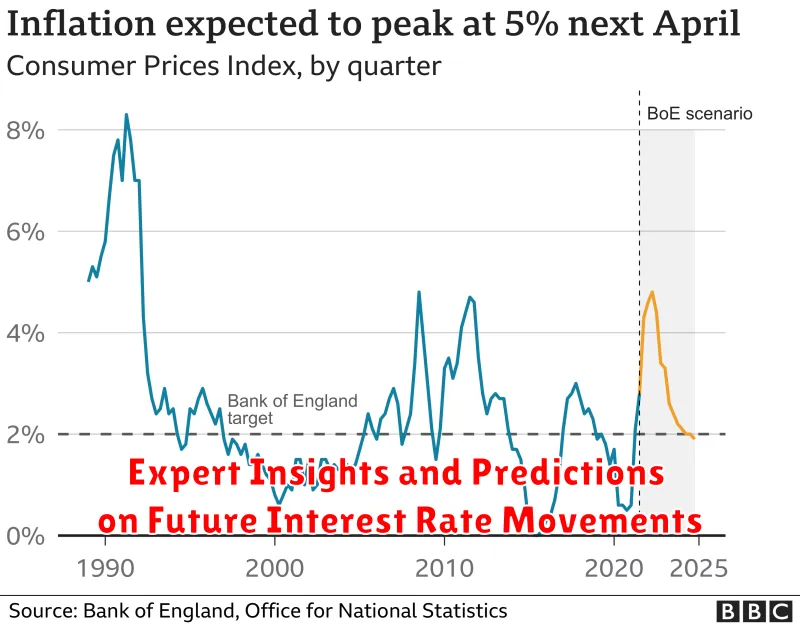

The Role of Inflation in Commercial Real Estate and Interest Rates

Inflation plays a crucial role in the relationship between commercial real estate and interest rates. As inflation rises, lenders tend to increase interest rates to protect their returns from the eroding value of money. This higher cost of borrowing can impact the affordability of commercial real estate for both developers and investors.

However, inflation can also have a positive effect on commercial real estate. When inflation is high, property values tend to rise, which can increase the attractiveness of real estate as an investment. This is because the value of real estate appreciates over time, providing a hedge against inflation.

The impact of inflation on commercial real estate and interest rates is complex and multifaceted. Understanding the intricate interplay between these factors is essential for making informed investment decisions in the commercial real estate market.

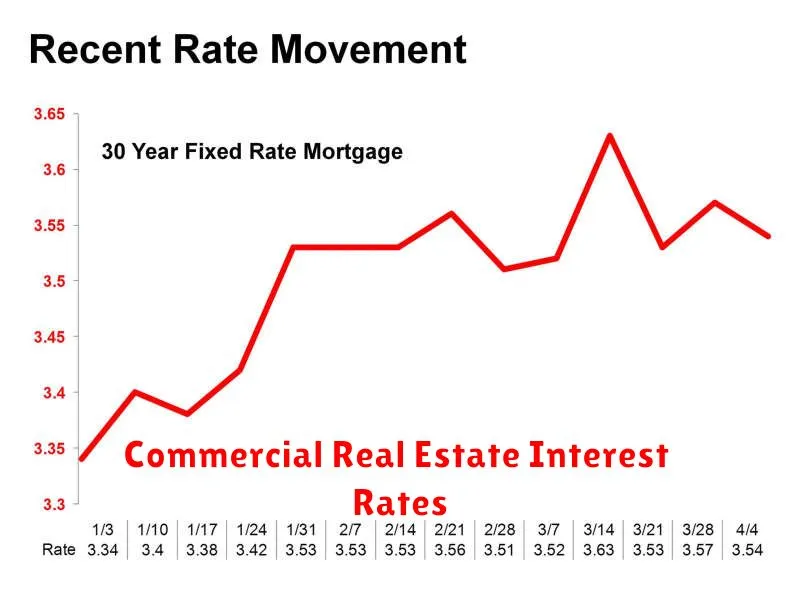

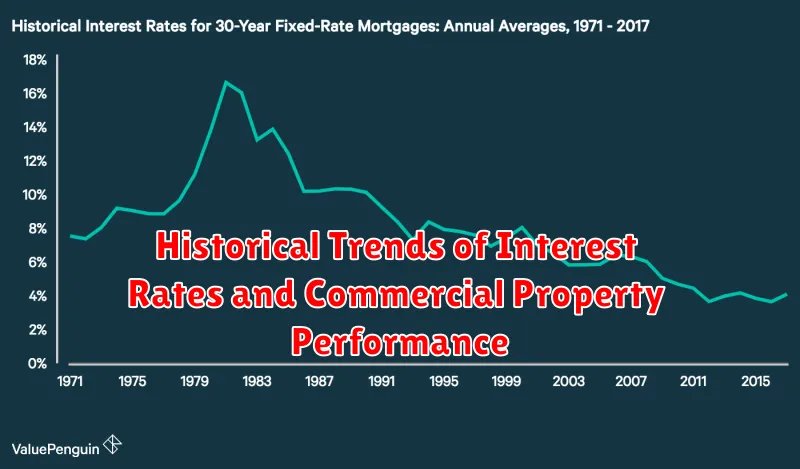

Historical Trends of Interest Rates and Commercial Property Performance

The relationship between interest rates and commercial property performance has been a topic of intense study and debate for decades. Historically, there has been a strong correlation between the two, with rising interest rates often leading to a decline in property values and vice versa.

During periods of low interest rates, borrowing money becomes more affordable for both developers and investors. This can lead to increased construction activity, higher demand for commercial properties, and ultimately, appreciation in property values. The 1980s and early 2000s are prime examples of this phenomenon.

Conversely, when interest rates rise, borrowing becomes more expensive. This can lead to a slowdown in construction, reduced demand for properties, and potentially even a decline in property values. The 1990s and late 2000s provide examples of this trend.

It’s important to note that the relationship between interest rates and commercial property performance is not always linear. Other factors, such as economic growth, inflation, and supply and demand dynamics, can also play a significant role. However, the historical record clearly demonstrates that interest rate fluctuations have a profound impact on the commercial real estate market.

Expert Insights and Predictions on Future Interest Rate Movements

The trajectory of interest rates is a crucial factor impacting commercial property investments. Here’s what some experts are saying about the future:

Short-term Volatility: Most economists predict that interest rates will continue to rise in the short term. This is primarily driven by the Federal Reserve’s efforts to combat inflation. This upward trend will likely impact borrowing costs, making financing commercial properties more expensive.

Long-term Uncertainty: While the near-term outlook is relatively clear, the longer-term trajectory of interest rates is shrouded in uncertainty. Factors like economic growth, inflation levels, and global events will play a significant role.

Expert Opinions: Some experts believe that interest rates will stabilize and potentially even decline in the latter part of the decade. However, others anticipate continued upward pressure, especially if inflation proves to be stickier than expected.

Impact on Commercial Properties: As interest rates rise, the cost of financing new acquisitions and refinancing existing loans increases. This can impact property values and reduce investor appetite for certain types of commercial real estate.

Navigating the Uncertainty: Investors and developers need to closely monitor interest rate trends and their impact on the commercial property market. Careful analysis of market conditions, risk assessments, and flexible financing strategies are crucial for making informed decisions.

Navigating the Commercial Real Estate Market in a Changing Interest Rate Environment

The commercial real estate market is sensitive to interest rate fluctuations. As interest rates rise, the cost of borrowing increases, impacting the affordability and attractiveness of commercial properties. This creates a dynamic environment for both buyers and sellers, requiring strategic navigation to make informed decisions.

For buyers, rising interest rates can lead to higher mortgage payments, potentially reducing their purchasing power. However, it also presents opportunities to negotiate more favorable terms with sellers, as the market may become less competitive. Buyers should carefully assess their financial situation, leverage their equity, and explore alternative financing options to navigate this changing landscape.

Sellers may face challenges in attracting buyers, especially if the property’s value is closely tied to market conditions. However, well-maintained properties with strong cash flow can remain attractive even in a rising interest rate environment. Sellers should focus on showcasing the property’s strengths, potentially adjusting their expectations to attract a wider pool of potential buyers.

Investors need to adapt their strategies as interest rates rise. They may need to adjust their investment criteria, focusing on properties with strong fundamentals and steady cash flows, and potentially considering alternative asset classes. Diversification and a long-term perspective remain key to navigating the market effectively.

To successfully navigate the commercial real estate market in a changing interest rate environment, it is crucial to:

- Stay informed: Monitor market trends and interest rate movements closely.

- Seek expert advice: Consult with experienced real estate professionals, including brokers, appraisers, and financial advisors.

- Develop a comprehensive strategy: Tailor your approach based on your specific goals and financial situation.

- Be flexible and adaptable: Be prepared to adjust your plans and expectations as market conditions evolve.

In conclusion, the impact of interest rate fluctuations on the commercial real estate market can be significant. By understanding the dynamics, being proactive, and seeking expert advice, both buyers and sellers can make informed decisions and navigate this evolving landscape successfully.