Are you tired of paying exorbitant amounts for your property insurance premiums? You’re not alone. Many homeowners find themselves burdened by soaring insurance costs, leaving them wondering how to reduce their financial strain. Luckily, there are ways to slash your property insurance premiums without compromising on coverage. This comprehensive guide will reveal insider tips and tricks to effectively lower your insurance costs, giving you more financial freedom and peace of mind.

From understanding your coverage needs to implementing practical strategies, we’ll explore proven techniques to negotiate lower premiums with your insurer. Discover how simple adjustments to your property, smart shopping tactics, and proactive measures can significantly impact your bottom line. Get ready to unlock the secrets to slashing your property insurance premiums and save money on your monthly expenses.

Understanding the Factors Affecting Your Premiums

Your property insurance premium is calculated based on several factors. Understanding these factors can help you identify areas where you can potentially save money.

Location: Your home’s location plays a significant role in determining your premiums. Areas prone to natural disasters like earthquakes, hurricanes, or wildfires typically have higher premiums. The crime rate and proximity to fire stations also factor in.

Property Value: The higher the value of your property, the more it costs to insure. Factors like the size of your home, its construction materials, and the presence of valuable possessions can affect the value.

Coverage: Your premium is determined by the type and amount of coverage you choose. Higher coverage limits for things like liability, dwelling, or personal property will result in higher premiums.

Deductible: A higher deductible, the amount you pay out of pocket before your insurance kicks in, can lower your premium. However, ensure the deductible is within your financial capacity in case of a claim.

Risk Profile: Insurance companies assess your risk profile based on factors such as your credit history, claims history, and safety measures in place. A good credit score and no recent claims can lower your premium. Installing security systems or fire alarms can also demonstrate responsible risk management.

Age and Condition of Property: Older properties with outdated safety features can pose a higher risk and therefore attract higher premiums. Proper maintenance and upgrades can help lower your premium.

Boosting Home Security for Lower Insurance Costs

A strong home security system can be a game-changer for your property insurance premiums. Insurance companies often offer discounts to homeowners who implement robust security measures. Here are some ways to enhance your home’s security and potentially save on your insurance costs:

Install a Security System: A monitored alarm system with sensors for doors, windows, and motion detection can significantly deter burglars. It can also alert authorities in case of an intrusion, minimizing potential damage.

Upgrade Locks: Replace old, easily compromised locks with high-quality, tamper-resistant ones. Consider deadbolt locks for exterior doors and consider upgrading to smart locks for added convenience and security features.

Invest in Motion-Sensing Lights: Installing motion-sensing lights around your property can act as a deterrent, especially in dark areas. The sudden illumination can startle potential intruders and make your home appear more secure.

Secure Your Windows: Strengthen your windows with reinforced glass or security film. Window bars can also add an extra layer of protection but ensure they meet local safety regulations.

Don’t Forget Landscaping: Trim bushes and trees that provide cover for potential intruders. Keep your yard well-lit and ensure there are no easy access points for climbing over fences or walls.

Install Security Cameras: Security cameras can provide visual evidence in case of an incident and deter crime. Choose cameras with high-resolution recording, night vision capabilities, and remote access options.

Communicate with Your Insurance Company: After implementing these security upgrades, contact your insurance company. They might offer a discount based on your enhanced security measures.

By investing in home security, you’re not only protecting your belongings and loved ones, but you’re also potentially reducing your insurance premiums. Make your home a less appealing target for criminals and reap the rewards of lower insurance costs.

The Power of Bundling: Combining Insurance Policies

Looking to slash your property insurance premiums? One powerful strategy often overlooked is bundling your policies. This involves combining multiple types of insurance, such as home, auto, and renters, with the same insurance company. By doing so, you can unlock significant discounts and save a substantial amount of money on your premiums.

The magic of bundling lies in the economies of scale that insurance companies achieve. When you bundle your policies, the insurer can streamline its operations, reduce administrative costs, and ultimately offer you a more competitive rate. Think of it as a reward for your loyalty and trust.

In addition to potential premium discounts, bundling often comes with added benefits. These can include:

- Simplified billing and payment process: One convenient bill for all your insurance needs.

- Faster claims handling: A single point of contact for all your insurance inquiries.

- Enhanced customer service: Building a stronger relationship with your insurer, potentially leading to more personalized support.

It’s important to shop around and compare quotes from different insurers to find the best bundled rates. While bundling can be a fantastic way to save money, it’s crucial to ensure the coverage you receive aligns with your specific needs. Don’t sacrifice coverage for lower premiums.

Increasing Your Deductible: A Balancing Act

One of the most effective ways to reduce your property insurance premiums is by increasing your deductible. This means you’ll pay more out-of-pocket if you file a claim, but you’ll save money on your monthly premiums. It’s a trade-off, and finding the right balance depends on your individual circumstances.

How it Works: A deductible is the amount you agree to pay before your insurance kicks in. The higher your deductible, the lower your premium. Think of it as a gamble – you’re betting you won’t need to file a claim, and if you do, you’ll pay more upfront.

Key Considerations:

- Financial Cushion: Can you afford to pay a higher deductible in case of a claim?

- Claim Frequency: Do you have a history of filing claims? If so, increasing your deductible might not be the best strategy.

- Risk Tolerance: Are you comfortable with the idea of potentially paying more out-of-pocket for a claim?

The Bottom Line: Increasing your deductible can be a smart way to lower your premiums, but it’s important to do it thoughtfully. Analyze your financial situation, consider your risk tolerance, and ensure you can comfortably afford the potential increase in out-of-pocket expenses.

Maintaining a Good Credit History: Yes, It Matters!

While you might not immediately associate your credit history with your property insurance premiums, they are actually closely linked. Insurers use your credit score as a factor in determining your risk profile, and a strong credit history can lead to significant savings on your premiums.

Think of it this way: insurers are looking for responsible individuals who demonstrate financial stability. A good credit score reflects this responsibility, showing that you manage your finances well and are less likely to file a claim. Conversely, a poor credit score suggests a higher risk of financial instability, potentially leading to more claims and higher premiums.

Here’s the good news: you have control over your credit history. By consistently paying your bills on time, managing your debt wisely, and avoiding unnecessary credit applications, you can build a strong credit score that translates into lower insurance premiums. Taking these steps not only benefits your insurance costs but also sets you up for financial success in other areas of life.

Shopping Around: Compare Quotes Regularly

One of the most effective ways to slash your property insurance premiums is to shop around and compare quotes regularly. Just like you wouldn’t buy the first car you see without checking out other options, don’t settle for the first insurance quote you receive.

Insurance companies use different algorithms and factors to calculate premiums, so you might be surprised at the variance in pricing. You can use online comparison tools or contact multiple insurers directly to get personalized quotes.

Remember, don’t just focus on the lowest price. Consider the reputation of the insurer, their customer service, and the coverage they offer. It’s important to find a balance between cost and quality.

Asking About Discounts: You Never Know!

Don’t be shy about asking about discounts! Insurance companies often offer a variety of discounts that you may not even know about. From bundling your policies to having safety features on your property, there are many ways to save on your premiums.

Here are some common discounts to ask about:

- Loyalty discounts: Rewarding long-time customers

- Bundle discounts: Saving when you insure multiple vehicles or properties with the same company

- Safety discounts: For features like smoke detectors, security systems, and storm shutters

- Early payment discounts: For paying your premium in full upfront or setting up automatic payments

- Good driver discounts: For having a clean driving record

It never hurts to ask! Your insurance agent or company may have even more discounts available that aren’t advertised. Be prepared to provide information about your property, your driving record, and any safety features you have. You could be surprised at the savings you can find.

Reviewing Your Coverage Annually

Don’t let your insurance premiums become a hidden cost. Take a proactive approach and review your property insurance coverage annually. This simple step can save you money and ensure you have the right protection.

Why Annual Reviews Matter

Insurance premiums fluctuate based on factors like:

- Changes in your property value

- Renovations or additions

- Local risk assessments

- Changes in your personal circumstances

By reviewing your coverage annually, you can:

- Identify potential gaps in coverage: Ensure your policy adequately protects you against all possible risks.

- Negotiate lower premiums: If your risk profile has changed, you may be eligible for lower premiums.

- Avoid overpaying: If your property value has decreased, you might be overinsured.

Tips for Effective Reviews

Here are some practical tips for reviewing your coverage:

- Gather your policy documents: Review the details of your policy, including coverage limits, deductibles, and exclusions.

- Assess your property value: Update your home’s market value to ensure your policy reflects its current worth.

- Review your personal circumstances: Have you made significant changes to your property or lifestyle?

- Contact your insurer: Discuss your needs and explore potential discounts or policy adjustments.

Remember, your insurance needs can evolve over time. By reviewing your coverage annually, you take control of your premiums and ensure you have the right protection for your most valuable asset.

Mitigating Natural Disaster Risks

One of the most effective ways to lower your property insurance premiums is by actively mitigating natural disaster risks. By taking proactive steps to protect your home from potential damage, you can demonstrate to insurers that you’re a lower-risk policyholder, leading to potential discounts. Here are some key ways to minimize your risk:

Strengthening your home’s structure: Investing in upgrades like impact-resistant windows and doors, reinforcing your roof, and installing storm shutters can significantly reduce the likelihood of damage during a natural disaster. This can lead to lower premiums and increased peace of mind.

Adopting preventative measures: Simple actions like trimming trees near your house, clearing gutters regularly, and installing smoke detectors and fire alarms can go a long way in preventing potential damage and earning you a lower premium.

Engaging with local initiatives: Many communities offer programs and incentives for homeowners to implement disaster-resistant upgrades. Researching and participating in these initiatives can provide valuable resources and potentially lower your insurance costs.

By actively mitigating natural disaster risks, you can not only protect your home and loved ones but also save money on your insurance premiums. Remember, proactive measures speak volumes to insurers, showcasing your commitment to minimizing risks and earning you a lower premium.

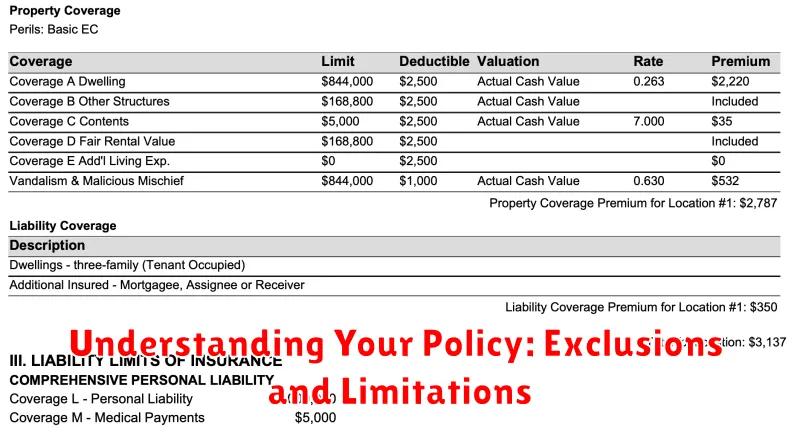

Understanding Your Policy: Exclusions and Limitations

Before you start looking for ways to lower your property insurance premiums, it’s crucial to understand what your policy covers and what it doesn’t. Exclusions are events or situations that your policy specifically doesn’t cover. Limitations are restrictions on the coverage you have, such as limits on the amount of money your insurer will pay for certain types of damage.

For example, most standard homeowners’ insurance policies don’t cover damage from floods, earthquakes, or acts of war. These are common exclusions. There may also be limitations on the amount of coverage for specific types of property, such as jewelry or fine art. You may need to purchase additional coverage, such as flood insurance or earthquake insurance, to protect yourself against these risks.

It’s important to carefully read through your policy and understand its exclusions and limitations. You can also talk to your insurance agent to clarify any questions you may have. Knowing what’s covered and what’s not will help you make informed decisions about your insurance needs and prevent any surprises if a covered event happens.