Are you a real estate investor looking for ways to maximize your profits and minimize your tax burden? Look no further than depreciation. This powerful tax advantage can significantly reduce your tax liability and boost your bottom line. Depreciation allows you to deduct the cost of your investment property over time, which can result in significant tax savings throughout the life of your investment.

While depreciation may seem like a complex concept, it’s actually quite simple. In essence, it reflects the natural wear and tear that your property experiences over time. By claiming depreciation on your taxes, you’re essentially acknowledging that your property’s value declines gradually. This deduction can be a game-changer for real estate investors, offering substantial financial benefits and helping you achieve greater success in your endeavors.

What is Real Estate Depreciation?

Real estate depreciation is a method used in accounting that allows landlords and investors to deduct a portion of their property’s value from their taxable income each year. It’s a key benefit for real estate investors as it can significantly reduce tax liabilities.

Contrary to popular belief, depreciation doesn’t reflect an actual decline in the property’s market value. Instead, it recognizes that buildings and improvements wear down over time, becoming less valuable. This wear and tear is factored into the depreciation calculation, allowing investors to gradually recover their investment through tax deductions.

The process of calculating depreciation is based on the Internal Revenue Service (IRS) guidelines, which specify a property’s estimated useful life and how it should be depreciated. This information determines the amount of depreciation expense that can be deducted each year.

For example, a rental property with an estimated useful life of 27.5 years would be depreciated at a rate of 3.64% per year. This means that the owner can deduct 3.64% of the property’s value from their taxable income each year.

Understanding how depreciation works is crucial for real estate investors. By taking advantage of this tax benefit, investors can lower their tax burden, increase their cash flow, and ultimately, enhance their returns on investment.

Understanding Different Depreciation Methods

Depreciation is a crucial concept for real estate investors as it allows you to deduct a portion of your property’s value from your taxable income each year. This deduction can significantly reduce your tax liability and boost your overall returns. However, understanding the different depreciation methods is essential for maximizing these tax advantages.

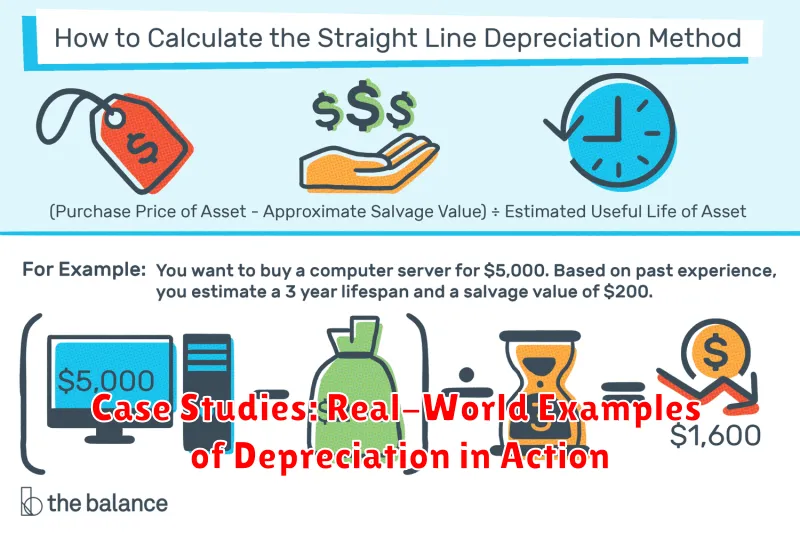

The most common depreciation method used for residential rental properties is the straight-line method. This method evenly distributes the depreciation over the useful life of the property, which is generally 27.5 years for residential buildings. The annual depreciation expense is calculated by dividing the depreciable basis (the cost of the property minus the land value) by the useful life.

For example, if you purchase a rental property for $200,000, and the land value is $50,000, the depreciable basis would be $150,000. Using the straight-line method, the annual depreciation expense would be $150,000 / 27.5 years = $5,454.55.

Another method, the accelerated depreciation method, allows you to take larger deductions in the early years of the property’s life. This can be beneficial for properties with higher initial expenses or those expected to depreciate rapidly. The most common accelerated depreciation method is the Modified Accelerated Cost Recovery System (MACRS).

Choosing the right depreciation method depends on your individual investment goals and the specific characteristics of your property. Consulting with a tax advisor can help you determine the most advantageous method for your situation.

Qualifying for Depreciation Deductions

Depreciation deductions are a powerful tax advantage available to real estate investors, allowing you to offset your taxable income and potentially reduce your tax liability. To qualify for these deductions, you must meet specific criteria outlined by the Internal Revenue Service (IRS).

The key requirement is that the property must be used for business or income-producing purposes. This typically applies to rental properties, commercial buildings, and even certain parts of your home used for a home office.

The IRS classifies real estate into two categories for depreciation: residential and non-residential property. Residential property, including rental houses and apartments, is depreciated over 27.5 years, while non-residential property, such as office buildings and retail spaces, is depreciated over 39 years.

In addition to property usage, the IRS also considers the ownership structure. If you own the property directly, you can claim depreciation on your personal tax return. However, if you own the property through an entity, such as a limited liability company (LLC) or a corporation, you’ll claim depreciation on the entity’s tax return.

It’s crucial to consult with a tax professional to determine your eligibility for depreciation deductions and how to properly claim them. They can help you navigate the complex IRS regulations and ensure you’re maximizing your tax benefits.

Calculating Depreciation Expense for Your Property

Depreciation is a non-cash expense that allows real estate investors to deduct a portion of their property’s value from their taxable income each year. While the physical property isn’t losing value, the IRS recognizes that assets wear down over time, and depreciation allows you to account for that wear and tear. This deduction can significantly reduce your tax liability, making your investment more profitable.

To calculate depreciation, you need to determine the depreciable basis of your property. This is the cost of the property minus the value of the land. For example, if you purchased a property for $500,000 and the land value is $100,000, your depreciable basis would be $400,000.

Next, you need to determine the useful life of the property. The IRS sets a standard useful life for various types of real estate, such as residential rental property, commercial property, or industrial property. The useful life is the period over which the property is expected to be productive for its intended use.

Once you have the depreciable basis and useful life, you can calculate the annual depreciation expense using the straight-line depreciation method. This method spreads the depreciation expense evenly over the useful life of the property. The formula is:

Annual Depreciation Expense = (Depreciable Basis) / (Useful Life)

For example, if the depreciable basis is $400,000 and the useful life is 27.5 years, the annual depreciation expense would be $14,545.45 ($400,000 / 27.5). This amount would be deducted from your taxable income each year.

Keep in mind that you can only depreciate the improvements made to the property, not the land. You can also only claim depreciation expense for rental properties and other income-generating properties, not for your primary residence.

Understanding how to calculate depreciation expense is essential for any real estate investor. By accurately accounting for depreciation, you can reduce your tax liability, increase your cash flow, and enhance the overall profitability of your real estate investments.

Benefits of Depreciation for Rental Property Owners

Depreciation, a crucial concept in real estate investing, allows rental property owners to deduct a portion of their property’s value each year for tax purposes. This deduction, applied to the tangible assets of the property like the building and improvements, reduces taxable income, resulting in significant financial benefits for investors.

One primary advantage of depreciation is the reduction in taxable income. By deducting depreciation, investors can lower their annual tax liability, leaving more money in their pockets. This is particularly beneficial in the initial years of ownership when rental income may be lower compared to the cost of financing and maintenance.

Another major benefit is the potential for tax savings. The depreciation deduction can lead to significant tax savings over time, especially for properties held for long periods. These savings can be reinvested into the property, used to cover operating expenses, or even allocated towards future investments.

Furthermore, depreciation can create a tax shield. It acts as a buffer against future capital gains taxes, which are levied when an investment property is sold. By claiming depreciation over the years, the taxable gain on sale is reduced, potentially lowering the overall tax bill.

Depreciation plays a vital role in the financial planning of rental property owners. Understanding and leveraging its benefits can lead to substantial tax advantages, ensuring a more profitable and sustainable real estate investment strategy.

Depreciation and Capital Gains Tax

Depreciation is a powerful tool for real estate investors seeking to minimize their tax burden. It allows investors to deduct a portion of their property’s value each year, offsetting taxable income and reducing their overall tax liability. This is particularly advantageous when it comes to capital gains tax, which is levied on the profit realized when an asset is sold.

When you sell an investment property, the profit you make is subject to capital gains tax. This profit is calculated by subtracting your adjusted cost base (ACB) from the selling price. The ACB is the original purchase price of the property plus any subsequent improvements, less any depreciation claimed.

Here’s where depreciation plays a crucial role. By claiming depreciation deductions over the years, you effectively reduce your ACB. This lower ACB results in a higher capital gain when you sell, but it also means that you’ll pay less tax on that gain. In essence, depreciation allows you to defer some of your tax liability until you sell the property.

For example, if you purchase a property for $500,000 and claim $50,000 in depreciation deductions over several years, your ACB would be reduced to $450,000. If you later sell the property for $600,000, your capital gain would be $150,000 (selling price – ACB) instead of $100,000 (selling price – original purchase price). This lower capital gain translates into less capital gains tax payable.

Depreciation Recapture: What You Need to Know

Depreciation recapture is a tax rule that applies when you sell an asset that you’ve claimed depreciation on. This rule is important to understand because it can affect your tax liability when you sell your real estate investment property.

When you claim depreciation on a rental property, you’re essentially deducting the cost of the property over time. This deduction lowers your taxable income and your tax liability each year. However, when you sell the property, you’ll have to pay taxes on the depreciation you previously claimed.

There are two types of depreciation recapture:

- Recapture of ordinary income: This applies to depreciation you claimed on the property’s improvements. This income is taxed at your ordinary income tax rate.

- Recapture of capital gains: This applies to depreciation you claimed on the property’s land. This income is taxed at the lower capital gains rate.

How it works: For example, let’s say you purchased a rental property for $100,000 and claimed $20,000 in depreciation over the years. When you sell the property for $150,000, your taxable gain is $50,000 (selling price minus purchase price). However, you will also be required to recapture the $20,000 in depreciation, which will be taxed at your ordinary income tax rate. This means your total taxable gain would be $70,000 ($50,000 + $20,000).

It’s essential to consult with a tax professional to understand the specific tax implications of depreciation recapture for your situation.

Common Mistakes to Avoid When Claiming Depreciation

Depreciation is a powerful tool for real estate investors, allowing them to reduce their taxable income and ultimately pay less in taxes. However, claiming depreciation incorrectly can lead to penalties and audits. Here are some common mistakes to avoid:

1. Failing to Depreciate the Right Property: Only real estate used for business purposes qualifies for depreciation. This includes rental properties, commercial buildings, and even your home office if you use it for business. Personal residences are not depreciable.

2. Using the Wrong Depreciation Method: There are two main depreciation methods: straight-line and accelerated. The straight-line method depreciates the property at a constant rate over its useful life, while the accelerated method depreciates the property faster in the early years. Choosing the wrong method can impact your tax liability, so it’s crucial to understand the differences and consult with a tax professional.

3. Not Tracking Expenses Accurately: Depreciation is calculated based on the cost of the property, excluding land. Keeping meticulous records of purchase price, improvements, and expenses related to the property is essential for accurate depreciation calculations.

4. Overlooking the Useful Life of the Property: The IRS assigns a useful life to different types of real estate, which determines how long you can depreciate it. For example, residential rental property has a useful life of 27.5 years. Failing to consider the useful life can result in incorrect depreciation calculations.

5. Not Filing the Correct Forms: Depreciation is claimed on your tax return using specific forms, such as Form 4562 (Depreciation and Amortization). Using the wrong form or failing to file the correct information can lead to errors and potential penalties.

6. Not Consulting a Tax Professional: Navigating depreciation rules and regulations can be complex. Seeking advice from a qualified tax professional can help ensure you claim depreciation correctly and avoid costly mistakes.

Maximizing Depreciation Benefits for Your Portfolio

Depreciation is a powerful tool for real estate investors, allowing them to deduct the cost of their property over time, ultimately reducing their taxable income. By maximizing depreciation benefits, investors can significantly enhance their portfolio’s profitability and generate substantial tax savings. This strategy involves carefully considering the type of property, its age, and the appropriate depreciation methods to ensure the maximum deduction.

One critical aspect of maximizing depreciation is understanding the different types of depreciation. There are two primary types: straight-line depreciation and accelerated depreciation. Straight-line depreciation spreads the cost of the property evenly over its useful life, while accelerated depreciation allows for larger deductions in the early years of ownership. The choice between these methods depends on individual investment goals and financial circumstances.

Another key factor in maximizing depreciation is accurately identifying the depreciable assets within the property. This includes components like the building, plumbing, electrical systems, and even landscaping. By meticulously listing and valuing each depreciable asset, investors can ensure they claim the full allowable deduction.

Furthermore, it’s crucial to consult with a qualified tax professional who can advise on the most advantageous depreciation methods and ensure compliance with relevant regulations. They can help investors leverage their depreciation deductions strategically, optimize their tax savings, and maximize the overall profitability of their real estate investments.

Case Studies: Real-World Examples of Depreciation in Action

Depreciation, a key tax advantage for real estate investors, allows you to deduct a portion of your property’s value each year. Let’s examine real-world examples to illustrate this concept:

Scenario 1: Residential Rental Property

Imagine you purchase a single-family home for $250,000 as a rental property. This includes $200,000 for the building and $50,000 for the land. Land is not depreciable, so you’ll depreciate the $200,000 building value over 27.5 years using the straight-line method. This equates to an annual depreciation deduction of approximately $7,273. This deduction reduces your taxable income, saving you money.

Scenario 2: Commercial Building

You acquire a commercial building for $1 million. The building’s value is $800,000, and the land is worth $200,000. Using the 39-year depreciation schedule for commercial properties, your annual depreciation deduction would be approximately $20,513. This significant deduction directly impacts your tax liability, making your investment more profitable.

Scenario 3: Multifamily Property

A multifamily property worth $500,000, with a $400,000 building value and $100,000 land value, can be depreciated over 27.5 years. The annual depreciation deduction would be $14,545. This deduction can offset rental income, potentially reducing your tax burden.

Key Takeaways:

- Depreciation is a powerful tax strategy that can save real estate investors significant money.

- The amount of depreciation depends on the property type, its value, and the chosen depreciation method.

- Understanding depreciation’s impact on your investment can help you make more informed decisions and maximize your returns.

Expert Tips for Utilizing Depreciation to Your Advantage

Depreciation, a crucial concept in real estate investing, allows you to deduct a portion of your property’s value each year for tax purposes. This deduction, known as depreciation expense, reduces your taxable income, thus lowering your tax liability. While depreciation doesn’t directly put money back in your pocket, it significantly impacts your bottom line.

To maximize the benefits of depreciation, consider these expert tips:

- Understand Depreciation Methods: The most common method used is the Straight-Line Depreciation Method, which allows you to depreciate the property’s value evenly over its useful life. Another method is the Accelerated Depreciation Method, which allows you to depreciate the property’s value more quickly in the early years. Consult with a tax professional to determine the best method for your situation.

- Maximize Depreciable Basis: Ensure you accurately calculate your depreciable basis, which includes the purchase price, closing costs, and any capital improvements. This can lead to greater tax savings.

- Track Expenses: Keep meticulous records of all expenses related to your property, including repairs, maintenance, insurance, and property taxes. These expenses can offset your depreciation expense, further reducing your tax liability.

- Seek Professional Guidance: Collaborate with a tax professional to fully understand the intricacies of depreciation and how it applies to your specific investment situation. They can help you maximize your tax benefits and ensure compliance with regulations.

By incorporating these expert tips, you can effectively leverage the power of depreciation to optimize your real estate investments and reap significant tax advantages.