Are you a homeowner looking to maximize your financial gains while minimizing your tax burden? Smart tax planning is crucial for navigating the complexities of capital gains taxes, especially when it comes to your primary residence. Whether you’re planning to sell your home, downsize, or simply understand your tax obligations, understanding the intricacies of capital gains tax strategies can significantly impact your bottom line.

This comprehensive guide will explore effective strategies for navigating the complexities of capital gains tax on your home. From the homeowner exclusion to tax-loss harvesting and 1031 exchanges, we’ll delve into the key considerations and actionable steps to optimize your tax planning for homeownership.

Understanding Capital Gains Tax on Property Sales

When you sell a property that you’ve owned for a period of time, you may be subject to capital gains tax. This tax applies to the profit you make on the sale, which is calculated as the difference between the selling price and your original purchase price, plus any associated costs like improvements or renovations. Understanding this tax is crucial for effective financial planning, especially when making real estate decisions.

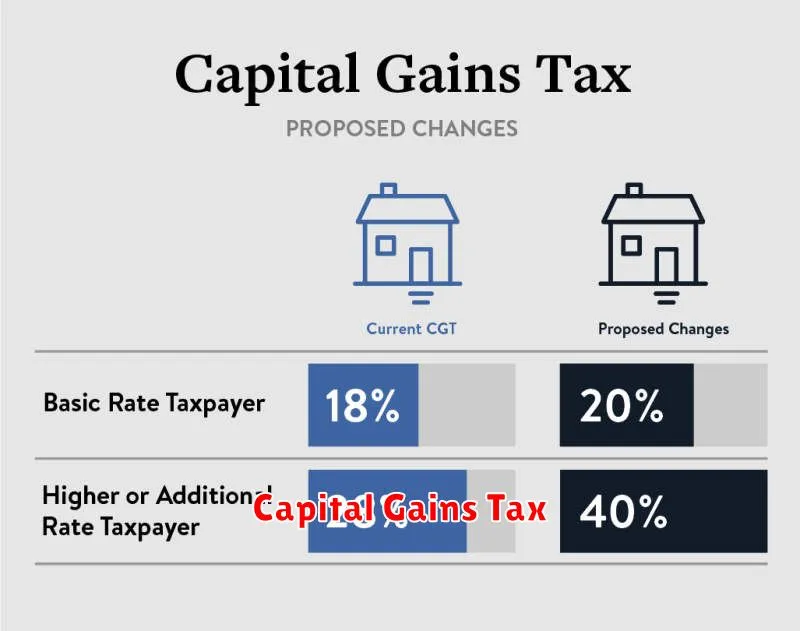

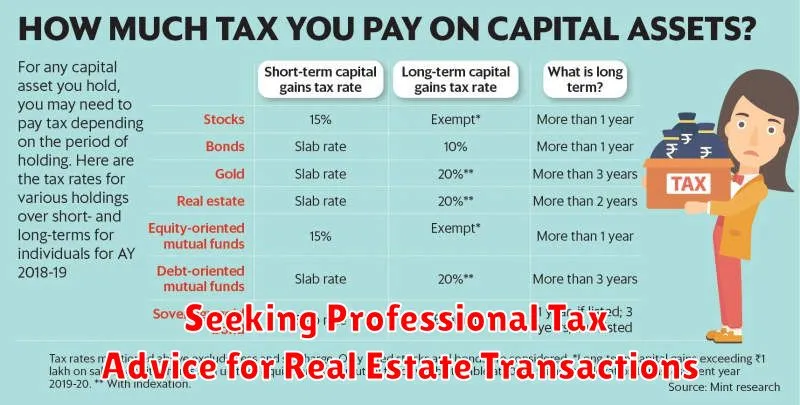

The capital gains tax rate depends on your individual circumstances, such as your income level and the type of property sold. In the United States, for instance, long-term capital gains (held for more than a year) are taxed at different rates depending on your income bracket.

It’s important to note that there are often exemptions and deductions that can reduce your capital gains tax liability. For example, in many countries, you may be exempt from paying tax on the first portion of your profit (known as the “principal residence exemption”). Additionally, certain types of investments, like retirement funds, may be exempt from capital gains tax.

Consult with a qualified tax advisor to determine your specific tax liability and explore any potential exemptions or deductions available to you. This proactive approach can help you maximize your profits and minimize your tax burden when selling your property.

Exclusions and Deductions to Reduce Your Tax Liability

When you sell your home, you may be subject to capital gains tax on any profit you make. However, there are several exclusions and deductions that can help reduce your tax liability.

One of the most significant exclusions is the principal residence exclusion. This allows you to exclude up to $250,000 in capital gains if you are single, or $500,000 if you are married filing jointly, if you have lived in the home for at least two out of the five years leading up to the sale.

In addition to the principal residence exclusion, you may also be able to deduct certain expenses related to the sale of your home. These expenses include:

- Real estate commissions

- Legal fees

- Advertising costs

- Property taxes

- Home improvements

It is important to keep detailed records of all your home sale expenses. This will help you accurately calculate your capital gains and determine if you qualify for any deductions. If you are unsure about your tax obligations, consult with a qualified tax advisor. They can help you navigate the complex world of capital gains taxes and ensure you are taking advantage of all the available exclusions and deductions.

Strategies for Deferring Capital Gains Tax

When you sell your home, you may be subject to capital gains tax on any profit you make. This can be a significant expense, especially if you’ve owned your home for many years and its value has appreciated substantially. However, there are a number of strategies you can use to defer or reduce your capital gains tax liability. Here are a few of the most common:

1. The 1031 Exchange: This strategy allows you to defer capital gains tax by reinvesting the proceeds from the sale of your home into another like-kind property. This can be a great option if you’re planning to move to a new home or invest in a rental property.

2. The Principal Residence Exclusion: This exclusion allows homeowners to exclude up to $250,000 in capital gains ($500,000 for married couples filing jointly) from their taxable income. This applies if you’ve owned and lived in the home for at least two of the five years prior to the sale.

3. The 72t Rule: This rule allows you to defer capital gains tax on the sale of your home if you are at least 59 1/2 years old and use the proceeds to purchase a qualified annuity.

4. Tax-Deferred Retirement Accounts: If you’re planning to downsize to a smaller home, you may be able to use the proceeds from the sale to contribute to a tax-deferred retirement account, such as a 401(k) or IRA. This can help reduce your tax burden in the long run.

5. Donate Your Home to Charity: If you donate your home to a qualified charity, you may be able to deduct the fair market value of the home from your taxable income. This can be a significant tax benefit, especially if you’ve owned your home for many years and it has appreciated in value.

Important Note: Consult with a qualified tax professional before making any decisions about how to handle your capital gains tax. They can help you understand the rules and regulations that apply to your specific situation and recommend the best strategies for minimizing your tax liability.

1031 Exchange: Deferring Taxes Through Property Swaps

A 1031 exchange, also known as a like-kind exchange, is a powerful tax strategy that allows investors to defer capital gains taxes when selling investment property. This strategy is particularly relevant for homeowners who are looking to upgrade their property or invest in a different type of real estate.

Instead of selling your current property and paying capital gains tax on the profits, a 1031 exchange allows you to reinvest those proceeds into a new property of “like-kind.” This means the properties must be used for similar investment purposes, such as rental properties or commercial real estate. By rolling over the gains into a new property, you defer the capital gains tax until you eventually sell the replacement property.

To execute a 1031 exchange, you must work with a qualified intermediary who will handle the transaction. They will ensure that the exchange meets IRS requirements. While this strategy can save you significant tax dollars in the long run, it’s crucial to understand the complexities and timing involved in a 1031 exchange.

Remember, a 1031 exchange only defers capital gains taxes. When you eventually sell the replacement property, you will be liable for the capital gains tax on the accumulated gains from both the original and replacement properties.

Utilizing Primary Residence Exclusion

One of the most valuable tax benefits for homeowners is the primary residence exclusion. This allows you to exclude up to $250,000 in capital gains from the sale of your home if you are single or $500,000 if you are married filing jointly. This exclusion applies if you have owned and lived in the home as your primary residence for at least two of the five years prior to the sale.

The primary residence exclusion is a powerful tool for minimizing your tax liability when selling your home. Here are some key points to keep in mind:

- The exclusion is applied to the gain, which is the difference between the sale price and your adjusted basis in the home.

- Your adjusted basis is your original purchase price plus any improvements you made to the home minus any depreciation claimed.

- If you have lived in the home for less than two years, you may be eligible for a partial exclusion.

It’s important to note that the primary residence exclusion has some limitations. For example, it only applies to one home sale every two years. If you sell multiple homes in a short period, you may not be able to claim the exclusion on all of them. Additionally, the exclusion does not apply to capital gains from the sale of rental property or other investment properties.

To maximize your benefit from the primary residence exclusion, it’s crucial to understand the requirements and plan accordingly. Consult with a qualified tax professional for guidance specific to your individual situation.

Capital Gains Tax Implications for Inherited Property

When you inherit property, it’s generally considered a tax-free event. You receive the property at its fair market value at the time of the owner’s death, known as the stepped-up basis. This means you won’t have to pay capital gains tax on any appreciation in value that occurred during the deceased’s ownership.

However, the stepped-up basis only applies to the value of the property at the time of death. If you sell the property later, you’ll only pay capital gains tax on any appreciation that occurs after the deceased’s death. For example, if you inherit a house worth $300,000 and sell it for $400,000 five years later, you’ll only pay capital gains tax on the $100,000 profit.

There are some exceptions to the stepped-up basis rule. For instance, if you inherit property that is subject to estate tax, the basis may be adjusted to reflect the estate tax liability. Additionally, if you inherit property from a spouse, the carryover basis rule may apply, meaning you inherit the same basis as the deceased. This can have tax implications if the property was purchased at a lower price than its current market value.

It’s important to consult with a tax advisor to understand the capital gains tax implications of inheriting property. They can help you determine your tax liability and develop a strategy to minimize your tax burden.

Tax-Efficient Ways to Manage Investment Property Sales

Selling an investment property can lead to significant capital gains tax obligations. However, with careful planning, you can minimize your tax burden and maximize your profits. Here are some tax-efficient ways to manage investment property sales:

1. Utilize the Principal Residence Exemption (PRE): If you’ve lived in the property for at least two of the five years preceding the sale, you may qualify for the PRE. This allows you to exclude up to $250,000 (or $500,000 for married couples filing jointly) of capital gains from taxation. However, it’s crucial to meet the residency requirements and ensure proper documentation to claim this exemption.

2. Consider a 1031 Exchange: A 1031 exchange allows you to defer capital gains taxes by reinvesting the proceeds from the sale into a like-kind property of equal or greater value. This strategy is ideal for investors who wish to continue holding real estate assets without incurring immediate tax liabilities. However, strict rules and timelines govern 1031 exchanges, requiring professional guidance to ensure compliance.

3. Leverage Tax Loss Harvesting: If you’ve experienced losses on other investments, you can offset capital gains from your investment property sale by selling those losing investments. This strategy, known as tax loss harvesting, can reduce your overall tax burden.

4. Capital Gains Tax Deductions: You may be eligible for deductions related to selling expenses, such as realtor commissions, legal fees, and advertising costs. These deductions can reduce your taxable capital gains and lower your overall tax liability.

5. Consult with a Tax Professional: Navigating the complexities of capital gains tax regulations can be daunting. It’s highly recommended to consult with a qualified tax professional to discuss your specific situation and develop a personalized tax plan that minimizes your tax exposure and maximizes your investment returns.

Impact of Holding Period on Capital Gains Tax

The length of time you hold an asset, known as the holding period, significantly influences the capital gains tax you’ll owe. In the case of homes, the holding period determines your eligibility for certain tax breaks and impacts the tax rate applied to your profits.

For homes sold after owning them for less than a year, any profit is considered short-term capital gains and taxed at your ordinary income tax rate. This can be significantly higher than the long-term capital gains rate.

However, if you’ve held your home for at least a year, you qualify for long-term capital gains treatment. This often results in a lower tax rate, typically 0%, 15%, or 20%, depending on your income level.

It’s crucial to understand that the primary residence exclusion allows you to exclude up to $250,000 in capital gains for single filers and $500,000 for married couples filing jointly. This exclusion applies regardless of the holding period. However, it’s only applicable once every two years, so you should carefully consider the timing of your home sale to maximize its benefit.

Therefore, carefully planning your holding period can significantly affect your tax liability. If you’re considering selling your home soon, consult with a tax professional to understand the implications of the holding period on your capital gains tax.

Calculating Your Capital Gains Tax Liability

When you sell your home, you may owe capital gains tax on the profit you make. The profit is calculated by subtracting your adjusted cost basis from the selling price. Your adjusted cost basis is the original purchase price plus any improvements you made to the home.

For example, if you bought your home for $200,000 and sold it for $300,000, your profit would be $100,000. If you made improvements to the home that cost $20,000, your adjusted cost basis would be $220,000 and your profit would be $80,000.

The capital gains tax rate depends on your income and how long you’ve owned the home. You may be eligible for the exclusion of capital gains tax, which allows you to exclude up to $250,000 of profit if you are single and $500,000 if you are married filing jointly.

It’s important to consult with a tax professional to understand your specific situation and how to minimize your capital gains tax liability.

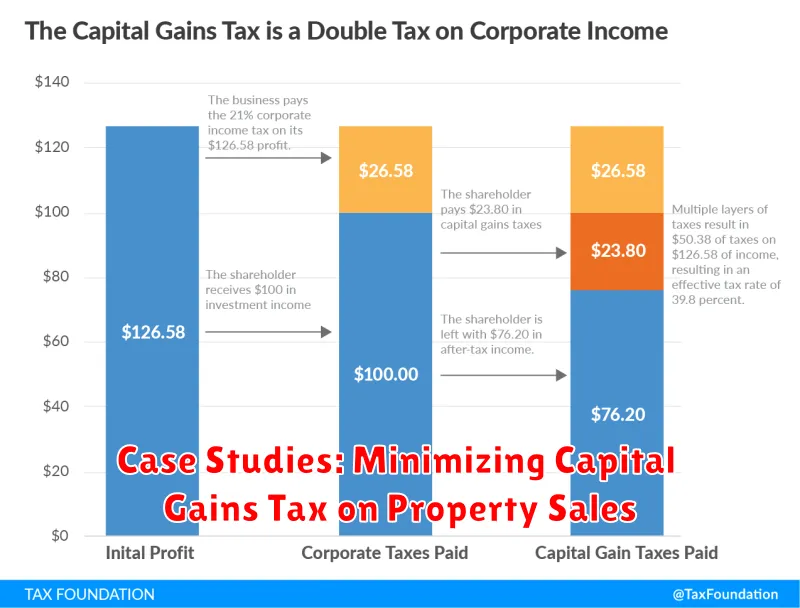

Seeking Professional Tax Advice for Real Estate Transactions

Real estate transactions, whether buying, selling, or renting, can have significant tax implications. Navigating the complex world of capital gains tax, property taxes, and depreciation deductions can be overwhelming for homeowners. Therefore, seeking professional tax advice is crucial to ensure you’re taking advantage of all available tax benefits and minimizing your tax liability.

A qualified tax advisor, such as a certified public accountant (CPA) or an enrolled agent (EA), can provide expert guidance on various aspects of your real estate transactions, including:

- Capital Gains Tax Calculation: They can help you determine your capital gains or losses on the sale of your property, taking into account factors like holding period, improvements, and expenses.

- Depreciation Deductions: If you’re a homeowner who rents out a portion of your property, you may be eligible for depreciation deductions, which can significantly reduce your taxable income.

- Tax-Deferred Exchanges: In certain circumstances, you can use a 1031 exchange to defer capital gains tax by reinvesting the proceeds from the sale of your property into a similar property.

- Property Tax Strategies: They can advise on strategies to minimize property taxes, such as homestead exemptions and deductions for specific expenses.

By engaging a tax professional, you gain access to their expertise and experience, ensuring you’re making informed decisions about your real estate transactions. They can help you identify potential tax savings, optimize your tax strategy, and avoid costly mistakes. Remember, seeking professional tax advice can save you money in the long run and ensure compliance with tax regulations.

Case Studies: Minimizing Capital Gains Tax on Property Sales

Navigating the complexities of capital gains tax on property sales can be daunting. However, with strategic planning, it’s possible to minimize your tax burden and maximize your profits. Let’s explore some real-world case studies that illustrate effective strategies:

Case 1: The Downsizer

Sarah, a retiree, wanted to downsize from her large family home to a smaller condo. She had owned her home for 30 years and accumulated significant equity. To avoid a large capital gains tax liability, she strategically used the principal residence exemption. This exemption allowed her to exclude a portion of the profit from taxation, significantly reducing her overall tax burden. By carefully timing the sale and understanding the exemption rules, Sarah successfully navigated the complexities of capital gains tax.

Case 2: The Investor

John, a real estate investor, purchased a fixer-upper property. He invested time and money in renovations, increasing the property’s value. When he sold the property, he strategically offset his capital gains with eligible expenses related to the renovations, including labor and materials. By claiming these deductions, John effectively reduced his taxable gains, resulting in significant tax savings.

Case 3: The Business Owner

Emily, a small business owner, used her home as an office. She had a portion of her home dedicated to her business activities. To minimize her capital gains tax liability when she sold the property, Emily claimed a deduction for the business portion of the home. This deduction allowed her to exclude a portion of the profit from taxation, leading to a more favorable tax outcome.

Key Takeaways:

These case studies highlight the importance of proactive tax planning when selling property. By understanding the available exemptions, deductions, and strategies, you can potentially minimize your tax liability and maximize your financial returns. Consulting with a qualified tax professional can provide tailored advice based on your specific circumstances and help you navigate the intricacies of capital gains tax.