In the competitive landscape of e-commerce, understanding Customer Lifetime Value (CLV) is paramount to sustainable success. CLV represents the total revenue a business can reasonably expect from a single customer throughout their relationship. Accurately calculating and leveraging CLV empowers businesses to make informed decisions regarding marketing spend, customer acquisition strategies, and overall business growth. This article will delve into the intricacies of CLV, providing a comprehensive understanding of its calculation, importance, and practical applications within the e-commerce domain. From customer retention tactics to optimizing customer acquisition cost (CAC), mastering CLV is key to maximizing profitability and building a thriving online business.

Beyond simply a metric, CLV offers a profound shift in perspective, encouraging businesses to view customers as long-term assets rather than single transactions. By understanding the long-term value of each customer, e-commerce businesses can strategically invest in customer relationships, fostering loyalty and maximizing return on investment. This introductory exploration into Customer Lifetime Value (CLV) will equip you with the knowledge necessary to leverage this powerful metric and drive sustainable growth in the dynamic world of e-commerce. We will explore various CLV models, discuss practical strategies for improving CLV, and highlight the importance of incorporating CLV into your overall business strategy.

Why CLV Is a Critical Metric

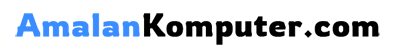

Customer Lifetime Value (CLV) is a key metric for any business. It represents the total revenue a business can reasonably expect from a single customer throughout their relationship. Understanding CLV helps businesses make informed decisions about sales, marketing, product development, and customer support. By focusing on CLV, companies can prioritize long-term profitability over short-term gains.

Calculating and analyzing CLV provides valuable insights. It allows businesses to identify their most valuable customer segments, understand the factors that drive customer retention, and optimize marketing spend for acquisition and retention. Knowing the CLV can also help determine the acceptable cost of acquiring new customers, ensuring that marketing efforts are cost-effective and contribute to the bottom line. This knowledge also empowers businesses to make strategic decisions about pricing, product development, and customer service improvements to maximize the value of each customer relationship.

Ultimately, focusing on CLV leads to sustainable business growth. By investing in strategies that increase customer lifetime value, companies can build stronger customer relationships, improve customer retention rates, and achieve greater profitability. This focus shifts from transactional interactions to fostering long-term loyalty, creating a more stable and valuable customer base for the future.

How to Calculate Customer Lifetime Value

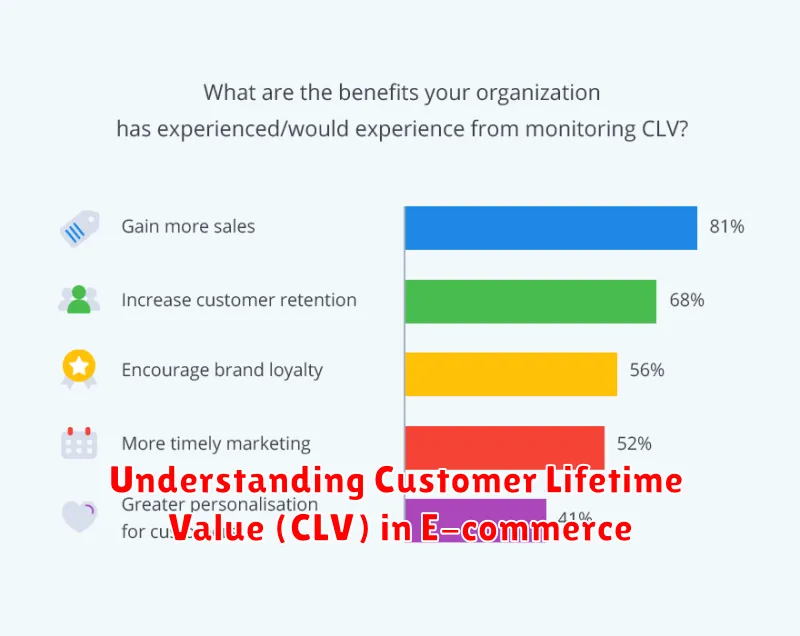

Customer Lifetime Value (CLTV or CLV) is a key metric that predicts the total revenue a business expects from a single customer over the entire duration of their relationship. Understanding CLTV helps businesses make informed decisions about sales, marketing, product development, and customer support. By focusing on maximizing CLTV, companies can improve profitability and build stronger, more sustainable customer relationships.

There are several ways to calculate CLTV, ranging from simple to complex. A basic formula is: Average Purchase Value x Average Purchase Frequency x Average Customer Lifespan. For example, if a customer spends an average of $50 per purchase, buys twice a year, and remains a customer for five years, their CLTV is $50 x 2 x 5 = $500. More advanced calculations incorporate factors like customer churn rate and discount rates to account for the time value of money.

While the basic formula provides a useful starting point, businesses often require more sophisticated models to accurately reflect customer behavior and predict future revenue. These models might segment customers based on demographics, purchase history, or engagement levels. By understanding the drivers of CLTV, such as customer retention and average order value, businesses can implement targeted strategies to increase profitability and build long-term value.

The Impact of Retention on CLV

Customer Lifetime Value (CLV) represents the total revenue a business can reasonably expect from a single customer throughout their relationship. Retention plays a crucial role in maximizing CLV. Acquiring new customers is typically more expensive than retaining existing ones. Therefore, by focusing on retention strategies, businesses can reduce acquisition costs and increase the overall profitability of each customer.

Higher retention rates directly translate to increased CLV. When customers remain loyal to a brand, they continue to make purchases over an extended period. This consistent revenue stream contributes significantly to a higher CLV for each retained customer. Furthermore, loyal customers often become brand advocates, recommending products or services to others, which can further contribute to new customer acquisition and overall revenue growth.

Strategies for improving retention and subsequently CLV include personalized communication, loyalty programs, exceptional customer service, and proactive engagement. By investing in initiatives that foster customer loyalty, businesses can cultivate long-term relationships that drive substantial growth and enhance profitability.

Segmentation for Higher CLV

Customer Lifetime Value (CLV) represents the total revenue a business can reasonably expect from a single customer throughout their relationship. Segmentation plays a crucial role in maximizing CLV by allowing businesses to identify, understand, and cater to specific customer groups with tailored strategies. By dividing the customer base into segments based on shared characteristics like demographics, purchase behavior, or engagement levels, companies can more effectively allocate resources and personalize the customer experience.

Effective segmentation allows for targeted marketing campaigns, leading to increased conversion rates and improved customer retention. For example, high-value customers might receive exclusive offers and personalized service, while newer customers could be nurtured through onboarding programs and targeted educational content. This strategic approach strengthens customer relationships and encourages repeat purchases, ultimately boosting CLV.

Analyzing segmentation data provides valuable insights into customer behavior, informing product development, pricing strategies, and customer service improvements. Understanding the unique needs and preferences of each segment allows businesses to optimize their offerings and deliver a more relevant and valuable customer experience, further enhancing CLV.

Email Marketing to Boost Retention

Email marketing is a powerful tool for boosting customer retention. By staying in touch with your customers, you can nurture relationships, build loyalty, and encourage repeat purchases. Personalized emails based on customer behavior and preferences are key. This could include tailored product recommendations, exclusive offers, or valuable content related to their past purchases. Consistent communication keeps your brand top-of-mind and reminds customers of the value you provide.

A successful retention strategy involves segmenting your audience. This allows you to target specific customer groups with relevant messaging. For example, you can send welcome emails to new subscribers, re-engagement emails to inactive customers, or birthday discounts to loyal patrons. By tailoring your communication, you increase the chances of resonating with each customer and driving engagement.

Measuring your email marketing efforts is essential. Track key metrics like open rates, click-through rates, and conversion rates to understand what’s working and what’s not. Use this data to refine your strategy and improve your retention efforts over time. Analyzing these metrics can help you optimize subject lines, email content, and sending frequency to maximize impact.

Cross-Selling and Upselling Tactics

Cross-selling involves suggesting related products or services to a customer who is already purchasing something. This tactic aims to increase the overall value of the transaction by offering complementary items. For example, a customer buying a laptop might be offered a carrying case, a mouse, or software. Effective cross-selling requires understanding customer needs and offering relevant additions to their purchase. Bundling related items at a discounted price can also be a powerful cross-selling incentive.

Upselling focuses on persuading a customer to purchase a higher-end or more feature-rich version of the product they are considering. This can involve highlighting the benefits of the premium option, such as improved performance, durability, or additional features. For example, a customer looking at a basic television model could be upsold to a larger screen size, a smart TV with streaming capabilities, or a model with better picture quality. Successful upselling relies on showcasing the value proposition of the upgraded product and demonstrating how it better meets the customer’s needs.

Both cross-selling and upselling are valuable sales strategies that can increase revenue and customer satisfaction. When implemented effectively, they can enhance the customer experience by providing tailored recommendations and helping customers find the products and services that best suit their requirements. However, it’s important to avoid being overly pushy or aggressive, as this can deter customers and damage relationships. The key is to offer helpful suggestions and clearly explain the benefits of the additional or upgraded items.

Personalization to Enhance Loyalty

Personalization is a powerful tool for building customer loyalty. By tailoring experiences and offers to individual preferences, businesses can foster a stronger sense of connection and value. This approach moves beyond simply addressing customers by name and delves into understanding their unique needs, past behaviors, and expressed interests. When customers feel understood and appreciated, they are more likely to remain engaged and choose your brand over competitors.

Implementing effective personalization requires data collection and analysis. Gathering information on customer demographics, purchase history, browsing behavior, and interaction with marketing campaigns provides valuable insights. This data allows businesses to segment their audience and create targeted messages, product recommendations, and promotions that resonate with each individual. Analyzing customer feedback and reviews further enhances personalization efforts by providing a direct understanding of their needs and pain points.

The benefits of personalization extend beyond increased loyalty. It can also drive sales growth, improve customer lifetime value, and strengthen brand advocacy. By delivering relevant experiences, businesses can increase conversion rates and encourage repeat purchases. Personalized recommendations can also introduce customers to new products or services they may be interested in, further expanding their engagement with the brand. Ultimately, personalization fosters a sense of loyalty that translates into long-term customer relationships and sustainable business growth.

CLV vs Acquisition Cost

Customer Lifetime Value (CLV) represents the total revenue a business can reasonably expect from a single customer throughout their relationship. Customer Acquisition Cost (CAC) is the total cost associated with convincing a customer to make their first purchase. Comparing these two metrics is crucial for understanding the profitability and sustainability of a business. A healthy business model requires CLV to significantly outweigh CAC.

Ideally, your CLV should be at least three times greater than your CAC. A lower ratio indicates potential problems with pricing, customer retention, or marketing effectiveness. For example, a high CAC and low CLV could suggest your marketing campaigns are targeting the wrong audience or that your product pricing isn’t aligned with the value delivered. Conversely, a high CLV and low CAC indicates a highly efficient and profitable business model.

Analyzing the relationship between CLV and CAC can guide strategic decision-making. By understanding these metrics, businesses can optimize marketing spend, improve customer retention strategies, and ultimately, drive sustainable growth and profitability.

Using Data to Improve Predictions

Data plays a crucial role in enhancing the accuracy and reliability of predictions. By analyzing historical trends, patterns, and correlations within data, we can gain valuable insights into potential future outcomes. This allows us to develop more robust and informed predictive models. Whether forecasting sales, predicting weather patterns, or assessing risk, leveraging data empowers us to make more accurate and data-driven decisions.

The process of using data to improve predictions typically involves collecting, cleaning, and preparing relevant data sets. This data is then used to train predictive models, employing various statistical and machine learning techniques. Model validation is essential to ensure the accuracy and reliability of the predictions. This often involves testing the model on unseen data to assess its performance and identify areas for improvement. Continuously evaluating and refining the model based on new data further enhances its predictive capabilities.

The benefits of data-driven prediction are numerous. Improved predictions lead to better decision-making, reduced uncertainty, and increased efficiency across various domains. Businesses can optimize resource allocation, mitigate risks, and identify new opportunities. In scientific fields, accurate predictions are essential for understanding complex phenomena and advancing research. Ultimately, harnessing the power of data leads to more informed choices and a greater understanding of the world around us.

Real-Life Case Studies

Case studies provide valuable insights into real-world applications and outcomes. Examining specific examples allows us to understand the practical implications of theories, strategies, and interventions. By analyzing both successes and failures, we gain a deeper comprehension of the complexities and nuances involved in various fields, including business, medicine, and social sciences. These studies often highlight critical factors contributing to specific results and can inform future decision-making processes.

A compelling case study typically involves a detailed examination of a particular subject, whether it’s a single individual, a group, an organization, or a specific event. Data collection methods often include interviews, observations, and analysis of relevant documents. The presentation of a case study usually involves a narrative describing the context, the problem or challenge faced, the implemented solutions, and the ultimate outcomes. This narrative approach makes complex information more accessible and relatable.

Ultimately, the purpose of a case study is to offer evidence-based insights and practical lessons that can be applied to similar situations. They serve as a valuable tool for learning, teaching, and improving practices across various disciplines. By demonstrating the real-world consequences of specific actions and decisions, case studies provide a powerful platform for understanding, analyzing, and addressing complex issues.