Are you curious about how to unlock the secrets of property appreciation? Do you want to know how to make informed decisions about buying, selling, or investing in real estate? If so, then you’ve come to the right place! In this comprehensive guide, we will delve into the fascinating world of property appreciation, exploring the key factors that influence its rate and providing you with the knowledge you need to analyze and understand it. Whether you’re a seasoned investor or just starting your real estate journey, this guide will equip you with the insights you need to make smart, profitable decisions.

From understanding the fundamentals of supply and demand to recognizing the impact of local market dynamics, we’ll cover it all. We’ll explore the role of economic indicators, interest rates, and infrastructure development in shaping property values. Armed with this knowledge, you’ll be able to identify potential hotspots for real estate investment, anticipate market trends, and make sound investment choices that align with your financial goals. Let’s unlock the secrets of property appreciation together!

What is Property Appreciation and Why Does It Matter?

Property appreciation refers to the increase in the value of a real estate property over time. This increase can be driven by various factors like market demand, economic growth, and improvements to the property itself.

Understanding property appreciation is crucial for both homeowners and investors. For homeowners, it represents potential wealth building as their property becomes more valuable. For investors, it offers the prospect of strong returns on their investment.

Here’s why property appreciation matters:

- Increased Equity: As your property appreciates, the difference between its market value and your outstanding mortgage becomes larger. This increased equity serves as a financial cushion and can be used for various purposes like home improvements, debt consolidation, or as a down payment for another property.

- Higher Selling Price: When you decide to sell your property, a higher appreciation rate translates to a higher selling price, leading to a larger profit. This can be particularly beneficial in the long term.

- Potential for Investment Growth: For real estate investors, property appreciation is a key driver of returns. By purchasing properties that appreciate, investors can generate significant returns, potentially exceeding other investment options.

Property appreciation is not guaranteed and can be influenced by various factors. However, understanding its concept and implications is essential for making informed decisions regarding your real estate investments.

Factors Influencing Property Appreciation Rates

Property appreciation, the increase in the value of a property over time, is a key driver of wealth for many investors. Understanding the factors that influence these appreciation rates is crucial for making informed investment decisions.

Location is a primary factor. Properties in high-demand areas with strong economic growth, good schools, and desirable amenities tend to appreciate faster. Conversely, properties in declining or underdeveloped areas may experience slower or even negative appreciation.

Economic conditions play a significant role. Strong economic growth, low interest rates, and high employment rates create a favorable environment for property appreciation. Conversely, economic downturns, high interest rates, and unemployment can dampen property values.

Supply and demand dynamics are also crucial. When demand for housing exceeds supply, prices tend to rise. Factors like population growth, migration patterns, and local development projects influence supply and demand.

Property characteristics, such as size, age, condition, and amenities, directly impact appreciation rates. Well-maintained, updated properties with desirable features tend to appreciate at a higher rate.

Interest rates have a direct impact on property appreciation. Lower interest rates make borrowing more affordable, leading to increased demand and higher prices. Conversely, higher interest rates can slow down appreciation.

Government policies, such as tax incentives, zoning regulations, and infrastructure investments, can influence property values. Favorable policies can stimulate appreciation, while restrictive ones can hinder it.

Market volatility, caused by factors like economic shocks, natural disasters, or political instability, can significantly impact appreciation rates.

By carefully considering these factors, investors can gain a deeper understanding of the forces driving property appreciation and make more informed investment decisions.

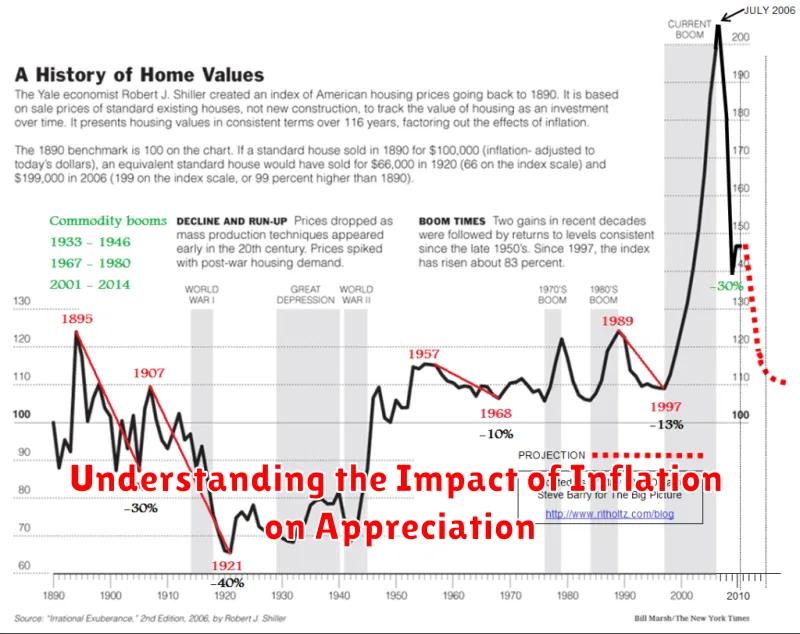

Historical Property Appreciation Trends and Patterns

Understanding historical property appreciation trends is crucial for making informed real estate investment decisions. By analyzing past data, investors can gain insights into the factors that drive property value growth and identify potential opportunities and risks. Historical data allows for the identification of recurring patterns and cyclical trends, providing valuable information for predicting future performance.

One of the most significant factors influencing property appreciation is economic growth. As the economy expands, employment rates increase, and incomes rise, demand for housing typically increases, leading to price appreciation. Conversely, during economic downturns, property values may decline due to reduced demand and lower affordability.

Another crucial factor is interest rates. Lower interest rates often encourage borrowing, increasing demand for housing and driving prices upward. Conversely, higher interest rates make borrowing more expensive, potentially dampening demand and slowing appreciation.

Demographics also play a vital role. Population growth, particularly in specific areas, can lead to increased demand for housing and drive prices up. Age demographics, such as the growth of the millennial generation, can also influence housing preferences and market trends.

Government policies significantly impact property appreciation. Tax incentives, zoning regulations, and infrastructure investments can stimulate or restrain property value growth.

It is essential to note that property appreciation is not always consistent or predictable. Local market conditions, including supply and demand dynamics, can significantly influence price trends. Local economic factors, such as job opportunities and amenities, can also play a role.

Analyzing historical data can provide valuable insights into the factors that drive property appreciation. By understanding these trends, investors can make more informed decisions about their real estate investments and potentially achieve better returns. However, it’s essential to remember that past performance is not always indicative of future results and that market conditions can change significantly.

Analyzing Local Market Conditions and Their Impact

Understanding the local market conditions is crucial for determining a property’s potential appreciation. This involves a comprehensive analysis of factors that influence property values, including economic indicators, demographics, and infrastructure development.

Economic Indicators: A strong local economy is a key driver of property appreciation. Consider factors such as employment rates, average income, and industry growth. A booming economy generally translates to higher demand for housing, which can lead to increased property values.

Demographics: Population growth, age distribution, and household size can significantly impact property demand. For example, a growing population with young families might create a higher demand for single-family homes, while an aging population might favor retirement communities or smaller units.

Infrastructure Development: Improvements in infrastructure, such as new transportation systems, schools, or hospitals, can positively influence property values. These enhancements often improve the desirability and convenience of a neighborhood, attracting more buyers and potentially increasing property prices.

Supply and Demand: The balance between supply and demand in the housing market is crucial. When demand outpaces supply, property values tend to rise. However, an oversupply of properties can lead to price stagnation or even decline.

By carefully analyzing these local market conditions, you can gain valuable insights into the potential for property appreciation in a specific area. This knowledge can help you make informed decisions about real estate investments and maximize your chances of achieving positive returns.

The Role of Economic Growth in Property Value Increases

A strong economy is often a key driver of property value appreciation. When the economy is booming, businesses are thriving, unemployment is low, and consumer confidence is high. This translates into increased demand for housing, as more people are looking to buy homes, start families, and invest in real estate. As demand increases, so do prices, leading to property value appreciation.

Economic growth is often measured by factors like GDP growth, job creation, and consumer spending. When these indicators are positive, it signals a healthy economy and a strong real estate market. For instance, a growing economy can lead to higher wages, which in turn allows people to afford more expensive homes. Additionally, economic growth often brings about new job opportunities, attracting more people to a region and increasing demand for housing.

On the other hand, a weak economy can have the opposite effect on property values. When economic growth slows down, businesses may struggle, unemployment may rise, and consumer spending may decrease. This can lead to a decline in demand for housing, causing property values to stagnate or even decline.

Therefore, understanding the relationship between economic growth and property value appreciation is crucial for investors seeking to make informed decisions. By monitoring key economic indicators, investors can get a better sense of the overall health of the economy and its potential impact on the real estate market.

Understanding the Impact of Inflation on Appreciation

Inflation, the persistent increase in the general price level of goods and services, plays a significant role in the appreciation of property. It impacts both the supply and demand dynamics in the real estate market, ultimately influencing the growth of property values.

As inflation rises, the cost of construction materials, labor, and other resources necessary for building new homes increases. This can lead to a reduction in new construction projects, creating a scarcity of available properties. The limited supply, coupled with increasing demand from buyers seeking a hedge against inflation, drives property prices upward.

Furthermore, rising inflation often translates to higher interest rates. While higher interest rates make borrowing more expensive, they also incentivize investors to put their money into appreciating assets like real estate, further increasing demand and pushing up property prices.

Therefore, understanding the interplay between inflation and property appreciation is crucial. While inflation can boost property values, it also presents challenges such as increased borrowing costs. Investors must carefully consider their individual financial situations and market dynamics when evaluating the impact of inflation on their property investments.

How Interest Rates Affect Property Appreciation

Understanding how interest rates impact property appreciation is crucial for any investor. Interest rates play a significant role in the housing market by influencing borrowing costs, which directly affect demand for homes.

When interest rates rise, borrowing money becomes more expensive. This leads to:

- Reduced demand for homes: Potential buyers are less likely to take out loans with higher interest rates, leading to lower demand for properties.

- Slower appreciation: With fewer buyers, prices may stagnate or increase at a slower rate.

- Potential for price decreases: In extreme cases, high interest rates can even lead to a decline in property values.

Conversely, when interest rates fall, borrowing becomes more affordable, resulting in:

- Increased demand for homes: More buyers are willing to take out loans, leading to higher demand for properties.

- Accelerated appreciation: Increased demand can drive property prices upward at a faster pace.

It’s important to remember that the relationship between interest rates and property appreciation is complex and influenced by other factors such as economic conditions, supply and demand dynamics, and local market trends.

Analyzing Neighborhood Specific Factors and Amenities

Beyond broader market trends, neighborhood-specific factors can significantly influence property appreciation. Understanding these factors is crucial for making informed real estate decisions. Key areas to analyze include:

Amenities and Infrastructure: The presence of desirable amenities and robust infrastructure can boost property values. Consider factors like:

- Schools: Top-rated schools attract families and increase demand.

- Parks and Recreation: Green spaces and recreational facilities enhance quality of life.

- Transportation: Easy access to public transportation and major roadways improves connectivity.

- Shopping and Dining: A vibrant commercial district with diverse options adds convenience and desirability.

Community Dynamics: The character and demographics of a neighborhood play a role in property appreciation:

- Crime Rates: Low crime rates enhance safety and attract buyers.

- Homeowner Association (HOA): Active HOAs can maintain property values and community standards.

- Demographics: A growing and desirable demographic profile can drive demand.

Development and Investment: Ongoing development and investment in a neighborhood signal its potential for appreciation:

- New Construction: New homes and developments can raise property values in the area.

- Infrastructure Improvements: Upgrades to roads, utilities, and public spaces enhance neighborhood appeal.

- Business Growth: Expanding businesses and job opportunities attract residents and boost demand.

By carefully assessing these neighborhood-specific factors and amenities, you can gain valuable insights into the potential for property appreciation in a particular area. This analysis empowers you to make informed investment decisions and maximize your chances of long-term financial success in the real estate market.

Using Data and Analytics to Estimate Future Appreciation

While predicting the future is an inexact science, leveraging data and analytics can provide valuable insights into potential property appreciation. This involves analyzing historical trends, economic indicators, and market dynamics to identify patterns and forecast future growth.

Historical data on property prices, sales volume, and appreciation rates can reveal long-term trends and cyclical patterns. By studying this information, you can identify periods of rapid growth and understand the factors that drove them. Analyzing comparable properties in the same area can also provide valuable insights into current market conditions and potential appreciation.

Economic indicators such as GDP growth, interest rates, and employment levels play a crucial role in shaping the real estate market. A strong economy with low interest rates typically favors property appreciation, while economic downturns can lead to stagnation or even depreciation.

Understanding local market dynamics is equally important. Factors like population growth, infrastructure development, and the availability of amenities can significantly influence property values. Analyzing demographic trends and the supply and demand for housing in the specific area can provide valuable clues about future appreciation potential.

While data and analytics can provide a valuable framework for estimating future appreciation, it’s important to remember that real estate markets are dynamic and unpredictable. Other factors such as government policies, natural disasters, and unexpected events can also influence property values. Therefore, it’s crucial to consider multiple data sources and perspectives to form a well-rounded assessment.

Strategies for Investing in High-Appreciation Properties

Identifying properties with high appreciation potential is crucial for maximizing returns on real estate investments. Here are some key strategies to consider:

1. Focus on High-Demand Locations: Invest in areas with strong population growth, job markets, and limited housing supply. Cities experiencing economic booms, developing urban centers, and desirable suburban communities often offer attractive appreciation prospects.

2. Seek Out Emerging Neighborhoods: Explore up-and-coming areas with potential for revitalization. These neighborhoods might have lower entry prices but offer upside potential as they attract new residents and businesses.

3. Analyze Market Trends: Stay informed about local housing market trends, including supply and demand, interest rates, and economic factors that can influence property values.

4. Consider Property Type and Features: Evaluate different property types, such as single-family homes, condos, multi-family units, or commercial properties. Factors like desirable amenities, modern updates, and energy efficiency can enhance appreciation potential.

5. Invest in Rental Properties: Rental properties can provide steady cash flow while benefiting from long-term appreciation. Targeting areas with high rental demand and low vacancy rates can boost returns.

6. Leverage Value-Adding Improvements: Invest in upgrades that enhance the property’s value, such as kitchen and bathroom renovations, landscaping, or energy-efficient features.

7. Partner with Experienced Professionals: Seek guidance from real estate agents, appraisers, and property managers with expertise in identifying high-appreciation properties and navigating the investment process.

Remember that property appreciation is influenced by numerous factors and involves inherent risks. Thorough research, due diligence, and a strategic approach are essential for maximizing investment success.

Risks and Considerations When Evaluating Appreciation Rates

While property appreciation can be a powerful engine for wealth creation, it’s crucial to approach evaluating appreciation rates with a discerning eye. Several risks and considerations can significantly impact your projections and outcomes.

Market Volatility: Real estate markets are cyclical, meaning they experience periods of boom and bust. A sudden economic downturn, interest rate hikes, or changes in government policies can dramatically affect property values, potentially reversing gains or even leading to depreciation.

Location-Specific Factors: Appreciation rates can vary significantly between neighborhoods, cities, and even individual properties. Factors such as local amenities, infrastructure development, employment opportunities, and crime rates can all influence the desirability and, ultimately, the value of a property.

Property Condition and Maintenance: A well-maintained property with desirable features and updates is more likely to appreciate than one in need of repairs or lacking modern amenities. Investing in upgrades and regular maintenance can help protect and enhance your property’s value.

Overvaluation: In a hot market, property prices can become inflated, leading to an overvaluation. While this may seem like a boon in the short term, it can create a bubble that could burst when market conditions shift.

Unforeseen Events: Natural disasters, economic crises, or political instability can all significantly impact property values. While these events are unpredictable, it’s essential to consider their potential impact when evaluating appreciation rates.

To mitigate these risks, conducting thorough due diligence, consulting with experienced real estate professionals, and considering a diversified investment strategy can be invaluable.