As a real estate investor, you’ve worked hard to build a successful portfolio. But have you considered what will happen to your properties when you’re gone? Estate planning is crucial for any investor, ensuring your legacy is protected and your loved ones are taken care of. This comprehensive guide will provide you with the essential knowledge and strategies to safeguard your real estate investments and secure your financial future.

From wills and trusts to succession planning and tax implications, we’ll delve into the key aspects of estate planning for real estate investors. Learn how to navigate the complexities of property ownership, minimize potential liabilities, and ensure a smooth transfer of your assets. This guide will empower you to make informed decisions and create a plan that aligns with your unique goals and circumstances.

Why Estate Planning is Crucial for Real Estate Investors

Estate planning isn’t just for the wealthy; it’s a vital strategy for anyone who owns real estate, especially active investors. Here’s why:

Protecting Your Assets: Estate planning ensures your real estate holdings are distributed according to your wishes. Without a will or trust, your assets could be subject to probate, which can be expensive and time-consuming. You can also establish clear instructions for managing your properties after your passing, preventing potential conflicts among heirs.

Minimizing Taxes: Real estate investments often come with significant tax implications. Proper estate planning can minimize taxes by utilizing strategies like trusts, charitable donations, and beneficiary designations, helping to preserve your wealth for future generations.

Ensuring Business Continuity: For investors with large portfolios or partnerships, estate planning is essential for ensuring the smooth continuation of their business ventures. It allows you to designate successors, provide for ongoing management, and safeguard against disruptions in case of unexpected events.

Peace of Mind: Having a comprehensive estate plan provides peace of mind, knowing that your family and your business are protected in the event of your absence. It’s an investment in your future and a legacy for your loved ones.

Understanding Probate and Its Implications for Your Assets

Probate is the legal process of administering a deceased person’s estate. It involves identifying and gathering the deceased person’s assets, paying debts and taxes, and distributing the remaining assets to their beneficiaries. While it might seem straightforward, probate can be a complex and time-consuming process, potentially involving legal fees, court costs, and significant delays. This is especially true for real estate investors, whose portfolios might include numerous properties.

For real estate investors, understanding the implications of probate on their assets is crucial. If a property is held in the investor’s name alone, it will be subject to probate upon their death. This means the property will be frozen until probate is completed, potentially delaying the transfer to beneficiaries and hindering their ability to leverage the asset. Moreover, the probate process can be costly, eating into the value of the inherited property.

To avoid the potential pitfalls of probate, real estate investors should consider estate planning strategies such as revocable living trusts. By transferring assets to a trust, investors can control how their assets are distributed after their death, bypassing the probate process. A trust also provides for more privacy, as the contents are not a matter of public record.

While probate may be unavoidable in some situations, it’s essential for real estate investors to be aware of its potential impact and consider proactive steps to mitigate its complications. By exploring estate planning options and consulting with legal professionals, investors can ensure their legacy is protected and their assets are distributed according to their wishes.

Creating a Will: Distributing Your Real Estate Holdings

A will is a crucial part of your estate plan, especially if you own real estate. It allows you to decide who will inherit your property upon your death. You can specify the exact distribution of your real estate holdings, ensuring your wishes are followed.

Consider these factors when deciding how to distribute your real estate in your will:

- Heirs: Identify the individuals or entities you want to inherit your properties. This could include family members, friends, charities, or trusts.

- Types of Ownership: Depending on the property, you may need to consider joint ownership, tenancy in common, or other legal structures. Consult with an attorney to determine the best approach.

- Property Taxes: Be aware of potential tax implications for both you and your heirs when distributing real estate. Tax laws vary by state, so seek professional guidance.

- Property Management: If your heirs are not familiar with property management, consider appointing a trusted individual or entity to manage the properties after your passing. This will ensure smooth operations and minimize potential conflicts.

It is highly recommended to consult with an experienced estate planning attorney to create a comprehensive will that accurately reflects your intentions and protects your real estate holdings. They can guide you through the process, ensure compliance with all legal requirements, and address any potential complexities.

Utilizing Trusts: Protecting Your Assets and Beneficiaries

As a real estate investor, you’ve worked hard to build a successful portfolio. But have you thought about how your assets will be protected and distributed after you’re gone? Estate planning is essential for ensuring your legacy and safeguarding your loved ones’ financial future. Trusts play a vital role in this process, offering numerous advantages for real estate investors.

A trust is a legal arrangement where you (the grantor) transfer ownership of your assets to a trustee, who manages them for the benefit of your designated beneficiaries. Here’s how trusts can benefit real estate investors:

- Asset Protection: Trusts can shield your assets from potential creditors and lawsuits. By placing your real estate properties within a trust, you can minimize the risk of losing them to unforeseen circumstances.

- Tax Advantages: Depending on the type of trust you establish, you can potentially minimize estate taxes and capital gains taxes on your real estate investments.

- Control and Flexibility: Trusts allow you to dictate how your assets will be managed and distributed. You can specify the terms of the trust, such as when beneficiaries will receive their inheritance and how the assets will be used.

- Privacy: Trusts provide privacy by keeping your estate planning arrangements confidential, unlike probate proceedings, which are public records.

- Beneficiary Protection: Trusts can protect your beneficiaries, especially if they are minors or have special needs. The trustee will manage the assets and distribute them responsibly, ensuring their financial well-being.

There are various types of trusts, each tailored to specific estate planning needs. Consulting with an experienced estate planning attorney is crucial for determining the most suitable trust for your situation.

Exploring Gifting Strategies: Minimizing Estate Taxes

Gifting strategies can be a powerful tool in your estate planning arsenal, potentially minimizing estate taxes and ensuring your legacy is passed on as intended. The key is to understand the intricacies of gift tax laws and utilize gifting techniques effectively.

One common strategy is the annual gift tax exclusion. In 2023, you can gift up to $17,000 per person, per year, without incurring any gift tax. This exclusion is per recipient, meaning you can gift $17,000 to your spouse, $17,000 to your child, and so on. This allows you to gradually transfer assets over time, potentially reducing your taxable estate and minimizing potential estate taxes.

Beyond the annual exclusion, there are other gifting strategies that can be beneficial. For example, you can consider gifting assets with a low fair market value, such as real estate with significant debt. Since the value of the gift is determined by its fair market value, gifting assets with lower valuations can reduce your taxable estate.

Another strategy is to leverage the lifetime gift tax exemption, which allows you to give away a significant amount of assets during your lifetime without incurring gift tax. In 2023, the lifetime exemption is $12.92 million per person. This allows you to gift larger sums to beneficiaries or create charitable trusts, effectively removing those assets from your taxable estate.

It is crucial to consult with a qualified estate planning attorney or tax advisor before implementing any gifting strategies. They can help you tailor a plan that aligns with your specific needs and goals, ensuring you maximize the benefits while minimizing the risks.

Leveraging Beneficiary Designations: Simplifying Asset Transfer

Estate planning is essential for real estate investors, ensuring your assets are distributed according to your wishes and minimizing potential legal complexities. One powerful tool in your estate planning arsenal is beneficiary designations. These are instructions you provide on your financial and asset accounts specifying who receives your assets upon your passing. This can significantly simplify the asset transfer process, avoiding probate court and potential delays.

Here’s how beneficiary designations work for real estate investors:

- Retirement Accounts: Designate beneficiaries for your 401(k), IRA, and other retirement accounts. This ensures your beneficiaries receive the funds directly, bypassing probate and potential estate taxes.

- Life Insurance Policies: Name beneficiaries for your life insurance policies. This provides a financial safety net for your loved ones upon your death, helping them cover expenses and manage their financial future.

- Bank Accounts and Brokerage Accounts: Designate beneficiaries for your checking, savings, and brokerage accounts. This ensures swift and efficient transfer of these assets to your chosen recipients.

- Real Estate: While you can’t directly designate beneficiaries for real estate ownership, you can consider using a Revocable Living Trust. This allows you to specify who will inherit your properties upon your passing, potentially simplifying the transfer process and minimizing estate taxes.

Benefits of Beneficiary Designations:

- Avoids Probate: Assets with beneficiary designations bypass probate, a time-consuming and expensive legal process. This streamlines the asset transfer process and ensures your wishes are followed.

- Saves on Estate Taxes: Some assets, such as retirement accounts, may have tax advantages when passed through beneficiary designations. This can help your beneficiaries receive a larger portion of the inheritance.

- Provides Clarity: Beneficiary designations clearly state your wishes for your assets, minimizing potential disputes among family members or heirs.

Remember:

- It’s crucial to regularly review and update your beneficiary designations to reflect any changes in your family or financial situation.

- Consult with an estate planning attorney to determine the best approach for your specific circumstances and to ensure your beneficiary designations align with your overall estate plan.

By leveraging beneficiary designations effectively, you can streamline the asset transfer process and protect your legacy for future generations. This crucial element of estate planning provides peace of mind and ensures your hard-earned assets are distributed according to your wishes.

Planning for Capital Gains Taxes: Strategies for Reducing Liability

As a real estate investor, you’ve likely built a substantial portfolio, and part of your estate plan involves minimizing the tax burden when you sell those properties. Capital gains taxes can significantly eat into your profits, so having a solid strategy is crucial.

One common strategy is to utilize the 1031 exchange, which allows you to defer capital gains taxes by reinvesting the proceeds from a property sale into a like-kind property. This strategy can be particularly beneficial for long-term investors who want to continue building their real estate portfolio while minimizing tax liability.

Another important consideration is the holding period of your properties. Properties held for longer than one year qualify for long-term capital gains tax rates, which are typically lower than short-term rates. By strategically planning your sale timing, you can potentially reduce your tax liability.

You can also explore charitable contributions as a way to minimize capital gains. If you donate appreciated property to a qualified charity, you may be able to deduct the fair market value of the donation from your taxable income, potentially offsetting capital gains.

In addition to these strategies, it’s essential to consult with a tax professional to develop a customized plan. They can help you understand the intricacies of capital gains tax laws and navigate the complexities of estate planning. They can also advise you on other tax-saving strategies specific to your individual situation.

By taking proactive steps to plan for capital gains taxes, you can protect your hard-earned profits and ensure your legacy is passed on with minimal financial strain. Remember, strategic planning and expert guidance can make a significant difference in mitigating your tax liability.

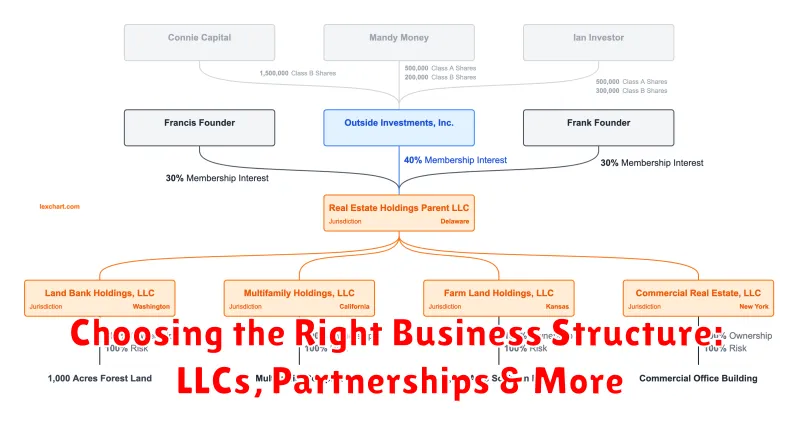

Choosing the Right Business Structure: LLCs, Partnerships & More

When it comes to estate planning, choosing the right business structure for your real estate investments is crucial. The structure you choose will impact your liability, taxes, and how your assets are passed on to your heirs. Here are some of the most common business structures for real estate investors and their key considerations:

Limited Liability Company (LLC)

LLCs offer personal liability protection, meaning your personal assets are shielded from business debts and lawsuits. They also provide flexibility in taxation, allowing you to choose to be taxed as a sole proprietorship, partnership, or corporation. LLCs are generally favored by real estate investors due to their liability protection and tax benefits.

Partnership

A partnership involves two or more individuals who agree to share in the profits and losses of a business. There are various types of partnerships, each with its own liability and tax implications. Partnerships can be advantageous for pooling resources and expertise, but it’s important to have a well-defined partnership agreement to avoid potential conflicts.

Sole Proprietorship

The simplest business structure, a sole proprietorship, is owned and operated by one person. This structure offers minimal paperwork, but it doesn’t provide liability protection, meaning personal assets are at risk. Sole proprietorships are often suitable for small-scale real estate ventures.

S Corporation

An S corporation offers liability protection like an LLC, but it is taxed as a pass-through entity, meaning profits and losses are passed through to the shareholders’ personal income. S corporations can be beneficial for larger real estate businesses or those with multiple investors.

Choosing the Right Structure

The optimal business structure depends on several factors, including:

- The size and scope of your real estate investments

- Your individual financial situation and tax liabilities

- Your risk tolerance

- Your long-term estate planning goals

Consult with an experienced attorney and accountant to determine the most suitable structure for your needs. They can help you navigate the legal and tax complexities associated with each structure and ensure that your business is properly established and protected.

Working with an Estate Planning Attorney: Expertise Matters

Navigating the complex world of estate planning, especially as a real estate investor, requires the guidance of a seasoned legal professional. A skilled estate planning attorney possesses the knowledge and experience to protect your legacy and ensure your assets are handled according to your wishes. Their expertise lies in understanding the intricacies of real estate law, tax implications, and various estate planning tools tailored specifically for investors.

Choosing the right attorney is crucial. Look for someone with a strong track record in estate planning, particularly for real estate investors. They should be well-versed in areas such as:

- Revocable Living Trusts: These powerful tools can help you manage and distribute your assets during your lifetime and after your passing, while potentially minimizing estate taxes.

- Irrevocable Trusts: For more complex estate planning needs, these trusts can offer significant tax advantages and asset protection strategies.

- Limited Liability Companies (LLCs): LLCs can provide liability protection for your real estate investments, shielding your personal assets from potential lawsuits.

- Wills and Codicils: These legal documents clearly outline your wishes for the distribution of your assets, including your real estate properties.

An experienced attorney can help you create a comprehensive estate plan that aligns with your specific goals and circumstances. This may involve:

- Identifying your heirs and beneficiaries: Determining who will inherit your properties and how they will be managed.

- Minimizing estate taxes: Implementing strategies to reduce potential tax liabilities on your real estate holdings.

- Protecting your assets from potential legal challenges: Ensuring your estate plan is legally sound and can withstand any legal scrutiny.

- Providing peace of mind: Knowing your assets are secure and will be managed according to your wishes, offering tranquility for you and your loved ones.

Working with an estate planning attorney is an investment in your future. They provide invaluable guidance, ensuring your hard-earned real estate assets are protected and distributed according to your vision.

Regularly Reviewing and Updating Your Estate Plan

Your estate plan is a living document that should be reviewed and updated regularly to reflect changes in your life and circumstances. It’s important to make sure that your estate plan is still meeting your needs and goals. This includes significant events like marriage, divorce, birth of a child, death of a loved one, or a change in financial status, all of which can necessitate revisions to your estate plan.

Here are some of the key reasons why you should regularly review and update your estate plan:

- Changes in Family Structure: Marriages, divorces, births, adoptions, or the death of family members can significantly impact your estate planning needs. It is crucial to ensure your beneficiaries and legal guardians remain up-to-date.

- Changes in Financial Situation: Your investment portfolio, business ventures, or overall wealth may change over time. Updating your estate plan allows you to ensure the smooth and equitable distribution of your assets according to your wishes.

- Changes in Tax Laws: Tax laws are constantly changing, and these changes can significantly affect your estate plan. Updating your plan will ensure that you are minimizing tax liability and maximizing the benefits for your heirs.

- Changes in Personal Values or Goals: As you go through life, your priorities may shift. It’s essential to ensure that your estate plan aligns with your current values and goals.

Regularly reviewing and updating your estate plan ensures that it continues to be a valuable tool for protecting your legacy and achieving your financial goals. It also provides you with peace of mind knowing that your loved ones will be taken care of in the event of your passing.

Legacy Planning: Passing on Your Wealth and Values

Legacy planning isn’t just about passing on your financial assets; it’s about ensuring your values and vision live on through generations. For real estate investors, this means strategically planning how your properties will be managed and distributed, ensuring a smooth transition for your loved ones and the preservation of your hard-earned wealth.

You can achieve this by considering:

- Succession planning: Designate a trusted individual or team to manage your real estate portfolio after your passing. This could involve family members, business partners, or professional property managers.

- Estate planning documents: Will, trusts, and power of attorney are essential tools to clearly outline your wishes regarding your real estate holdings, ensuring a clear and efficient transfer of ownership and avoiding potential disputes.

- Tax implications: Understand the tax implications of inheriting real estate and strategize ways to minimize tax burdens for your beneficiaries. Consider setting up trusts or incorporating gifting strategies to optimize tax efficiency.

- Family values: Involve your family in the legacy planning process, ensuring they understand your vision for your real estate holdings and their role in maintaining your legacy. This fosters transparency and encourages a shared understanding of your values.

Remember, legacy planning is an ongoing process. Regularly review and update your plans to reflect changes in your family, financial situation, and market conditions. By proactively addressing these aspects, you can ensure your real estate legacy thrives for generations to come.