Are you planning to buy a home? If so, you’ve probably heard of mortgage insurance. It’s a crucial component of many home loans, but it can also be confusing. You might wonder, “Do I really need mortgage insurance?” and “How does it work?” In this blog post, we’ll break down the essentials of mortgage insurance, explaining everything you need to know, from its purpose to its costs.

Whether you’re a first-time homebuyer or a seasoned investor, understanding mortgage insurance is essential. It can impact your monthly payments, overall borrowing costs, and even your eligibility for a loan. We’ll demystify the complexities of mortgage insurance, providing clarity on this important financial aspect of homeownership.

What is Mortgage Insurance and How Does it Work?

Mortgage insurance is a type of insurance that protects lenders against losses if a borrower defaults on their mortgage loan. It’s a way to mitigate risk for the lender, allowing them to offer more favorable terms to borrowers who may not have a large down payment or the highest credit scores. Essentially, it acts as a safety net for the lender in case the borrower can’t make their payments.

There are two main types of mortgage insurance:

- Private Mortgage Insurance (PMI): This is typically required for conventional loans with a down payment of less than 20%. It’s paid monthly as part of your mortgage payment and usually drops off automatically when your loan-to-value ratio (LTV) reaches 80%, meaning you’ve paid down 20% of the loan.

- Mortgage Insurance Premium (MIP): This is required for FHA loans, which are insured by the Federal Housing Administration. It’s paid upfront and monthly as part of your mortgage payment. MIP can be required for the entire term of the loan, depending on the type of FHA loan you have.

Mortgage insurance is designed to benefit both the lender and the borrower. For the lender, it provides a safety net against losses in the event of a default. For the borrower, it allows them to access homeownership with a smaller down payment, potentially saving them on upfront costs. However, it’s important to understand that mortgage insurance is an added expense, so it’s crucial to weigh the benefits against the cost when deciding whether or not to opt for it.

Types of Mortgage Insurance: PMI, MIP, and Lender-Paid MI

Mortgage insurance protects lenders from losses if a borrower defaults on their mortgage loan. There are three main types of mortgage insurance: Private Mortgage Insurance (PMI), Mortgage Insurance Premium (MIP), and Lender-Paid Mortgage Insurance (LPMI).

Private Mortgage Insurance (PMI) is typically required when a borrower makes a down payment of less than 20% on a conventional loan. PMI is paid by the borrower in monthly premiums and can be canceled once the borrower’s equity in the home reaches 20%.

Mortgage Insurance Premium (MIP) is required for Federal Housing Administration (FHA) loans. MIP is also paid by the borrower in monthly premiums, but it may remain in effect for the life of the loan depending on the loan’s terms and conditions.

Lender-Paid Mortgage Insurance (LPMI) is a type of PMI where the lender pays the insurance premium. This premium is typically rolled into the borrower’s monthly mortgage payments, but it can result in a higher interest rate.

It’s essential to understand the differences between these types of mortgage insurance to make informed decisions about your mortgage.

When is Mortgage Insurance Required?

Mortgage insurance is a type of insurance that protects the lender if you default on your mortgage loan. It is usually required when you make a down payment that is less than 20% of the purchase price of the home. This is because lenders are more likely to lose money if you default on a loan with a smaller down payment.

The amount of mortgage insurance you pay will depend on several factors, including the amount of your down payment, the interest rate on your loan, and the length of your loan term. You can usually choose to pay for mortgage insurance as a monthly premium or as a lump sum at the time of closing.

Mortgage insurance can be canceled once you have reached a loan-to-value ratio (LTV) of 80%, meaning you have at least 20% equity in your home. However, the rules can vary depending on the type of mortgage insurance you have. You should check with your lender to determine the specific requirements for canceling your mortgage insurance.

It’s important to note that mortgage insurance is not required for all borrowers. If you are able to make a down payment of 20% or more, you will not need to purchase mortgage insurance. There are also some exceptions, such as loans for VA-backed mortgages, where mortgage insurance is not required regardless of the down payment amount.

Calculating Mortgage Insurance Premiums

Mortgage insurance premiums are calculated based on several factors, including the loan-to-value ratio (LTV), the credit score, and the type of mortgage. The LTV is the percentage of the home’s value that is being financed, and it is the most important factor in determining the premium.

A higher LTV means that you are borrowing more money against the value of the home, which makes the loan riskier for the lender. As a result, the insurance premium will be higher. Conversely, a lower LTV means that you are borrowing less money, which makes the loan less risky and results in a lower premium.

Your credit score also plays a role in calculating the premium. A higher credit score indicates that you are a more responsible borrower, which makes the loan less risky and lowers the premium. A lower credit score, on the other hand, means you are a riskier borrower, which can lead to a higher premium.

Finally, the type of mortgage you choose can also affect the insurance premium. For example, a conventional mortgage typically has a lower premium than an FHA mortgage. This is because FHA loans are designed for borrowers with lower credit scores, making them riskier for lenders.

You can use an online calculator to estimate your mortgage insurance premiums based on your specific circumstances. However, it’s always a good idea to consult with a mortgage lender to get a more accurate estimate.

How to Avoid Paying Mortgage Insurance

Mortgage insurance is a type of insurance that protects lenders from losses if a borrower defaults on their loan. While it can be a good idea for some borrowers, it’s not always necessary and can be a significant expense. If you’re looking to avoid paying mortgage insurance, here are a few tips:

Make a larger down payment. One of the most common ways to avoid mortgage insurance is to put down a larger down payment. If you put down 20% or more of the purchase price, you’ll typically be able to avoid paying PMI. However, if you are unable to make a 20% down payment, you may want to consider a FHA loan, which requires a lower down payment of 3.5%. Keep in mind that you’ll still pay an upfront mortgage insurance premium (MIP) with an FHA loan.

Improve your credit score. A higher credit score can make you a more attractive borrower to lenders, which may lead to lower interest rates and, in some cases, the ability to avoid paying mortgage insurance. While it’s always a good idea to improve your credit score, it may not be enough to avoid PMI if you’re making a smaller down payment.

Consider a conventional loan with a higher interest rate. Some conventional loans have higher interest rates but do not require mortgage insurance, even if you’re putting down less than 20%. This is because lenders are willing to take on a bit more risk with a higher interest rate. However, it’s important to weigh the costs and benefits before choosing this option.

Shop around for different lenders. Not all lenders have the same requirements for mortgage insurance. Some lenders may be more willing to waive the requirement, especially if you have a good credit score and a strong financial history. Don’t be afraid to ask about the possibility of avoiding PMI during the application process.

Canceling PMI: Requirements and Procedures

Private mortgage insurance (PMI) is a type of insurance that protects lenders against losses if a borrower defaults on their mortgage. It is typically required for borrowers who put down less than 20% on their mortgage. While PMI can seem like an added expense, it can be beneficial for borrowers who are unable to make a larger down payment. Once you’ve built up enough equity in your home, you can usually cancel PMI. However, you will need to meet certain requirements and follow specific procedures.

To cancel PMI, you will generally need to reach a loan-to-value (LTV) ratio of 80% or less. This means that the amount you owe on your mortgage must be 80% or less of the current market value of your home. You can calculate your LTV ratio by dividing the outstanding loan balance by the current market value of your home.

Once you meet the LTV requirement, you will need to contact your mortgage lender to request cancellation of your PMI. They will likely ask for documentation, such as a recent appraisal, to verify the market value of your home. Your lender may also require you to provide proof of your current homeownership percentage, such as a recent mortgage statement. After reviewing your application and documentation, your lender will decide whether to cancel your PMI.

The procedures for canceling PMI can vary depending on your lender. Some lenders may have a specific form or process for requesting PMI cancellation, while others may allow you to request cancellation through a phone call or email. It is important to check with your lender to understand their specific procedures.

If your lender denies your request for PMI cancellation, you can always appeal their decision. However, it is important to be prepared with supporting documentation that demonstrates you meet the LTV requirement. You can also contact the Consumer Financial Protection Bureau (CFPB) if you believe your lender is unfairly denying your request.

Mortgage Insurance vs. Private Mortgage Insurance

Mortgage insurance is a type of insurance that protects lenders against losses if a borrower defaults on their mortgage loan. It’s often required for borrowers who put down less than 20% of the purchase price. There are two main types of mortgage insurance: mortgage insurance and private mortgage insurance (PMI).

Mortgage insurance is a type of insurance that is offered by the Federal Housing Administration (FHA) to protect lenders against losses if a borrower defaults on their mortgage loan. FHA-insured mortgages are typically available to borrowers with lower credit scores and lower down payments. The FHA charges a premium for mortgage insurance, which is typically added to the monthly mortgage payment.

Private mortgage insurance (PMI) is a type of insurance that is offered by private companies to protect lenders against losses if a borrower defaults on their mortgage loan. PMI is typically required for borrowers who put down less than 20% of the purchase price and have conventional mortgages. PMI premiums are typically paid monthly and can be canceled once the borrower has built up 20% equity in their home.

There are some key differences between mortgage insurance and PMI. The biggest difference is that mortgage insurance is offered by the government while PMI is offered by private companies. FHA-insured mortgages are typically available to borrowers with lower credit scores and lower down payments, while PMI is typically required for borrowers who put down less than 20% of the purchase price and have conventional mortgages.

Benefits and Drawbacks of Mortgage Insurance

Mortgage insurance is a type of insurance that protects lenders against losses if a borrower defaults on their mortgage. It is usually required for borrowers with a low down payment, typically less than 20% of the purchase price. While it might seem like an added expense, mortgage insurance can offer several benefits, including:

Easier qualification: Mortgage insurance allows you to qualify for a mortgage with a lower down payment, making homeownership more accessible, especially for first-time buyers.

Lower monthly payments: By lowering the required down payment, you can potentially get a lower interest rate, resulting in lower monthly mortgage payments.

Peace of mind: Mortgage insurance offers peace of mind to both the borrower and the lender, knowing that the lender is protected against financial loss in case of default.

Despite the benefits, mortgage insurance also comes with some drawbacks:

Additional costs: Mortgage insurance is an additional expense on top of your regular mortgage payments, adding to the overall cost of homeownership.

Limited coverage: Mortgage insurance typically only covers the lender’s losses, not the borrower’s losses, like the down payment or equity built up in the property.

No equity protection: Even if you’ve paid off a substantial amount of your mortgage, mortgage insurance doesn’t protect your equity if you default.

Ultimately, the decision of whether or not to get mortgage insurance depends on your individual circumstances and financial situation. It’s important to weigh the benefits and drawbacks carefully and consult with a financial advisor to determine if it’s the right choice for you.

Understanding FHA Loan Mortgage Insurance Premiums (MIP)

When you take out an FHA loan, you’re required to pay mortgage insurance. This is a type of insurance that protects the lender if you default on your loan. The FHA requires this insurance because it allows borrowers to put down smaller down payments and have less stringent credit score requirements than conventional loans.

FHA mortgage insurance premiums are broken down into two categories: an upfront premium and an annual premium.

The upfront premium is paid at closing. It is 1.75% of the loan amount, and can be financed into the loan or paid upfront in cash.

The annual premium is paid monthly, and it is added to your mortgage payment. The annual premium is based on the loan amount and the loan term. It is expressed as a percentage of the loan amount, and it typically stays the same throughout the life of the loan. However, the annual premium amount is recalculated every year.

MIP can be canceled if you reach 20% equity in your home, either through appreciation or principal paydown. Once your home is at least 20% equity, you can apply to have MIP canceled.

Here’s a breakdown of the different MIP scenarios for FHA loans:

- Purchase of a new home: You’ll pay both the upfront and annual premium

- Refinance of an existing FHA loan: You’ll continue to pay the annual premium, but you might not have to pay the upfront premium if you refinance into a new FHA loan.

- Refinance of an existing conventional loan into an FHA loan: You’ll need to pay both the upfront and annual premium.

Understanding the nuances of FHA mortgage insurance premiums is crucial for informed decision-making when considering an FHA loan. It’s important to factor in the MIP costs when comparing FHA loans to conventional loans, as the upfront and annual premiums can add a significant expense over the life of the loan.

VA Loan Funding Fees and Mortgage Insurance Alternatives

VA loans, offered to eligible veterans, active-duty military personnel, and surviving spouses, don’t require a down payment or private mortgage insurance (PMI). However, there are specific funding fees associated with VA loans, which can vary depending on the loan amount and the veteran’s service history.

Funding Fee Structure: VA funding fees typically range from 0.5% to 3.6% of the loan amount. These fees can be paid upfront or financed into the loan amount, increasing the monthly mortgage payment.

Funding Fee Waivers: Veterans with certain disabilities, service-connected disabilities, or who are receiving compensation from the Department of Veterans Affairs may be eligible for a waiver of the funding fee.

Alternatives to VA Loan Funding Fees: If you’re concerned about the funding fee, explore these options:

- Negotiate with the seller for a credit towards closing costs, potentially covering the funding fee.

- Incorporate the funding fee into the total loan amount, spreading the cost over the loan’s term.

- Explore other loan options, such as conventional loans, which may have different closing costs and funding requirements.

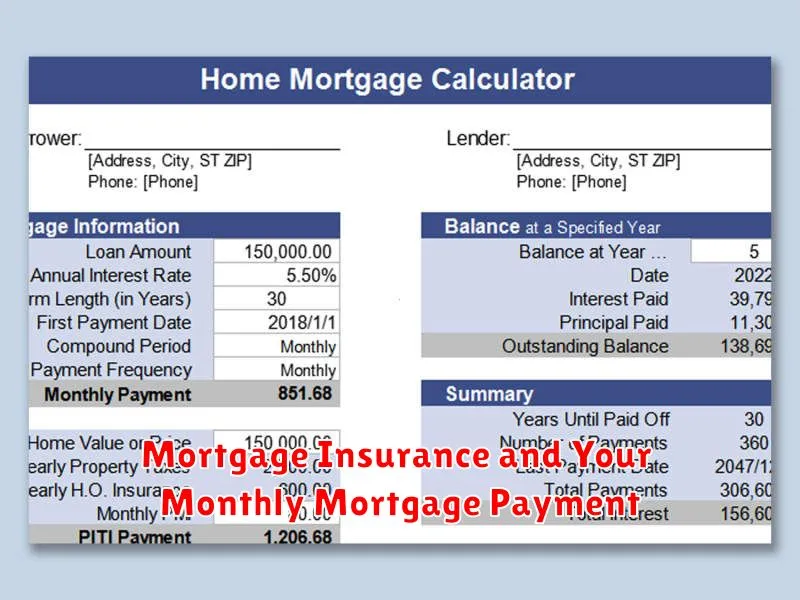

Mortgage Insurance and Your Monthly Mortgage Payment

Mortgage insurance is a type of insurance that protects lenders from financial losses if a borrower defaults on their mortgage loan. If you take out a mortgage with a low down payment, you may be required to pay for mortgage insurance.

The cost of mortgage insurance is typically added to your monthly mortgage payment. The amount you pay will depend on several factors, including your credit score, the amount of your down payment, and the type of loan you have. Mortgage insurance premiums are usually paid monthly.

There are two main types of mortgage insurance:

- Private mortgage insurance (PMI): This is required when you make a down payment of less than 20% on a conventional mortgage. It is typically canceled once your loan-to-value ratio (LTV) falls below 80%.

- Mortgage insurance premium (MIP): This is required for FHA-insured mortgages. MIP is typically paid throughout the life of the loan.

While it may seem like an added expense, mortgage insurance can help you get into a home sooner by allowing you to make a smaller down payment. It can also save you money in the long run by ensuring that you’re able to keep your home even if you experience a job loss or other financial hardship.

If you are considering buying a home with a small down payment, it’s important to factor in the cost of mortgage insurance when calculating your monthly payments. You can use an online mortgage calculator to estimate your total monthly cost.

The Impact of Mortgage Insurance on Your Loan-to-Value Ratio (LTV)

Mortgage insurance is a type of insurance that protects lenders from losses if a borrower defaults on their mortgage. When you take out a mortgage, the loan-to-value ratio (LTV) is the percentage of the home’s value that your loan represents. For example, if you borrow $200,000 to buy a home worth $250,000, your LTV would be 80%.

Mortgage insurance is typically required for borrowers who make a down payment of less than 20%. This is because a lower down payment means the lender is taking on more risk. By requiring mortgage insurance, lenders are protected in case the borrower defaults on their loan.

Mortgage insurance has a direct impact on your LTV. The lower your down payment, the higher your LTV will be. This means that you will be required to pay for mortgage insurance. The cost of mortgage insurance can be factored into your monthly mortgage payments or paid as a lump sum at closing.

Shopping Around for the Best Mortgage Insurance Rates

Once you’ve determined you need mortgage insurance, it’s time to shop around for the best rates. Just as you would compare interest rates from different lenders, it’s essential to compare mortgage insurance premiums from various providers. This will help you secure the most affordable option for your needs.

Factors influencing rates: The cost of mortgage insurance can vary significantly based on factors such as your loan amount, credit score, and the type of mortgage you obtain. It’s important to understand these factors and how they influence the premiums you’ll pay.

Types of providers: Mortgage insurance can be provided by private companies or government agencies, each with its own pricing structure and eligibility requirements. It’s essential to explore different providers and compare their offerings.

Online tools: Utilize online tools and mortgage calculators to estimate premiums from various providers and get a better idea of the costs involved. This can help you narrow down your choices and focus on the most competitive options.

Contacting providers: After researching online, reach out to several providers directly to request quotes and discuss your specific needs. This will provide you with a more accurate assessment of their rates and policies.

Negotiation: Don’t be afraid to negotiate with providers to try and secure a lower rate. Explain your financial situation and the factors that influence your need for mortgage insurance. Some providers may be willing to offer discounts or adjust their terms to suit your situation.

By actively shopping around and comparing rates, you can ensure you’re getting the most competitive mortgage insurance coverage at the best possible price. Remember, this is a significant financial commitment, so taking the time to explore different options can save you a substantial amount in the long run.