Owning a property is a significant investment, and protecting it from unforeseen circumstances is crucial. Property insurance acts as a safety net, providing financial protection against various risks that could jeopardize your asset. From fire and theft to natural disasters and liability claims, a comprehensive insurance policy can safeguard your financial well-being and peace of mind. Understanding the essential coverage options and choosing the right policy for your needs is paramount to ensure adequate protection.

This article will delve into the key aspects of property insurance, exploring different types of coverage, essential components, and factors to consider when selecting a policy. By grasping the fundamentals, you can make informed decisions to protect your property investment and navigate the complexities of insurance with confidence. Whether you own a home, apartment, commercial building, or land, this guide will equip you with the knowledge to secure your asset and avoid potential financial ruin.

Understanding Different Types of Property Insurance

Property insurance is essential for protecting your investment in your home, building, or other property. It provides financial coverage in case of unexpected events such as fire, theft, or natural disasters. While the basic concept is similar, there are various types of property insurance available, each designed to meet specific needs. Understanding the differences between them will help you choose the most appropriate policy for your situation.

Homeowner’s insurance is a common type of property insurance that covers both the structure of your home and your personal belongings. It typically includes coverage for fire, theft, vandalism, and natural disasters. This insurance comes in different forms, such as HO-3, HO-4, and HO-6, each offering specific coverage levels.

Renter’s insurance is specifically designed for tenants who lease their living space. It provides coverage for your personal belongings against theft, fire, and other covered events. While it doesn’t cover the building itself, it can offer essential protection for your valuables.

Commercial property insurance, as the name suggests, protects commercial properties like businesses, offices, and stores. It covers the building, contents, and liability for any incidents that may occur. This type of insurance can be tailored to meet the specific needs of different businesses.

Flood insurance is a specialized type of coverage that protects your property from flooding. It’s typically separate from standard homeowner’s or renter’s insurance and is often required in areas with a high risk of flooding.

Earthquake insurance is another specialized type of coverage that protects your property from damage caused by earthquakes. It’s often recommended for those living in areas prone to seismic activity.

Understanding the different types of property insurance is crucial for making informed decisions about protecting your valuable assets. By carefully considering your needs and the risks involved, you can choose the right insurance policy to provide adequate coverage and peace of mind.

Key Coverage Components for Homeowners

Navigating the world of property insurance can be overwhelming. However, understanding the key coverage components is essential to ensuring your investment is adequately protected. Here are some crucial components every homeowner should consider:

Dwelling Coverage: This is the heart of your policy. It covers the physical structure of your home against perils like fire, windstorm, hail, and vandalism. It also typically covers attached structures like garages and porches.

Personal Property Coverage: This component protects your belongings within your home, such as furniture, clothing, electronics, and appliances. It also includes coverage for personal property while it’s away from your home, like if it’s stolen or damaged during travel.

Liability Coverage: This crucial component protects you financially if someone gets injured on your property or if you accidentally damage someone else’s property. It covers legal expenses and potential payouts for medical bills and property damage.

Additional Living Expenses (ALE): If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing, meals, and other living expenses until your home is repaired or rebuilt. It offers peace of mind knowing your daily needs are covered during a difficult time.

Other Important Coverages: Depending on your needs and location, consider these additional coverages:

- Flood Insurance: If you live in a flood-prone area, this is a vital component to protect your home from water damage. It’s important to note that flood insurance is typically purchased separately from your homeowners’ policy.

- Earthquake Insurance: If you live in an earthquake-prone region, earthquake insurance is crucial to cover damage from seismic activity.

- Personal Injury Coverage: This provides protection against claims from slander, false arrest, or other personal injuries you might cause.

- Identity Theft Coverage: This helps cover costs related to identity theft, such as credit monitoring and restoration services.

Remember, your specific needs will dictate the exact coverage components you require. Consult with a qualified insurance agent to discuss your individual situation and ensure you have the right protection for your home and family.

Natural Disaster Coverage: Flood, Earthquake, and More

Natural disasters can strike at any time, leaving behind devastation and financial hardship. It’s crucial to understand how your property insurance policy protects you against these unforeseen events. While most standard homeowners’ insurance policies cover perils like fire, wind, and hail, they often exclude coverage for specific natural disasters like floods and earthquakes.

Flood insurance is typically a separate policy provided by the National Flood Insurance Program (NFIP) or private insurers. If you live in a flood-prone area, flood insurance is highly recommended, as standard homeowners’ insurance will not cover flood damage.

Earthquake insurance is another specialized coverage that you may need to purchase separately. This type of insurance can help cover repairs or rebuilding costs if your home is damaged by an earthquake. The availability and cost of earthquake insurance vary depending on your location and the seismic activity in your area.

Understanding the specific coverage provided by your property insurance policy is essential to ensure you have adequate protection against natural disasters. Review your policy carefully, and consult with your insurance agent to discuss your coverage needs and potential gaps. Don’t wait for a disaster to strike – take steps to protect your investment and your peace of mind.

Personal Liability Protection and Medical Payments

Your property insurance policy doesn’t just cover your home or building; it also protects you financially from liability issues. Personal liability coverage comes into play when you are found legally responsible for an injury or damage to someone else’s property. For instance, if a visitor trips and falls on your porch, your policy may help cover the cost of their medical bills and legal defense.

Medical payments coverage is another essential feature that covers medical expenses for you, your family, and sometimes even guests, regardless of who is at fault. This coverage is often used for minor accidents like a slip and fall on your property. It can provide financial protection for medical bills, even if you’re not found liable.

These coverages offer peace of mind knowing that your insurance policy will be there to protect you financially in case of unexpected accidents. It is essential to understand the limits and details of your personal liability and medical payments coverage to ensure you have adequate protection.

Dwelling Coverage: Rebuilding Costs and Market Value

Dwelling coverage is a crucial aspect of property insurance, providing financial protection in case of damage or destruction to your home. It’s important to understand the difference between rebuilding costs and market value when it comes to dwelling coverage.

Rebuilding costs refer to the actual cost of reconstructing your home to its pre-loss condition, using similar materials and construction methods. This includes labor, materials, and permits. Market value, on the other hand, reflects the estimated price your home would sell for in the current market.

It’s essential to have dwelling coverage that adequately covers the rebuilding costs of your home, as market value may not be sufficient to rebuild. Factors such as inflation, rising material costs, and potential changes in building codes can significantly impact rebuilding costs. Underinsured dwelling coverage can leave you with a substantial financial burden if your home needs extensive repairs or reconstruction.

When determining your dwelling coverage needs, consider the following:

- Type of construction (e.g., brick, wood, concrete)

- Square footage

- Age of the home

- Location and local building codes

- Inflation and rising material costs

It’s always recommended to consult with an insurance agent to get a comprehensive assessment of your dwelling coverage needs. They can help you determine the appropriate coverage amount to ensure your home is adequately protected against potential losses.

Loss of Use Coverage: Temporary Housing and Expenses

Imagine coming home to find your house uninhabitable due to a fire or other disaster. While you’re dealing with the emotional and logistical fallout, you also need to figure out where you’ll live and how you’ll cover your living expenses. This is where loss of use coverage, also known as additional living expenses (ALE), comes into play.

Loss of use coverage helps you stay afloat financially while your home is being repaired or rebuilt. It covers the costs of:

- Temporary housing: This includes rent or hotel expenses for you and your family.

- Food: You’ll be reimbursed for the additional costs of eating out or buying groceries while you’re displaced.

- Utilities: This covers any essential utility bills incurred at your temporary residence.

- Other expenses: Depending on your policy, coverage might extend to additional costs like laundry, transportation, and even pet care.

The amount of coverage you have for loss of use is determined by your insurance policy. It’s usually calculated as a percentage of your dwelling coverage, with a maximum limit. It’s important to review your policy carefully to understand the specific terms and limitations of this coverage.

Loss of use coverage can be a lifesaver during a difficult time. It helps alleviate financial stress and allows you to focus on rebuilding your life. Be sure to talk to your insurance agent about this coverage and make sure you have sufficient protection in place.

Personal Property Coverage: Protecting Your Belongings

Personal property coverage is a vital component of homeowners and renters insurance policies. It provides financial protection for your belongings in the event of covered perils like fire, theft, or natural disasters. This coverage helps you replace or repair damaged or lost items, ensuring you can rebuild your life after a devastating event.

Your policy typically covers a wide range of personal property, including:

- Furniture

- Electronics

- Clothing

- Jewelry

- Artwork

- Collectibles

However, it’s essential to understand that most policies have limitations. The amount of coverage is usually capped, and there are specific exclusions for certain items. For instance, high-value possessions like jewelry and art may require additional coverage through endorsements or separate policies.

Here’s what you should know about personal property coverage:

- Actual Cash Value (ACV): This coverage pays the replacement cost of your belongings minus depreciation.

- Replacement Cost Value (RCV): This coverage pays the full cost of replacing your belongings, regardless of depreciation.

- Coverage Limits: Your policy will likely have a limit on the total amount of coverage for your personal property.

- Deductibles: You’ll need to pay a deductible before your insurance company covers any losses.

- Exclusions: Some items may not be covered under your policy, such as items with high risk, like expensive jewelry or firearms.

To ensure adequate protection for your belongings, it’s crucial to review your policy carefully. Consider scheduling valuable items for additional coverage and increasing your coverage limits as needed. By understanding your personal property coverage, you can ensure you’re properly protected in the event of an unexpected loss.

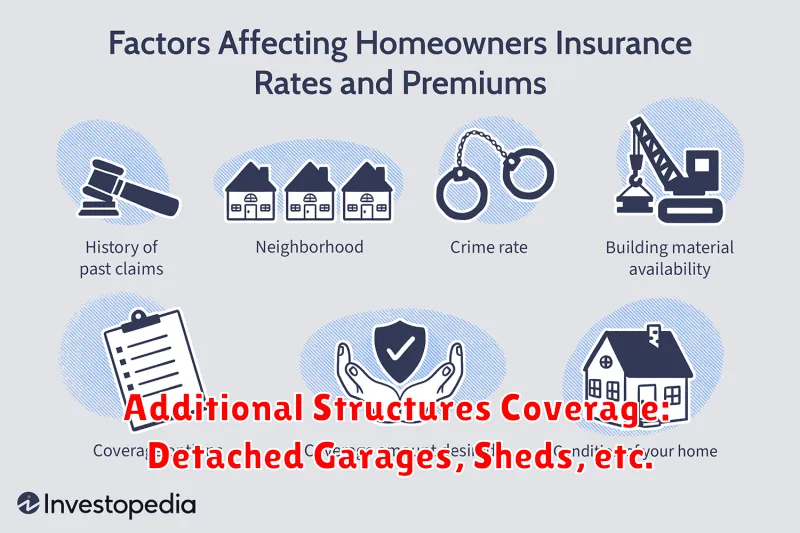

Additional Structures Coverage: Detached Garages, Sheds, etc.

Your home insurance policy typically covers your main dwelling, but what about the structures on your property that are separate from your house? This is where additional structures coverage comes into play. This coverage protects structures like detached garages, sheds, workshops, and even fences from damage caused by covered perils like fire, windstorm, hail, and vandalism.

The amount of coverage for your additional structures is usually a percentage of your dwelling coverage, typically 10% to 25%. However, you can often request increased coverage for valuable structures. It’s crucial to assess the value of your detached structures and ensure that your policy provides sufficient coverage. If you have a valuable workshop or a garage with expensive equipment, consider requesting increased coverage to protect your investment.

While additional structures coverage is typically included in most home insurance policies, it’s essential to carefully review your policy and understand the coverage limitations. You may have separate deductibles or limitations for specific types of damage or events. Consult your insurance agent to ensure you have the right coverage for your specific needs.

Factors Affecting Property Insurance Premiums

Your property insurance premium is determined by several factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money. Here are some key elements that influence your premium:

Location: The risk of natural disasters, crime rates, and the cost of rebuilding in your area all contribute to your premium. Areas prone to hurricanes, earthquakes, or wildfires may have higher premiums.

Property Type: The type of property you own, its age, and its construction materials play a role in your premium. For instance, older homes may have higher premiums due to potential maintenance issues and outdated building codes.

Coverage Amount: The amount of coverage you choose will directly impact your premium. Higher coverage amounts mean higher premiums, so it’s essential to find a balance between adequate protection and affordability.

Deductible: Your deductible is the amount you agree to pay out of pocket in case of a claim. Higher deductibles usually result in lower premiums, while lower deductibles mean higher premiums.

Risk Management: Implementing safety measures like smoke detectors, security systems, or fire sprinklers can lower your premium. Insurance companies reward proactive homeowners with discounts for these features.

Credit Score: In some states, your credit score can affect your insurance premium. A good credit history often leads to lower premiums.

Claim History: If you have a history of filing claims, your premium may be higher. Insurance companies assess risk based on past claims behavior.

Discounts: Many insurance companies offer discounts for various factors, including bundling multiple policies, having a good driving record, or being a member of certain organizations. Make sure to ask about available discounts to potentially lower your premium.

Choosing the Right Deductible for Your Needs

Your insurance deductible is the amount you pay out of pocket before your insurance coverage kicks in. It’s a crucial factor in determining your overall insurance costs and how much you’ll pay in the event of a claim. Choosing the right deductible for your needs requires careful consideration of your financial situation and risk tolerance.

Higher deductibles generally lead to lower premiums. If you have a healthy emergency fund and can comfortably cover a higher deductible, opting for a higher amount can significantly reduce your monthly insurance payments. This strategy makes sense for individuals with a strong financial foundation who are willing to shoulder more financial responsibility in case of a claim.

Conversely, a lower deductible translates to higher premiums. If you’re concerned about managing a large out-of-pocket expense in the event of a claim, a lower deductible might be a better choice. It offers greater financial protection, but comes at the cost of higher monthly premiums.

Ultimately, the ideal deductible is the one that balances your financial needs with your risk tolerance. It’s worth considering your individual circumstances, the value of your property, and your ability to manage potential out-of-pocket costs. Consulting with your insurance agent can provide personalized guidance and help you choose the deductible that aligns best with your specific situation.

Tips for Lowering Your Insurance Costs

While having adequate property insurance is crucial, it doesn’t have to break the bank. Here are a few tips to help you lower your insurance costs without sacrificing coverage:

Improve Your Home’s Security: Installing security systems, such as alarms, motion detectors, and surveillance cameras, can significantly reduce your premiums. These measures deter potential burglars and demonstrate to insurers your commitment to safeguarding your property.

Maintain Your Property: Regular maintenance and repairs can help prevent costly damage. Ensure your roof, plumbing, and electrical systems are in good working order. This proactive approach shows insurers your commitment to responsible property ownership, leading to potential discounts.

Consider a Higher Deductible: Opting for a higher deductible means you pay more out-of-pocket in case of a claim, but it can result in lower premiums. Weigh the potential financial burden of a higher deductible against the savings you’ll realize.

Bundle Your Policies: If you have multiple insurance policies, consider bundling them together with the same insurer. This practice often leads to discounted premiums as insurers appreciate your loyalty and consolidated business.

Shop Around and Compare Quotes: Don’t settle for the first insurance quote you receive. Contact multiple insurers to compare prices and coverage options. Websites and online tools can streamline this process, making it easier to find the best value for your needs.

Consider Discounts: Inquire about available discounts, such as those for good driving records, safety features, or being a senior citizen. Many insurers offer incentives for responsible behavior and risk mitigation.

Working with an Insurance Agent or Broker

When it comes to property insurance, having a knowledgeable and experienced insurance agent or broker on your side is crucial. They act as your advocate, helping you understand the complex world of insurance and find the right coverage for your specific needs. They can guide you through the process of selecting the appropriate policy, ensuring that your property is adequately protected.

Agents typically represent a single insurance company and offer policies from that specific provider. Brokers, on the other hand, work with multiple insurance companies and can shop around for the best rates and coverage options for you.

Here are some key advantages of working with an insurance agent or broker:

- Expert Guidance: They possess in-depth knowledge of insurance policies and can explain complex terms in a clear and concise way.

- Personalized Solutions: They can assess your individual needs and recommend customized coverage options that meet your specific requirements.

- Negotiation Skills: They can negotiate with insurance companies on your behalf to secure better rates and coverage terms.

- Claim Assistance: They can provide valuable support during the claims process, ensuring a smooth and efficient experience.

To make the most of your interaction with an insurance agent or broker, be prepared to provide them with detailed information about your property, including its value, location, and any specific features or risks. Be open and honest about your insurance needs and concerns. Ask questions until you fully understand your coverage options and the terms of your policy.

Reviewing and Updating Your Policy Regularly

Your property insurance policy is a vital document, but it’s not something you should just tuck away and forget about. Regularly reviewing and updating your policy is crucial to ensuring you have the right coverage for your unique needs. Life changes, and so do your insurance requirements. Over time, your property’s value could increase, new belongings might be acquired, or you might even make modifications to your home. These changes could leave you underinsured if you don’t adjust your policy accordingly.

Here are some key reasons why you should make reviewing your policy a regular practice:

- Changes in Property Value: As real estate markets fluctuate, the value of your property can change. An outdated policy could leave you with insufficient coverage in the event of a claim.

- New Acquisitions: Did you recently purchase a new car, expensive jewelry, or valuable artwork? Ensure these new possessions are added to your policy to protect your investment.

- Home Improvements: Remodeling your kitchen, adding a new extension, or installing a swimming pool can significantly increase the value of your home. Updating your policy reflects these changes and protects your investment.

- Changing Risks: Your insurance needs may change with your lifestyle. If you move to a higher-risk area, your policy should reflect this change.

- Policy Updates: Insurance companies periodically introduce new coverage options or adjust existing policies. Staying informed about these updates is vital for ensuring you have access to the most beneficial coverage.

By reviewing your policy regularly and making necessary updates, you’ll ensure you’re adequately protected in case of unexpected events, providing you with peace of mind and financial security.