In the ever-evolving financial landscape, securing the best mortgage rates is paramount to achieving your financial goals. Whether you’re a first-time homebuyer or looking to refinance, navigating the complexities of the mortgage market can be daunting. But fear not! This comprehensive guide will equip you with the knowledge and strategies to secure the most favorable mortgage rates in 2024, ensuring your financial future is on solid ground.

From understanding the factors influencing interest rates to exploring different mortgage types and lenders, we’ll delve into the intricacies of the mortgage process. We’ll provide you with practical tips and expert advice to help you navigate the complexities of the mortgage market, empower you to make informed decisions, and ultimately secure the best possible mortgage rate for your unique circumstances.

Understanding Mortgage Interest Rates

A mortgage interest rate is the cost of borrowing money to buy a home. It’s expressed as a percentage of the loan amount and is paid over the life of the mortgage. Understanding mortgage interest rates is crucial when securing a home loan, as it significantly impacts your monthly payments and overall loan cost.

There are several factors that influence mortgage interest rates, including:

- The Federal Reserve’s monetary policy: When the Fed raises interest rates, mortgage rates tend to rise as well.

- Inflation: High inflation can lead to higher mortgage rates.

- Economic growth: Strong economic growth can lead to higher mortgage rates as lenders become more confident in lending.

- Your credit score: Borrowers with good credit scores generally qualify for lower interest rates.

- The loan type: Different mortgage types, such as fixed-rate or adjustable-rate mortgages, carry different interest rates.

Fixed-rate mortgages have an interest rate that remains the same for the entire loan term, providing predictable monthly payments. Adjustable-rate mortgages (ARMs) have an interest rate that can change periodically based on market conditions. ARMs may offer a lower initial interest rate, but they come with the risk of higher payments in the future.

It’s important to shop around and compare rates from different lenders to find the best mortgage rate for your individual needs. Consider factors such as your financial situation, desired loan term, and risk tolerance. Understanding the factors influencing mortgage interest rates empowers you to make informed decisions and secure the best possible financing for your dream home.

Factors Influencing Mortgage Rate Trends

Understanding the factors that influence mortgage rate trends is crucial for anyone seeking to secure the best possible rate in 2024. Mortgage rates are not static and fluctuate based on a variety of economic and market forces. Here are some key factors to keep in mind:

Federal Reserve Monetary Policy: The Federal Reserve (Fed) plays a significant role in setting interest rates. When the Fed raises interest rates to combat inflation, mortgage rates generally follow suit. Conversely, when the Fed lowers rates to stimulate economic growth, mortgage rates tend to decline. The Fed’s actions have a direct impact on the cost of borrowing money, including mortgages.

Inflation: Inflation is a major driver of mortgage rate trends. When prices for goods and services rise, the Fed often responds by raising interest rates to cool down the economy. This can lead to higher mortgage rates as lenders seek to protect their profits in a high-inflation environment.

Economic Growth: The overall health of the economy also plays a role in mortgage rate trends. When the economy is strong and growing, lenders may be more willing to offer lower rates to attract borrowers. However, when economic growth slows or there are concerns about a recession, rates may rise as lenders become more cautious.

Government Bond Yields: Mortgage rates are closely tied to the yield on government bonds. When bond yields rise, mortgage rates tend to follow suit. This is because lenders use bond yields as a benchmark when setting mortgage rates.

Supply and Demand for Mortgage Money: The availability of mortgage money can also influence rates. When demand for mortgages is high, rates may rise as lenders compete for a limited pool of funds. Conversely, when demand is low, rates may fall as lenders seek to attract borrowers.

By staying informed about these factors, you can better understand the dynamics of the mortgage market and position yourself to secure the best possible rate for your financial needs.

Types of Mortgages and Their Rate Structures

Navigating the mortgage landscape can be daunting, especially with the various types available and their corresponding rate structures. Understanding these differences is crucial in securing the best mortgage for your financial needs. Here’s a breakdown of some common mortgage types:

Fixed-Rate Mortgages: This is the most common type, offering predictable monthly payments with a consistent interest rate throughout the loan term. Your monthly payment remains the same, ensuring budgeting ease. However, if interest rates fall, you may miss out on potential savings.

Adjustable-Rate Mortgages (ARMs): ARMs offer an initial fixed interest rate that adjusts periodically based on a benchmark index, usually for a specific period (e.g., 5 or 7 years). These can be attractive with initial lower rates, but they carry the risk of increasing payments if interest rates rise. ARMs are often considered suitable for those planning to sell their homes within the initial fixed-rate period or anticipating early repayment.

Conventional Mortgages: These are non-government-backed loans offered by private lenders and typically require a larger down payment (often 20%). Conventional mortgages offer various loan terms and flexibility in terms of rate types (fixed or adjustable). While they may have slightly higher interest rates, they can offer attractive features like lower monthly payments and the option to make extra payments.

Government-Backed Mortgages: Backed by agencies like FHA (Federal Housing Administration) or VA (Veterans Affairs), these mortgages offer lower down payment requirements and more lenient credit standards. They typically have slightly higher interest rates than conventional loans, but they are a great option for first-time buyers or those with less-than-perfect credit.

Jumbo Mortgages: These loans exceed the maximum loan limits set by government agencies and are typically for larger, more expensive properties. Jumbo mortgages often have higher interest rates and stricter lending requirements. They are more common in high-cost areas and appeal to those with higher credit scores and substantial down payments.

Choosing the right mortgage type and rate structure is crucial in securing your financial future. Consult with a qualified mortgage professional to determine which option best aligns with your individual needs and circumstances. They can help you navigate the complex world of mortgage rates and find the best deal for your specific financial situation.

Comparing Mortgage Rates from Different Lenders

Securing the best mortgage rate is crucial for your financial future. In today’s dynamic market, navigating through a multitude of lenders and their rates can feel overwhelming. A fundamental step is comparing mortgage rates from different lenders. By doing so, you can identify the most competitive rates available to you.

Start by checking with multiple lenders, including banks, credit unions, and online mortgage providers. Each lender may have different rates, terms, and fees. Remember to consider more than just the initial rate, as other factors, such as closing costs, points, and origination fees, can impact the overall cost of your loan.

Take advantage of online mortgage calculators and comparison tools to streamline the process. These tools allow you to input your loan details and compare offers side-by-side. They can also help you understand the impact of different interest rates and loan terms on your monthly payments and overall cost.

Don’t hesitate to negotiate with lenders. If you’ve found a competitive rate from another lender, you can use it as leverage to request a better offer from the current lender. Keep in mind that your credit score, debt-to-income ratio, and down payment can significantly influence the rates you qualify for.

Don’t rush into a decision. Take your time, gather all the necessary information, and compare offers carefully. By making an informed decision, you can secure a mortgage that aligns with your financial goals and helps you achieve long-term financial stability.

Strategies for Securing the Lowest Mortgage Rates

In today’s dynamic market, securing the most favorable mortgage rate is crucial for your financial well-being. Here are some tried-and-true strategies to help you achieve this goal:

Improve Your Credit Score: A strong credit score is paramount. Aim for a score above 740, as lenders often offer the best rates to borrowers with excellent credit history. Regularly check your credit report for any errors and pay your bills on time to enhance your score.

Shop Around for Lenders: Don’t settle for the first rate you see. Get quotes from multiple lenders, including banks, credit unions, and online lenders. Compare interest rates, loan terms, and closing costs to find the most competitive offer.

Consider a Fixed-Rate Mortgage: While adjustable-rate mortgages (ARMs) may initially offer lower rates, fixed-rate mortgages provide stability and predictability in your monthly payments. Choose a fixed-rate mortgage to protect yourself from fluctuating interest rates in the future.

Make a Larger Down Payment: A higher down payment often translates into lower interest rates. By putting more money down, you reduce the loan amount, which can result in a more favorable rate.

Negotiate With the Lender: Don’t be afraid to negotiate with the lender. Discuss your financial situation and express your desire for a lower rate. If you have strong credit and a solid financial track record, you may be able to secure a better deal.

Explore Loan Programs: Government-backed loan programs like FHA loans or VA loans may offer lower rates and more flexible terms. Research these programs to see if you qualify and determine if they fit your financial needs.

Avoid Closing Costs: Closing costs can significantly increase your overall mortgage expenses. Ask the lender about ways to reduce or waive these fees. Some lenders may offer incentives or discounts for certain borrowers.

Securing the lowest mortgage rate can save you thousands of dollars in interest payments over the life of your loan. By implementing these strategies and carefully evaluating your options, you can confidently navigate the mortgage market and achieve your financial goals.

The Importance of Credit Scores in Mortgage Rates

A strong credit score is crucial when applying for a mortgage. It significantly impacts the interest rate you’ll be offered, ultimately affecting your monthly payments and the overall cost of your loan. Lenders use your credit score as a measure of your creditworthiness, assessing your history of repaying debt.

A higher credit score indicates a lower risk to lenders, allowing them to offer you a more favorable interest rate. Conversely, a lower credit score signals a higher risk, leading to higher interest rates. This can translate into substantial savings or additional costs over the lifetime of your mortgage.

It’s essential to understand the credit score range and its impact on your mortgage rate. Generally, the higher your credit score, the lower your interest rate. Aiming for a score above 740 can significantly enhance your chances of securing the best rates available.

Locking in Your Mortgage Rate: Pros and Cons

In the dynamic world of mortgages, understanding the concept of locking in your interest rate is crucial. Locking in your rate essentially guarantees a specific interest rate for a set period, usually 30-60 days, before your loan closes. This can be a strategic move, but it’s important to weigh the pros and cons before making a decision.

Pros of locking in your rate:

- Rate Protection: Locking in your rate safeguards you against potential interest rate hikes during the closing period, ensuring you secure the current favorable rate.

- Peace of Mind: Locking in your rate eliminates uncertainty and provides peace of mind, allowing you to budget confidently knowing your monthly payments are fixed.

Cons of locking in your rate:

- Opportunity Cost: If interest rates drop after locking in, you might miss out on a potentially lower rate.

- Lock-in Fees: Some lenders charge fees for locking in your rate, which can add to your overall borrowing costs.

Factors to Consider:

- Market Conditions: Are interest rates expected to rise or fall in the near future?

- Loan Closing Timeline: How much time do you have before your loan closes?

- Your Risk Tolerance: Are you comfortable with the potential risk of higher rates or are you seeking certainty?

Ultimately, the decision of whether to lock in your mortgage rate depends on your individual circumstances and risk appetite. Consult with a qualified mortgage professional who can guide you based on your specific financial goals and market conditions.

Navigating Mortgage Points and Closing Costs

When you’re securing a mortgage, it’s crucial to understand the nuances of mortgage points and closing costs. These factors can significantly impact your overall loan costs and influence your monthly payments.

Mortgage points are essentially pre-paid interest that you pay to the lender. Each point is equal to 1% of your loan amount. By paying points, you can buy down your interest rate, resulting in lower monthly payments. However, you must consider the trade-off: you’re essentially paying upfront for the interest rate reduction.

Closing costs encompass various expenses associated with finalizing your mortgage transaction. These can include things like appraisal fees, title insurance, and loan origination fees. Closing costs are typically a percentage of your loan amount, and you’ll need to factor them into your budget.

To navigate mortgage points and closing costs effectively, it’s essential to:

- Shop around: Compare different lenders to find the best rates and fees.

- Negotiate: Don’t be afraid to negotiate with lenders to see if they’re willing to lower their points or closing costs.

- Understand the breakdown: Get a clear and detailed breakdown of all fees and charges associated with your mortgage.

By carefully considering your options and understanding the details of mortgage points and closing costs, you can secure a favorable mortgage that aligns with your financial goals.

Refinancing Your Mortgage: When Does It Make Sense?

Refinancing your mortgage can be a smart move to save money and improve your financial situation. However, it’s not always the best option. Here are some key factors to consider when deciding if refinancing makes sense for you:

Lower Interest Rates: If interest rates have dropped significantly since you took out your current mortgage, refinancing to a lower rate can save you substantial interest payments over the life of your loan.

Change Loan Term: Refinancing allows you to adjust your loan term. If you want to pay off your mortgage faster, you can refinance to a shorter term, even if the interest rate is slightly higher. Conversely, if you’re looking for lower monthly payments, consider a longer term.

Switch Loan Type: If you’re currently in an adjustable-rate mortgage (ARM) and are worried about rising interest rates, you might benefit from refinancing to a fixed-rate mortgage. This will give you predictable monthly payments and protect you from interest rate fluctuations.

Access Cash: A cash-out refinance allows you to borrow against your home’s equity. You can use this cash for home improvements, debt consolidation, or other financial goals. However, keep in mind that you’ll be taking on more debt and your monthly payments will likely increase.

Closing Costs: Refinancing involves closing costs, which can range from 2% to 5% of the loan amount. These costs include origination fees, appraisal fees, and title insurance. It’s important to weigh the potential savings from refinancing against these closing costs to determine if the overall cost is worth it.

Ultimately, the decision to refinance depends on your individual financial circumstances. Consult with a qualified mortgage lender or financial advisor to discuss your specific situation and determine if refinancing is the right choice for you.

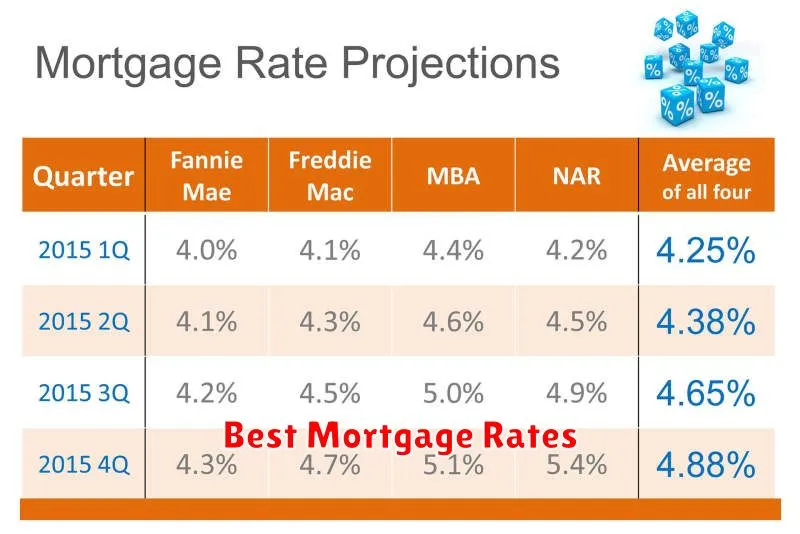

Expert Predictions for Mortgage Rates in 2024

Predicting the future of mortgage rates is a tricky business, but experts are offering some insights into what we might see in 2024. The Federal Reserve’s continued fight against inflation is likely to play a major role in determining interest rate trends. If inflation cools down, the Fed could potentially lower rates, which could benefit borrowers. However, if inflation remains stubborn, we might see rates continue to rise, making borrowing more expensive.

Some experts anticipate moderate increases in mortgage rates throughout the year, with forecasts ranging from 5% to 7%. Others are more optimistic, predicting a slight decline in rates towards the end of the year. Ultimately, the path of mortgage rates will depend on various economic factors, including inflation, economic growth, and the Fed’s monetary policy decisions.

It’s important to remember that these are just predictions, and the actual outcome may differ. Staying informed about economic news and consulting with a qualified financial advisor can help you make informed decisions about your mortgage financing in 2024.