Are you ready to embark on the exciting journey of homeownership? Buying a home is a significant financial decision, and understanding your mortgage payments is crucial. This comprehensive guide, “Mastering Your Mortgage: A Comprehensive Guide to Calculating Mortgage Payments,” will equip you with the knowledge and tools to navigate the intricacies of mortgage calculations. From understanding key terms like principal, interest, and amortization to exploring various loan types and factors that influence your monthly payments, this article will empower you to make informed decisions about your mortgage.

Whether you’re a first-time homebuyer or a seasoned investor, grasping the fundamentals of mortgage calculations is essential for achieving your financial goals. By mastering the art of calculating your mortgage payments, you can accurately budget, compare loan options, and ultimately, secure the perfect home within your financial means. So, let’s dive into the world of mortgages and unlock the secrets to calculating your monthly payments with confidence.

Understanding the Components of a Mortgage Payment

A mortgage payment is made up of several different components. Understanding these components will help you understand the total cost of your loan and how your payments are allocated. Here’s a breakdown of the common components of a mortgage payment:

Principal: This is the amount of money you borrowed from the lender to purchase your home. Each monthly payment includes a portion of the principal, gradually reducing the amount you owe.

Interest: This is the cost of borrowing money. The interest rate is determined by factors such as your credit score, the loan term, and prevailing market rates. You’ll pay interest on the remaining principal balance of your loan.

Property Taxes: These are taxes levied by your local government on the value of your property. In most cases, your mortgage lender will collect your property taxes along with your monthly mortgage payment, holding them in escrow until they are due.

Homeowners Insurance: This insurance policy protects your home and its contents from damage caused by events like fire, theft, or natural disasters. Like property taxes, your lender typically collects your homeowners insurance premiums as part of your monthly mortgage payment.

Private Mortgage Insurance (PMI): This insurance is usually required if you have a low down payment on your home. PMI protects your lender in case you default on your mortgage, and it’s typically paid monthly as part of your mortgage payment. You can often cancel PMI once your equity reaches a certain level.

Escrow: Escrow is a separate account held by your lender to collect and pay your property taxes and homeowners insurance premiums. The amount you pay into escrow is calculated based on your estimated annual property taxes and insurance premiums, divided by 12 months.

Principal and Interest: The Core of Your Payment

Your mortgage payment is made up of two main components: principal and interest. The principal is the actual amount you borrowed from the lender. The interest is the cost of borrowing that money, expressed as a percentage of the principal. Understanding these concepts is crucial for effectively managing your mortgage.

The principal is gradually paid down with each payment, while the interest portion covers the cost of borrowing that money. Over time, the principal portion of your payment will increase, and the interest portion will decrease. This is because as you pay down the principal, the amount of interest you owe on the remaining balance decreases.

Property Taxes and How They Affect Payments

Property taxes are levied by local governments and are based on the assessed value of your home. These taxes are often rolled into your monthly mortgage payment through an escrow account. While they aren’t part of your principal and interest, they can significantly impact your overall monthly costs.

The amount of property tax you pay can vary depending on your location, the assessed value of your home, and the local tax rate. It’s crucial to factor in this cost when calculating your total mortgage payment, as it can add hundreds of dollars to your monthly bill.

Here’s how property taxes influence your mortgage payments:

- Escrow Account: Most lenders require you to set up an escrow account to pay property taxes and homeowner’s insurance. Your monthly mortgage payment includes an escrow portion that covers these expenses.

- Tax Rate Fluctuations: Property tax rates can change over time, which can affect your escrow payment. If taxes go up, your monthly payment may increase accordingly.

- Impact on Affordability: Property taxes are an essential factor to consider when determining how much you can afford to borrow. Higher taxes can make a property less affordable, even if the principal and interest payments are lower.

To understand the full financial implications of a mortgage, make sure you factor in property taxes alongside principal, interest, and other fees. This will give you a comprehensive picture of your monthly costs and help you make informed financial decisions.

Homeowner’s Insurance: Protecting Your Investment

A mortgage is a significant financial commitment, and it’s crucial to protect your investment. Homeowner’s insurance is a vital component of responsible homeownership. It safeguards your property and finances against unexpected events like fire, theft, and natural disasters. Think of it as a safety net, providing peace of mind knowing that you’re covered in the event of unforeseen circumstances.

By securing homeowner’s insurance, you protect your property’s value and your financial well-being. It covers not only the structure of your home but also your belongings, providing financial compensation for repairs or replacement. Additionally, it offers liability coverage, shielding you from legal claims if someone gets injured on your property.

When choosing homeowner’s insurance, consider factors like your property’s value, location, and desired coverage levels. Consult with a trusted insurance agent to determine the most suitable policy for your needs. Remember, the right coverage can protect your investment and provide essential financial security.

Private Mortgage Insurance (PMI): When It’s Required

Private mortgage insurance (PMI) is an insurance policy that protects lenders from losses if a borrower defaults on their mortgage loan. PMI is usually required when a borrower makes a down payment of less than 20% of the purchase price of the home. This is because a smaller down payment means the lender is taking on more risk.

If you’re putting less than 20% down on your mortgage, you’ll likely be required to pay PMI. The amount of PMI you pay will depend on several factors, including the amount of your loan, your credit score, and the type of mortgage you choose. You can typically expect to pay PMI as a monthly premium, which is added to your mortgage payment.

While PMI can add to your monthly mortgage costs, it can also be beneficial in the long run. By helping lenders to reduce their risk, PMI can make it easier to qualify for a mortgage, especially if you have a lower credit score or a smaller down payment. It also allows you to purchase a home sooner than you might otherwise be able to.

There are a few ways to avoid PMI:

- Make a down payment of at least 20% of the purchase price.

- Refinance your mortgage once your home equity reaches 20%.

- Consider a mortgage with a lower loan-to-value ratio (LTV) or a higher credit score.

It’s important to note that PMI is typically canceled automatically when your home equity reaches 20% or when you’ve paid off a certain percentage of your mortgage, whichever comes first. It’s crucial to understand the specifics of your mortgage contract and the terms of your PMI policy to determine when you’ll be able to cancel it.

By understanding the basics of PMI and its potential impact on your mortgage, you can make informed decisions about your home purchase and ensure you’re prepared for any additional costs. It’s always a good idea to consult with a mortgage lender or financial advisor to discuss your individual situation and explore the best mortgage options available to you.

Calculating Your Monthly Mortgage Payment

Understanding your monthly mortgage payment is crucial for effective financial planning. Knowing this amount allows you to budget accurately, plan for future expenses, and ensure you can comfortably afford your home. There are several factors that determine your monthly mortgage payment, including the loan amount, interest rate, loan term, and property taxes and insurance.

The most common formula to calculate your monthly mortgage payment is the amortization formula. This formula considers all the above factors and uses a complex mathematical calculation to determine your monthly payment amount. While you can use a mortgage calculator online to quickly estimate your payment, understanding the basic components can provide valuable insights into your mortgage expenses.

Here’s a breakdown of how the different factors influence your monthly payment:

- Loan Amount: The total amount of money you borrow determines the base amount of your monthly payment.

- Interest Rate: The interest rate charged on your loan directly affects how much you pay over the life of the mortgage. A higher interest rate will result in a larger monthly payment.

- Loan Term: The loan term, typically in years, dictates the length of your mortgage. A longer loan term will usually lead to a lower monthly payment but higher total interest paid over the life of the loan.

- Property Taxes and Insurance: These costs are often added to your monthly mortgage payment through an escrow account. The amount varies depending on your location and the value of your property.

By understanding the factors that contribute to your monthly mortgage payment, you can make informed decisions about your mortgage financing. You can use this knowledge to negotiate a better interest rate, choose a suitable loan term, and ensure you can comfortably afford your mortgage payments.

Using Online Mortgage Calculators Effectively

Online mortgage calculators are powerful tools that can help you estimate your monthly mortgage payments, determine affordability, and explore different loan scenarios. To use them effectively, consider the following tips:

Input Accurate Information: Provide accurate details about your desired loan amount, interest rate, loan term, and any down payment you anticipate. Inaccurate information will lead to inaccurate calculations.

Explore Different Scenarios: Experiment with different loan amounts, interest rates, and loan terms to see how they impact your monthly payments and total interest paid. This will give you a better understanding of the potential financial implications of different choices.

Compare Multiple Calculators: Using multiple online mortgage calculators can provide a range of estimates, helping you assess the potential variations in calculations and ensure you’re getting a fair representation.

Consider Additional Costs: Keep in mind that mortgage calculators usually only factor in the principal and interest portion of your payment. Additional costs, such as property taxes, homeowners insurance, and private mortgage insurance (PMI), can significantly impact your overall monthly expenses.

Remember Limitations: Online calculators are helpful tools, but they don’t provide financial advice. They’re based on pre-defined formulas and may not fully account for individual circumstances or potential changes in interest rates.

By using online mortgage calculators effectively, you can gain valuable insights into your mortgage options and make informed decisions about your home purchase.

Factors Influencing Your Mortgage Payment Amount

Several factors come into play when calculating your monthly mortgage payment. Understanding these factors is crucial to making informed financial decisions and finding a mortgage that fits your budget.

Loan Amount: The amount of money you borrow directly impacts your monthly payment. A larger loan amount will result in a higher payment.

Interest Rate: This is the cost of borrowing money, expressed as a percentage. A higher interest rate will lead to a higher monthly payment.

Loan Term: This refers to the duration of your mortgage, typically expressed in years. A shorter loan term (e.g., 15 years) will result in higher monthly payments but a lower overall interest cost.

Property Taxes: In many areas, property taxes are included in your monthly mortgage payment. These taxes vary depending on the location and value of your property.

Homeowners Insurance: This insurance protects your home from damage and is usually included in your monthly payment. The cost of homeowners insurance depends on various factors, including the location and value of your property.

Private Mortgage Insurance (PMI): If you make a down payment of less than 20% on your home, you may be required to pay PMI. This insurance protects the lender if you default on your loan.

Points: You can pay points upfront to lower your interest rate. Each point costs 1% of the loan amount. By paying points, you can reduce your monthly payments but will need to factor in the upfront cost.

Loan Amount, Interest Rate, and Loan Term

The three main factors that determine your monthly mortgage payment are the loan amount, interest rate, and loan term. Understanding how these factors work together is crucial to making informed decisions about your mortgage.

The loan amount is simply the total amount of money you borrow to purchase your home. This is typically the purchase price minus any down payment you make.

The interest rate is the percentage charged by the lender for the privilege of borrowing money. A higher interest rate means you’ll pay more in interest over the life of the loan. Interest rates fluctuate based on market conditions, so it’s important to shop around for the best rates.

The loan term is the length of time you have to repay the loan. Common terms include 15, 20, and 30 years. A shorter loan term means you’ll pay more each month, but you’ll pay less in total interest over the life of the loan.

To illustrate how these factors interact, consider the following examples:

- A higher loan amount will result in a higher monthly payment.

- A higher interest rate will result in a higher monthly payment.

- A longer loan term will result in a lower monthly payment but higher overall interest paid.

By understanding how these factors affect your monthly mortgage payment, you can choose a mortgage that fits your budget and financial goals.

Down Payment and Loan-to-Value Ratio (LTV)

The down payment is the initial amount of money you put down towards the purchase of a home. This amount will vary depending on the price of the property and the type of mortgage you choose. A larger down payment typically results in a lower interest rate and a smaller monthly payment.

The loan-to-value ratio (LTV) is the percentage of the home’s value that you are borrowing from the lender. It is calculated by dividing the amount of your mortgage loan by the appraised value of the property. For example, if you’re purchasing a home for $300,000 and making a $30,000 down payment, your LTV would be 90%.

The LTV is important because it affects the terms of your mortgage. A lower LTV typically results in a lower interest rate and a better chance of getting approved for a loan.

Here are some of the benefits of making a larger down payment:

- Lower interest rates: Lenders typically offer lower interest rates to borrowers with higher down payments, as they are considered less risky. This translates to lower monthly payments and significant savings over the life of the loan.

- Lower monthly payments: A larger down payment reduces the overall loan amount, which in turn lowers your monthly mortgage payments.

- Less interest paid: With a lower loan amount, you’ll pay less in interest over the life of the loan.

- Increased equity: A larger down payment gives you more equity in your home from the start, meaning you own a larger portion of the property.

- Improved chance of approval: A larger down payment makes you a more attractive borrower in the eyes of lenders, increasing your chances of getting approved for a loan.

- Reduced risk of private mortgage insurance (PMI): Many lenders require borrowers with LTVs over 80% to pay PMI, which protects the lender if you default on your loan. A larger down payment can help you avoid PMI altogether.

While a large down payment offers numerous benefits, it’s important to remember that you need to balance it with other financial goals. Don’t deplete your savings to make a large down payment if it means sacrificing other important financial priorities, such as retirement savings or emergency funds.

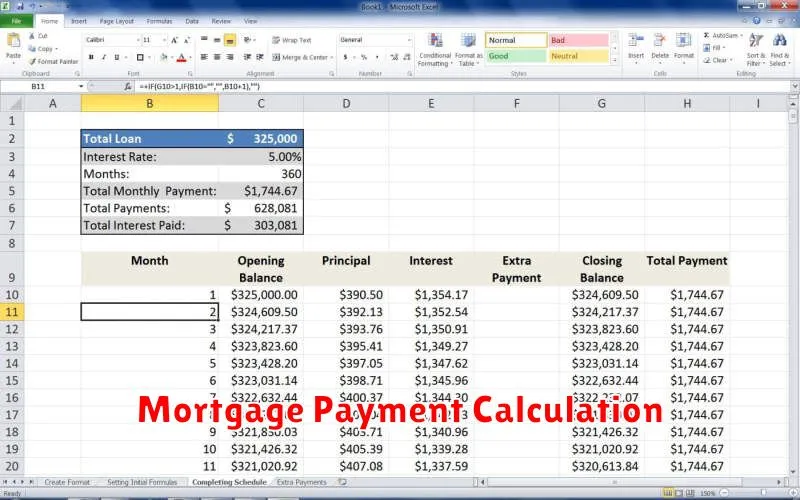

Amortization Schedule: Understanding Loan Payoff

An amortization schedule is a detailed breakdown of how your mortgage payments are applied over the life of your loan. It shows the principal and interest portion of each payment, as well as how your outstanding loan balance decreases over time. Understanding your amortization schedule is crucial for several reasons.

Firstly, it helps you visualize how your mortgage payments are allocated. Each payment is made up of two parts: principal and interest. Principal refers to the actual amount borrowed, while interest is the cost of borrowing money. The amortization schedule clearly shows the breakdown of each payment, allowing you to see how much is going towards reducing your loan balance and how much is being paid as interest.

Secondly, it allows you to track your loan payoff progress. You can see how much your loan balance is decreasing with each payment. This visualization can be motivating and help you stay on track to becoming debt-free.

Thirdly, it empowers you to make informed decisions about your mortgage. You can use the amortization schedule to explore different scenarios, such as making extra payments, refinancing, or shortening the loan term. By understanding how your loan is structured, you can make strategic choices to accelerate your payoff and save on interest costs.

Most lenders will provide you with an amortization schedule when you take out a mortgage. Alternatively, many online calculators and tools are available to help you create your own schedule. By understanding and utilizing your amortization schedule, you gain a comprehensive grasp of your mortgage and how your payments are working for you.

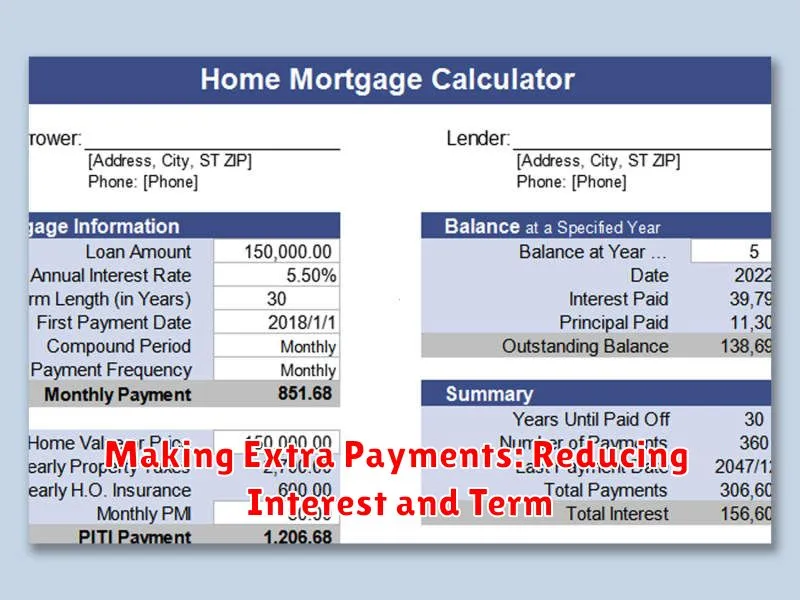

Making Extra Payments: Reducing Interest and Term

One of the most effective ways to accelerate your mortgage payoff is by making extra payments. This strategy can significantly reduce your total interest paid and shorten the overall loan term. There are several ways to make extra payments:

1. Lump Sum Payments: You can make one-time lump sum payments towards your principal balance. This is particularly beneficial if you receive a bonus, tax refund, or inherit money.

2. Biweekly Payments: Instead of making one monthly payment, you can make half the payment every two weeks. This effectively makes 13 monthly payments per year, leading to faster amortization.

3. Accelerated Payments: You can choose an accelerated payment plan offered by your lender. This option typically involves slightly higher monthly payments, but a shorter loan term.

Benefits of Extra Payments:

- Lower Interest Costs: Extra payments reduce the amount of interest you pay over the life of the loan.

- Shorter Loan Term: By paying down the principal faster, you can shorten the duration of your mortgage, saving you years of payments.

- Build Equity Faster: Extra payments increase your home equity, which is the portion of your home you own.

- Financial Flexibility: Paying off your mortgage sooner can free up cash flow for other financial goals.

Calculating Extra Payments:

To determine the impact of extra payments, use an online mortgage calculator. Input your current loan details and experiment with different extra payment scenarios. This will show you the potential savings in interest and time.

Important Considerations:

- Prepayment Penalties: Some mortgages have prepayment penalties, so check your loan agreement before making extra payments.

- Other Financial Priorities: Ensure extra payments don’t compromise your emergency fund, retirement savings, or other essential financial goals.

Making extra payments is a powerful tool for accelerating your mortgage payoff and gaining financial control. By strategically applying these strategies, you can significantly reduce your interest costs, shorten your loan term, and build equity faster.

Refinancing Your Mortgage: Potential Benefits and Drawbacks

Refinancing your mortgage can be a smart financial move, but it’s crucial to understand the potential benefits and drawbacks before making a decision.

Potential Benefits:

- Lower Interest Rate: Refinancing to a lower interest rate can significantly reduce your monthly payments and save you money over the life of your loan.

- Shorter Loan Term: Refinancing to a shorter loan term can help you pay off your mortgage faster and reduce the total amount of interest you pay.

- Switch from an Adjustable-Rate Mortgage (ARM) to a Fixed-Rate Mortgage: Refinancing from an ARM to a fixed-rate mortgage can provide peace of mind by locking in a predictable interest rate for the life of the loan.

- Cash Out Refinancing: This allows you to borrow against your home’s equity, providing access to funds for home improvements, debt consolidation, or other financial goals.

Potential Drawbacks:

- Closing Costs: Refinancing involves closing costs, including appraisal fees, lender fees, and title insurance, which can add up to a significant expense.

- Prepayment Penalties: Some mortgages include prepayment penalties, which can make refinancing less attractive.

- Interest Rate Lock-In: Locking in a lower interest rate often involves a fee, and you may miss out on even lower rates if interest rates drop further.

- Impact on Home Equity: Cash-out refinancing can reduce your home equity, making it harder to obtain future loans.