Are you ready to finally lower your monthly mortgage payments? Or maybe you’re looking to shorten your loan term and pay off your mortgage faster? Or, perhaps you’re just looking for the best way to take advantage of lower interest rates? If any of these sound familiar, you’re in the right place. This comprehensive guide will walk you through everything you need to know about refinancing your home loan, from the basics of how it works to the potential benefits and drawbacks.

Refinancing your home loan can be a smart financial move that can help you save money and reach your financial goals. But it’s important to understand the process thoroughly before you make any decisions. This guide will cover everything from determining your eligibility to comparing different loan options to understanding the closing costs involved. We’ll also provide you with tips for negotiating the best rates and avoiding common refinancing pitfalls.

What is Refinancing and How Does it Work?

Refinancing is the process of replacing an existing mortgage with a new one. This can be done to obtain a lower interest rate, change the loan term, or access equity from your home. When you refinance, you essentially pay off your current mortgage with a new loan. This means you’ll have a new loan amount, interest rate, and monthly payment.

There are several reasons why homeowners choose to refinance. Here are some of the most common:

- Lower Interest Rates: If interest rates have fallen since you took out your original mortgage, refinancing can help you save money on your monthly payments. You can even shorten your loan term and pay off your mortgage sooner.

- Change Loan Term: Refinancing allows you to switch to a different loan term. You can opt for a shorter term to pay off your mortgage faster or a longer term to lower your monthly payments. However, choosing a longer term usually means paying more interest over the life of the loan.

- Access Equity: Homeowners can use refinancing to access the equity they’ve built up in their homes. This means borrowing more money against your property, which can be used for home improvements, debt consolidation, or other major expenses.

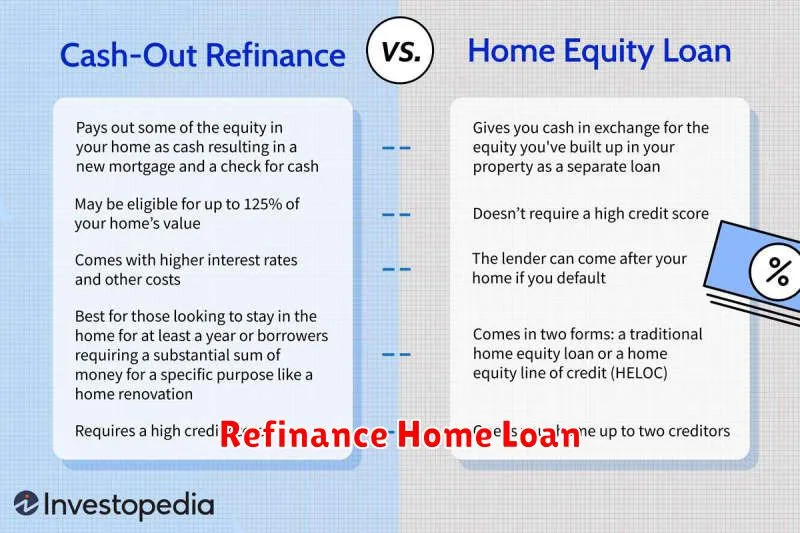

- Cash-out Refinancing: A cash-out refinance allows you to borrow more than your current loan balance. You can use the extra cash for various purposes, but it’s important to note that you’ll be taking on more debt.

Before you decide to refinance, it’s crucial to consider the associated costs. Refinancing usually involves closing costs, which can include appraisal fees, origination fees, and title insurance. You should also compare rates from different lenders to ensure you’re getting the best deal.

Reasons to Consider Refinancing Your Mortgage

Refinancing your mortgage can be a smart financial move, but it’s not always the right decision. Before you decide to refinance, it’s important to understand the potential benefits and drawbacks. Here are a few reasons to consider refinancing your mortgage:

Lower your monthly payments: If interest rates have fallen since you took out your original mortgage, you may be able to refinance and lower your monthly payments. This can free up cash flow for other financial goals, such as saving for retirement or paying down debt.

Shorten your loan term: Refinancing can also allow you to shorten your loan term. This will mean you’ll pay more each month, but you’ll pay off your mortgage faster and save money on interest in the long run.

Change your loan type: If you have an adjustable-rate mortgage (ARM), you may want to refinance to a fixed-rate mortgage to protect yourself from future interest rate increases. You can also refinance from an FHA or VA loan to a conventional loan.

Access your home equity: If you have built up equity in your home, you may be able to refinance and take out a cash-out refinance. This allows you to borrow against your home equity and use the funds for other purposes, such as home improvements or debt consolidation.

Get rid of private mortgage insurance (PMI): If you put down less than 20% on your original mortgage, you may have been required to pay private mortgage insurance (PMI). Refinancing to a loan-to-value ratio of 80% or less can allow you to get rid of PMI and save money on your monthly payments.

It’s important to weigh the potential benefits and drawbacks of refinancing before making a decision. Consider your financial goals, interest rates, and other factors to determine if refinancing is right for you.

Lowering Your Monthly Mortgage Payments

One of the primary reasons people refinance their home loans is to lower their monthly mortgage payments. By refinancing, you can potentially secure a lower interest rate, which can significantly reduce your monthly outlays. This can free up cash flow for other financial goals, such as saving for retirement, paying down debt, or simply having more disposable income.

To determine how much you can save, it’s important to understand the factors influencing your interest rate. Your credit score, debt-to-income ratio, and the current market interest rates play crucial roles. A higher credit score typically leads to a lower interest rate. Similarly, a lower debt-to-income ratio can also improve your chances of securing a favorable rate. Keep in mind that the current market interest rates fluctuate, so it’s essential to research and compare options from different lenders.

Before you jump into refinancing, it’s crucial to analyze the potential costs involved. Refinancing usually involves closing costs, which can range from 2% to 5% of the loan amount. These costs can offset any savings you achieve, especially if you plan to refinance for a shorter term.

Ultimately, lowering your monthly mortgage payments through refinancing can be a smart financial move if it aligns with your long-term goals. However, it’s essential to do your research, compare options from multiple lenders, and carefully analyze the potential costs and benefits before making a decision.

Shortening Your Loan Term

One of the most significant benefits of refinancing your home loan is the option to shorten your loan term. By doing so, you can potentially save thousands of dollars in interest payments and pay off your mortgage sooner. When you shorten your loan term, you’ll make higher monthly payments, but you’ll also build equity in your home more quickly.

Here’s how shortening your loan term can benefit you:

- Lower interest costs: By paying off your mortgage faster, you’ll pay less interest overall, saving you money in the long run.

- Faster equity growth: With each additional payment, you’ll build equity in your home more rapidly, increasing your ownership stake faster.

- More financial flexibility: Having a shorter loan term can free up your cash flow for other financial goals, such as investing or saving for retirement.

- Peace of mind: Knowing you’re on track to pay off your mortgage sooner can provide a sense of security and peace of mind.

However, it’s crucial to consider the trade-offs. Shortening your loan term means higher monthly payments, which may strain your budget. It’s important to assess your financial situation and ensure you can comfortably afford the increased payments. Additionally, if you choose to shorten your loan term, you may need to refinance to a higher interest rate to keep your monthly payments manageable.

Ultimately, the decision to shorten your loan term is a personal one that should be based on your individual circumstances and financial goals. Carefully weigh the benefits and drawbacks before making a decision. You can always consult with a financial advisor to get personalized guidance.

Tapping into Home Equity for Cash-Out Refinancing

A cash-out refinance lets you tap into your home’s equity to borrow money. This can be a good option for homeowners who need cash for home improvements, debt consolidation, or other major expenses.

Here’s how it works: You refinance your existing mortgage for a larger loan amount than your current mortgage. The difference between the new loan amount and your existing mortgage is the cash you receive. You then repay the larger loan over a new term.

For example, if your home is worth $300,000 and you have a mortgage of $200,000, you have $100,000 in equity. You could refinance your mortgage for $250,000 and receive $50,000 in cash.

Benefits of a cash-out refinance:

- Access to cash for home improvements, debt consolidation, or other major expenses

- Potentially lower interest rates than other forms of borrowing

- Can help you consolidate high-interest debt

Drawbacks of a cash-out refinance:

- You’ll have a larger mortgage balance and will pay more interest over the life of the loan

- It can increase your monthly mortgage payments

- You could lose your home if you can’t make your payments

Before considering a cash-out refinance, it’s important to weigh the pros and cons and make sure it’s the right decision for you.

Here are some factors to consider:

- Your current interest rate and mortgage term

- The amount of equity you have in your home

- Your financial goals and needs

- Your ability to make the new mortgage payments

If you’re considering a cash-out refinance, it’s best to talk to a mortgage lender to discuss your options and find the best solution for your situation.

Switching from an Adjustable-Rate to a Fixed-Rate Mortgage

An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate can change over time, usually based on a specific index. While ARMs can be appealing due to their initial low rates, they can become more expensive in the long run if rates rise. If you’re worried about rising interest rates, you may want to consider switching from an ARM to a fixed-rate mortgage.

A fixed-rate mortgage, as the name suggests, has a fixed interest rate for the entire term of the loan. This means your monthly payments will remain the same, providing predictability and financial stability. Switching to a fixed-rate mortgage can offer peace of mind, especially in a fluctuating interest rate environment.

However, it’s important to remember that refinancing comes with costs, including closing costs and potential prepayment penalties. You’ll need to carefully weigh the potential benefits of switching to a fixed-rate mortgage against these costs to see if it’s financially advantageous for you.

Here are some things to consider when deciding whether to switch from an ARM to a fixed-rate mortgage:

- Current Interest Rates: Compare current fixed-rate mortgage rates with your current ARM rate. Is the difference significant enough to justify refinancing?

- Term of your Existing Mortgage: How much time is left on your current ARM? If you have a short time left, refinancing might not be worthwhile.

- Refinancing Costs: Factor in closing costs and any prepayment penalties. Will the savings from a lower interest rate outweigh these costs?

- Your Financial Situation: Consider your current income, debt, and savings. Can you comfortably afford the new monthly payments if you refinance?

Ultimately, the decision to switch from an ARM to a fixed-rate mortgage is personal and depends on your individual circumstances. If you’re considering this option, it’s best to speak with a qualified mortgage professional who can assess your situation and help you make an informed decision.

Understanding Refinancing Costs and Fees

Refinancing your home loan can be a smart financial move, but it’s important to understand the costs involved. Refinancing isn’t free, and there are various fees you’ll need to pay before you can secure a new mortgage.

Here are some of the common refinancing costs and fees you might encounter:

- Origination Fee: A percentage of the loan amount charged by the lender to process the refinance.

- Appraisal Fee: A fee for a professional assessment of your home’s current market value.

- Closing Costs: These encompass various expenses associated with finalizing the loan, including title search fees, recording fees, and attorney fees.

- Underwriting Fee: A fee charged by the lender to assess your financial situation and determine if you qualify for the loan.

- Prepayment Penalty: A fee charged by some lenders if you pay off your existing loan early.

- Government Recording Fees: Fees paid to the local government to record the refinance.

The total refinancing costs will vary depending on factors like the loan amount, the lender, and your location. Make sure to factor in these costs when comparing refinancing options.

Calculating Your Break-Even Point

The break-even point is the point at which the savings from a lower interest rate on your refinanced mortgage equals the closing costs you paid. Essentially, it’s the amount of time it takes for your monthly savings to offset the upfront costs of refinancing.

To calculate your break-even point, you’ll need the following information:

- Your current mortgage interest rate

- Your current monthly mortgage payment

- The new interest rate you’re being offered

- The estimated closing costs for refinancing

- The principal balance of your current mortgage

You can use an online calculator or a mortgage professional to help you determine your break-even point.

Here are some tips for understanding and using your break-even point:

- The lower your interest rate and the higher your closing costs, the longer it will take to break even.

- It’s important to consider how long you plan to stay in your home. If you plan to move soon, refinancing may not be worth it.

- Be sure to factor in any other potential savings, such as lower monthly payments or a shorter loan term.

By understanding your break-even point, you can make a more informed decision about whether or not refinancing is right for you.

Shopping Around for the Best Refinance Rates

Finding the best refinance rate can be a challenging task. With so many lenders out there, it can be difficult to know where to start. However, the key is to shop around and compare offers from multiple lenders. Here are some tips to help you get the best deal:

Get pre-approved: This will give you a better idea of what you can afford and will help you streamline the process when you find a lender you like. Getting pre-approved also shows lenders that you’re serious about refinancing and helps you secure a competitive rate.

Compare rates and fees: Different lenders offer different rates and fees, so it’s essential to compare them carefully. Pay attention to the interest rate, origination fees, closing costs, and any other fees associated with the refinance.

Consider different loan types: There are many different types of refinance loans available, each with its own set of terms and conditions. Consider your individual needs and financial goals to determine the best loan type for you.

Look for lenders with a good reputation: It’s important to choose a lender with a solid track record and positive customer reviews. Check with the Better Business Bureau or other reputable organizations to find lenders with a good reputation.

Negotiate the terms: Once you’ve found a lender you like, don’t be afraid to negotiate the terms of the loan. This includes the interest rate, fees, and other terms. If you’re a good borrower with a good credit score, you may be able to get a better rate by negotiating.

Read the fine print: Before signing any documents, carefully review all the terms and conditions of the loan. This will ensure that you understand the terms and conditions of your refinance loan and that you’re not getting into any surprises.

By following these tips, you can increase your chances of getting the best refinance rate possible. Remember, taking the time to shop around and compare offers is essential for finding the right lender for your needs.

Gathering Necessary Documentation

Before you begin the refinancing process, it’s essential to gather all the necessary documents. These documents will help lenders assess your financial situation and determine if you qualify for a refinance loan.

Here are the essential documents you’ll need:

- Recent pay stubs: These documents show your current income and employment status.

- W-2 forms: These documents provide your income details for the past year.

- Bank statements: These statements demonstrate your cash flow and savings.

- Credit report: This report shows your credit history and score.

- Home appraisal: This report evaluates the current market value of your home.

- Mortgage statement: This document outlines your current mortgage details.

- Tax returns: These documents verify your income and tax status.

Having all the necessary documentation ready will streamline the refinancing process and improve your chances of a smooth transaction.

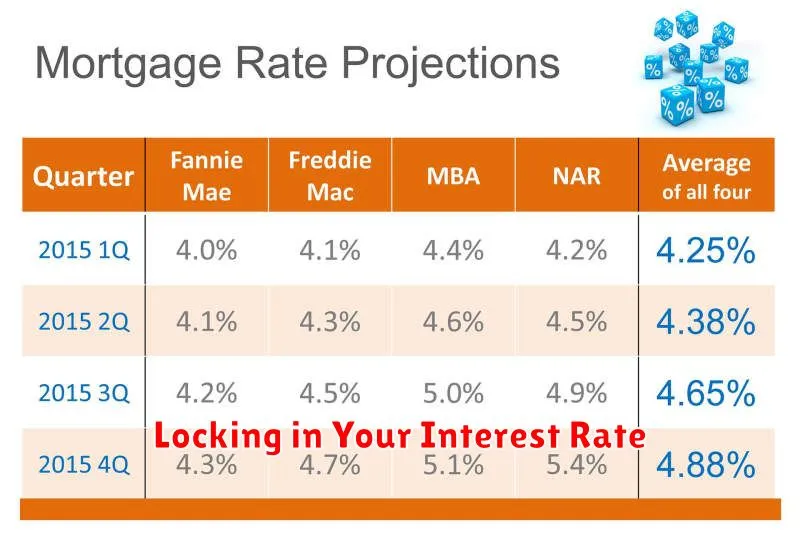

Locking in Your Interest Rate

Once you’ve decided to refinance, you’ll need to lock in your interest rate. This means that you’re agreeing to a specific rate for a set period of time, typically 30 to 60 days. Locking in your rate is important because it protects you from interest rate fluctuations. If rates rise between the time you apply for a refinance and the time you close on your loan, your locked-in rate will remain the same.

However, you should keep in mind that locking in your rate comes with a cost. The lender will typically charge a fee for locking in your rate, and this fee can vary depending on the lender and the terms of your loan. You’ll also need to factor in the time it takes to close on your loan. If you lock in your rate and then the closing process takes longer than expected, you could miss out on the opportunity to secure a lower rate.

To decide whether or not to lock in your rate, you’ll need to weigh the pros and cons. If you’re concerned about interest rate fluctuations, locking in your rate may be a good option. However, if you’re comfortable with taking a risk, you may be able to secure a lower rate by waiting to lock in until closer to the closing date.

Here are some things to consider when deciding whether or not to lock in your rate:

- The current interest rate environment

- Your risk tolerance

- The length of time it will take to close on your loan

- The cost of locking in your rate

If you decide to lock in your rate, be sure to do your research and compare rates from multiple lenders. You should also make sure you understand the terms of the rate lock, including the length of the lock period and any fees that apply.

The Refinancing Process: Step-by-Step

Refinancing your home loan can be a great way to save money on your monthly payments, lower your interest rate, or even shorten your loan term. But before you jump in, it’s important to understand the refinancing process. Here’s a step-by-step guide to help you navigate it:

1. Check Your Credit Score: Lenders use your credit score to determine your interest rate and eligibility. A good credit score will help you secure better terms. You can check your credit score for free from websites like Credit Karma or AnnualCreditReport.com.

2. Shop Around for Lenders: Get quotes from multiple lenders to compare interest rates, fees, and loan terms. This will help you find the best deal for your situation.

3. Determine Your Loan Type: Decide on the type of refinancing you need: rate-and-term refinance (to lower your interest rate or shorten your loan term), cash-out refinance (to access equity in your home), or fixed-rate refinance (to switch from an adjustable-rate mortgage to a fixed-rate mortgage).

4. Provide Documentation: Lenders will require you to provide documentation like your income verification, bank statements, and recent tax returns to verify your financial information.

5. Review and Sign the Loan Documents: Once your loan application is approved, you’ll receive the loan documents to review and sign. Make sure you understand the terms and conditions before signing.

6. Close on the Loan: The final step in the refinancing process is closing on the loan. This involves signing the final documents and transferring the funds.

Refinancing can be a complex process, but following these steps will help you make informed decisions and navigate the process smoothly. Always consult with a qualified financial advisor to ensure you understand the implications of refinancing and make the best decision for your financial situation.