Owning a home is a significant milestone in life, and securing a mortgage is the key to unlocking that dream. However, for individuals with less-than-perfect credit, the process can seem daunting. A bad credit score can significantly impact your loan approval and interest rates, making homeownership appear out of reach. But don’t despair! There are strategies and steps you can take to improve your credit and increase your chances of getting approved for a mortgage.

This comprehensive guide will equip you with the knowledge and tools to navigate the mortgage application process with a bad credit score. We’ll delve into the factors that affect mortgage approval, explore practical tips for improving your credit, and discuss alternative mortgage options tailored for borrowers with less-than-stellar credit history. Whether you’re just starting your credit journey or seeking to improve your score, this article provides actionable insights to help you achieve your homeownership goals.

Understanding Your Credit Score and History

Your credit score is a numerical representation of your creditworthiness, reflecting how likely you are to repay your debts on time. It plays a crucial role in securing a mortgage, as lenders use it to assess your financial risk. A credit score ranges from 300 to 850, with higher scores indicating better credit health.

Your credit history encompasses all your borrowing and repayment activity, including credit cards, loans, and even utility bills. It’s used to calculate your credit score, and it contains information about:

- Payment history: This is the most important factor, accounting for 35% of your score. Late or missed payments negatively impact your score.

- Amounts owed: This reflects the amount of credit you’re currently using, accounting for 30% of your score. A high credit utilization ratio (the percentage of available credit you’re using) can lower your score.

- Length of credit history: The longer your credit history, the better. This accounts for 15% of your score. It demonstrates your ability to manage credit responsibly over time.

- New credit: Opening new accounts can temporarily lower your score, accounting for 10% of your score. It signals increased borrowing activity and potential risk.

- Credit mix: Having a mix of credit accounts, such as credit cards, loans, and mortgages, can be beneficial, accounting for 10% of your score. It shows responsible borrowing practices.

It’s important to regularly check your credit report and score for errors and ensure your information is accurate. Understanding your credit history is crucial for taking steps to improve your score and potentially qualify for a mortgage.

Factors Affecting Mortgage Approval with Bad Credit

Securing a mortgage with bad credit can be a challenging process, but it is not impossible. Several factors influence the approval of your mortgage application, and understanding these factors can help you improve your chances of getting approved. Here are some key factors that lenders consider when evaluating a borrower with bad credit:

Credit Score: Your credit score is the most significant factor in mortgage approval. Lenders use your credit score to assess your creditworthiness and determine your risk as a borrower. A lower credit score typically leads to higher interest rates and stricter lending terms.

Debt-to-Income Ratio (DTI): Lenders look at your DTI to determine how much debt you have relative to your income. A high DTI indicates that you have a significant amount of debt, which could make you a riskier borrower. A lower DTI is generally more favorable for mortgage approval.

Credit History: Your credit history reflects your past borrowing and repayment behavior. Lenders carefully review your credit history to identify any red flags, such as late payments, defaults, or bankruptcies. A history of consistent and timely payments is essential for mortgage approval.

Down Payment: A larger down payment can significantly improve your chances of getting a mortgage with bad credit. A substantial down payment reduces the amount of money the lender needs to loan you, lowering their risk and making you a more appealing borrower.

Type of Mortgage: Some mortgage programs are specifically designed for borrowers with bad credit. These programs often come with stricter requirements and higher interest rates but offer an opportunity to rebuild your credit. Consulting with a mortgage broker can help you find the right program that suits your situation.

Income and Employment History: Lenders want to ensure you have a stable income source to make your mortgage payments. A consistent income history and stable employment demonstrate your ability to meet your financial obligations. Providing documentation of your income, such as pay stubs or tax returns, is crucial for mortgage approval.

Assets: Having liquid assets, such as savings or investments, can make you a more attractive borrower. Assets provide additional security for the lender and can help offset the risk associated with your credit history.

It’s important to remember that securing a mortgage with bad credit requires careful planning and preparation. By understanding the factors that influence mortgage approval and taking steps to improve your creditworthiness, you can increase your chances of getting the loan you need.

Strategies to Improve Your Chances of Approval

Securing a mortgage with bad credit can feel like an uphill battle, but it’s not impossible. With the right strategies, you can increase your chances of approval and achieve your homeownership goals. Here are some key steps you can take:

1. Improve Your Credit Score

The foundation of any successful mortgage application is a strong credit score. Here’s how you can work on improving yours:

- Pay your bills on time: This is the single most important factor in improving your credit score. Set up automatic payments or reminders to ensure you never miss a deadline.

- Reduce your credit utilization: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit.

- Dispute errors on your credit report: Check your credit report for any mistakes and file a dispute with the credit bureaus if you find any.

- Consider a secured credit card: A secured credit card can help you build credit by requiring a security deposit.

2. Boost Your Down Payment

A larger down payment can be a powerful tool for securing a mortgage with bad credit. A substantial down payment reduces the lender’s risk, making them more likely to approve your loan. Here’s how to build up your down payment:

- Save diligently: Make saving a priority by creating a budget and identifying areas where you can cut expenses.

- Consider a gift from family or friends: Some lenders allow down payment gifts from family members, which can help you reach your goal faster.

- Explore down payment assistance programs: Many local and national programs offer financial assistance for down payments.

3. Shop Around for Lenders

Not all lenders are created equal. Different lenders have varying criteria for approving mortgages with bad credit. Be sure to:

- Compare interest rates and fees: Lenders offer different interest rates and fees, so it’s crucial to shop around and find the best deal.

- Look for lenders specializing in bad credit mortgages: There are lenders who specialize in working with borrowers with less-than-perfect credit.

4. Prepare a Strong Financial Picture

Lenders want to see a clear picture of your financial stability. Here’s what you can do:

- Gather necessary documentation: Be prepared to provide your tax returns, pay stubs, and bank statements.

- Stabilize your income: If your income is fluctuating, try to find a more stable source of income. This demonstrates to lenders that you can consistently make mortgage payments.

- Minimize debt: Reduce your outstanding debt as much as possible before applying for a mortgage.

Dispute Errors on Your Credit Report

A credit report is a snapshot of your financial history, and it plays a significant role in getting approved for a mortgage. Any errors on your credit report can negatively impact your credit score and make it challenging to secure a loan. Therefore, it’s crucial to review your credit report regularly and dispute any inaccuracies.

The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccurate information on your credit report. You can submit a dispute directly to the credit bureaus (Equifax, Experian, and TransUnion) or through a credit reporting agency. When disputing, provide clear and concise evidence that the information is incorrect. This could include a copy of a cancelled cheque, a letter from a creditor, or a court document.

By diligently reviewing and disputing errors, you can improve your credit score and increase your chances of getting approved for a mortgage. Remember, a clean credit report is crucial for securing a favourable mortgage interest rate and terms.

Lower Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when evaluating your mortgage application, especially if you have bad credit. DTI represents the percentage of your monthly gross income that goes towards debt payments. A lower DTI generally signifies a stronger financial standing, making you a more attractive borrower.

To lower your DTI, you can focus on these strategies:

- Pay down existing debt: Prioritize paying off high-interest debts like credit cards. Even small payments can significantly reduce your DTI over time.

- Consolidate debt: Combining multiple debts into a single loan with a lower interest rate can decrease your monthly payments and improve your DTI.

- Reduce discretionary spending: Analyze your spending habits and identify areas where you can cut back. This could involve minimizing restaurant visits, entertainment costs, or subscriptions.

- Increase your income: If possible, look for ways to boost your income through a side hustle, promotion, or salary negotiation.

Remember that a lower DTI doesn’t automatically guarantee loan approval, especially with bad credit. However, it significantly strengthens your application and demonstrates your commitment to financial responsibility.

Save for a Larger Down Payment

If you have bad credit, securing a mortgage can be a challenge. One way to improve your chances of getting approved is to save for a larger down payment. Lenders are more likely to approve a loan if you have a significant amount of equity in your home, as it reduces their risk. A larger down payment demonstrates financial stability and a commitment to the mortgage.

Aim for a down payment of at least 20% of the purchase price. This will help you avoid having to pay for private mortgage insurance (PMI), which can add to your monthly payments. You might even consider aiming for a larger down payment if your credit score is significantly below the average.

Saving for a larger down payment can take time, but it’s a crucial step in securing a mortgage with bad credit. Start by creating a budget and finding ways to reduce your expenses. You may also want to consider taking on a side hustle or selling off unused assets to generate extra income.

Explore Government-Backed Loan Programs

If you have a less-than-perfect credit score, securing a mortgage can feel like an uphill battle. But don’t despair! There are government-backed loan programs designed to help individuals with limited credit histories or lower credit scores achieve homeownership. These programs offer more lenient credit requirements, flexible down payment options, and potentially lower interest rates.

One such program is the Federal Housing Administration (FHA) loan. FHA loans are insured by the government, allowing lenders to extend mortgages to borrowers with lower credit scores and down payments. FHA loans typically require a minimum credit score of 580 for a 3.5% down payment, but borrowers with scores as low as 500 can still qualify with a 10% down payment.

Another option is the U.S. Department of Agriculture (USDA) Rural Development loan. USDA loans are available to borrowers in eligible rural areas. These loans don’t require a down payment and have lenient credit score requirements. They are designed to promote homeownership in rural communities and often come with lower interest rates.

Finally, the Veterans Affairs (VA) loan program is available to eligible veterans, active-duty military personnel, and surviving spouses. VA loans offer 100% financing, meaning no down payment is required, and have competitive interest rates. They also have relaxed credit score requirements, making them an attractive option for veterans with less-than-perfect credit.

It’s important to note that eligibility requirements and terms may vary depending on the specific program and lender. It’s advisable to contact a mortgage lender or housing counselor to determine if you qualify for any of these programs and explore the specific benefits and requirements.

Find a Co-Signer or Guarantor

If your credit score is low, you may have difficulty getting approved for a mortgage on your own. In this case, finding a co-signer or guarantor can be a valuable strategy. A co-signer agrees to be jointly responsible for the loan along with you, while a guarantor only steps in if you fail to make payments.

When choosing a co-signer or guarantor, it is crucial to select someone with excellent credit and a stable financial history. They should be someone you trust and who is comfortable taking on this level of financial responsibility. Remember, having a co-signer or guarantor can significantly impact their credit score as well, so it’s essential to have open communication and a clear understanding of the commitment involved.

Before applying for a mortgage with a co-signer or guarantor, make sure to thoroughly research the lender’s policies and requirements. Some lenders may have specific guidelines regarding co-signers or guarantors, such as income level or relationship to the borrower.

Work with a Mortgage Broker Specializing in Bad Credit

A mortgage broker specializing in bad credit can be an invaluable asset in your homeownership journey. These brokers have extensive knowledge and experience in navigating the complexities of securing a mortgage with less-than-perfect credit. They understand the various lending programs available for individuals with challenging credit histories and can help you find the most suitable option.

Here are some key benefits of working with a bad credit mortgage broker:

- Access to a Wider Range of Lenders: Bad credit mortgage brokers have established relationships with a diverse network of lenders, including those who specialize in working with borrowers with less-than-perfect credit. This expands your options beyond traditional lenders who might be more hesitant to approve your application.

- Expert Guidance and Negotiation: Mortgage brokers act as your advocates, guiding you through the entire process, from pre-approval to closing. They can negotiate terms with lenders on your behalf, striving to secure the most favorable interest rates and loan conditions possible.

- Streamlined Application Process: Brokers can help you gather and organize the necessary documentation for your mortgage application, ensuring a smoother and more efficient experience.

- Personalized Solutions: Bad credit mortgage brokers can tailor their approach to your specific financial situation, offering customized solutions that cater to your unique circumstances and credit profile.

It’s essential to choose a reputable and experienced mortgage broker who specializes in bad credit. They should be knowledgeable about the latest lending guidelines and have a proven track record of success in assisting borrowers with similar credit situations. Look for a broker who prioritizes transparency, communication, and your financial well-being.

Demonstrate Consistent Income and Employment History

Even with bad credit, lenders want to see a stable financial history. Demonstrating a consistent income and employment history is crucial in securing a mortgage. Lenders need to be confident that you can afford the monthly payments.

Here’s how you can showcase your financial reliability:

- Maintain a consistent income: If possible, try to avoid any significant changes in your income before applying for a mortgage. A steady income stream shows lenders you can handle the financial responsibility.

- Stay employed: If you’ve had multiple jobs in a short time, it may raise red flags. Ideally, you should have been employed for at least two years in your current position. If you’ve changed jobs frequently, consider finding a more stable position before applying for a mortgage.

- Keep detailed records: Organize your pay stubs, tax returns, and bank statements. This documentation can help demonstrate your consistent income and employment history to lenders.

By highlighting your consistent income and employment history, you can show lenders you’re a responsible borrower, even with a less-than-perfect credit score.

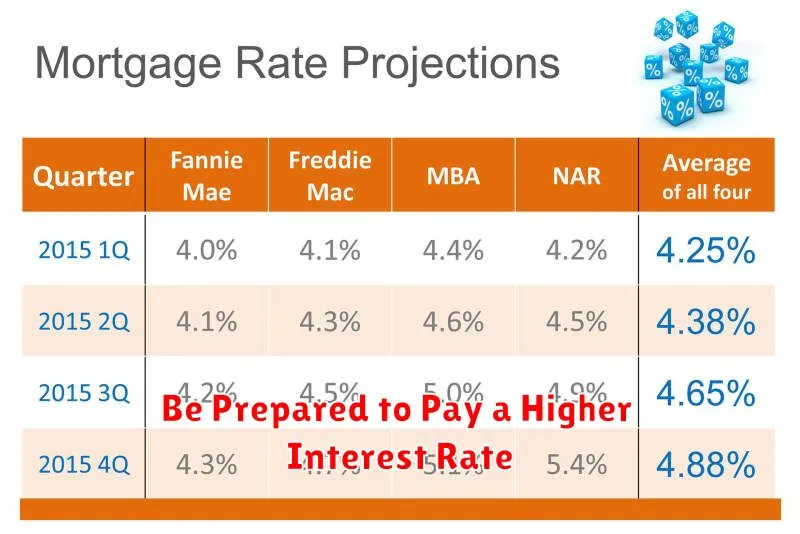

Be Prepared to Pay a Higher Interest Rate

When you have bad credit, lenders perceive you as a higher risk. This means they’ll charge you a higher interest rate on your mortgage to compensate for the added risk. The higher interest rate will result in you paying more in total interest over the life of the loan. Be sure to compare interest rates from multiple lenders to find the best possible rate for your situation.