Are you looking to build wealth through rental properties? Understanding cash flow is crucial for any successful real estate investor. Mastering rental property cash flow analysis allows you to make informed decisions, maximize your returns, and minimize risks. This article will guide you through the essential steps involved in analyzing rental property cash flow and provide valuable insights to help you achieve your investment goals.

By analyzing the income and expenses associated with a rental property, you can determine its profitability and assess its long-term viability. We’ll explore key metrics like rental income, operating expenses, debt service, and cash flow. This knowledge will empower you to identify lucrative opportunities, negotiate favorable terms, and confidently build a solid portfolio of rental properties.

What is Cash Flow and Why is it Important?

In the world of real estate investing, understanding cash flow is crucial. It’s simply the difference between the money coming into your rental property (rental income) and the money going out (expenses). A positive cash flow means you’re making more money than you’re spending, while a negative cash flow means you’re losing money.

So, why is cash flow so important? It’s the lifeblood of your investment. Positive cash flow allows you to:

- Cover your monthly expenses, including mortgage payments, property taxes, insurance, and repairs.

- Generate a profit, which can be used to reinvest in your property or other investments.

- Build wealth over time. By consistently generating positive cash flow, you can steadily increase your net worth.

- Protect against unexpected expenses. Having a buffer of cash flow can help you handle unforeseen repairs or market downturns.

In essence, cash flow is the key to determining the profitability of your rental property. Without a good understanding of your cash flow, it’s impossible to make informed decisions about your investment and achieve your financial goals.

Calculating Your Rental Income Accurately

Accurate rental income calculation is the foundation of a sound cash flow analysis. It involves more than just the monthly rent; understanding all potential income streams is key.

Start by identifying the base rent. This is the core amount your tenant pays each month. But don’t stop there. Consider these additional income sources:

- Security deposits: These are often equal to one month’s rent, providing a safety net in case of damage or unpaid rent.

- Pet fees: If you allow pets, charge a one-time fee or monthly pet rent for added income.

- Late fees: Imposing late fees on late rent payments can incentivize timely payments and boost your income.

- Parking fees: If you provide parking spaces, charge a monthly fee for their use.

- Laundry income: If you offer laundry facilities, charge tenants for use, generating consistent revenue.

While these income streams may seem small, they add up over time, contributing significantly to your overall rental income. By calculating all potential income sources accurately, you gain a clearer picture of your rental property’s financial performance.

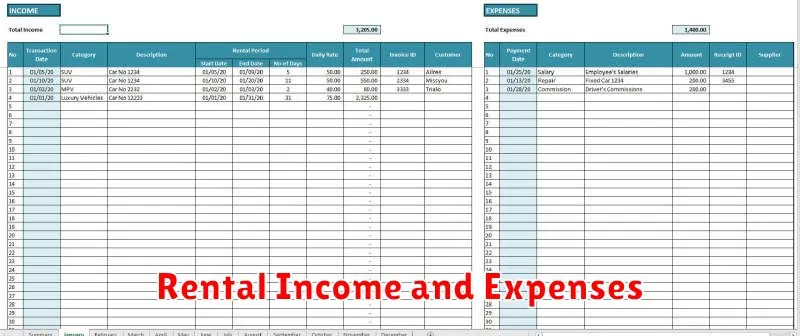

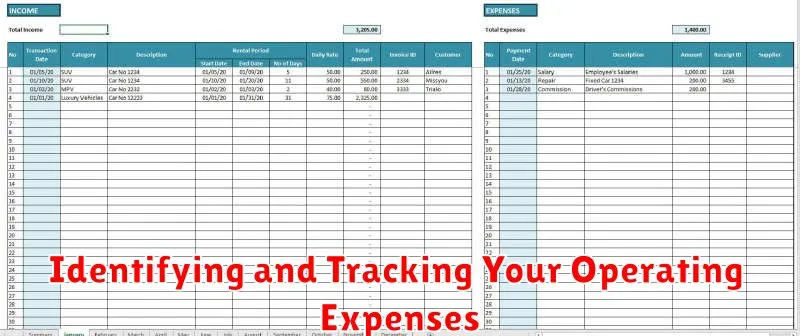

Identifying and Tracking Your Operating Expenses

Understanding your rental property’s operating expenses is crucial for accurate cash flow analysis and making informed investment decisions. Here’s a breakdown of the essential expenses to identify and track:

-

Property Taxes:

These are annual taxes levied by local governments based on the property’s assessed value. Ensure you budget for these payments, as they can vary significantly depending on the location.

-

Insurance:

You’ll need both property insurance (covering damage to the building) and liability insurance (protecting you against lawsuits from tenants or visitors). Make sure your coverage is adequate.

-

Mortgage Payments (if applicable):

If you have a mortgage on the property, include the principal and interest payments in your expenses. Keep track of any escrow accounts for property taxes and insurance as well.

-

Utilities:

Depending on your lease agreement, you may be responsible for paying some or all utilities, such as water, sewer, gas, and electricity. Factor in the average cost of these services for accurate budgeting.

-

Repairs and Maintenance:

Set aside a portion of your income for routine maintenance, repairs, and unexpected emergencies. This includes everything from plumbing problems to appliance replacements.

-

Management Fees (if applicable):

If you hire a property manager, include their fees in your expenses. These fees typically range from 8% to 12% of the monthly rent.

-

Vacancy Costs:

Estimate the potential for vacancies between tenants. You’ll need to account for lost rental income during these periods.

-

Advertising and Marketing:

If you’re responsible for finding tenants, factor in the costs of advertising your property and marketing it to potential renters.

-

Other Expenses:

Consider any other recurring expenses associated with your property, such as landscaping, snow removal, or HOA fees.

By meticulously tracking your operating expenses, you’ll have a clear picture of your actual costs and can make more informed decisions about pricing your rent, budgeting for future expenses, and maximizing your rental property’s profitability.

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) is a key metric used in real estate investment analysis, particularly for rental properties. It represents the property’s profitability before accounting for debt service, taxes, or other expenses related to the ownership of the property.

NOI is calculated by subtracting all operating expenses from the property’s total revenue. This includes rental income, as well as any other revenue streams like parking fees or laundry income. Operating expenses include property taxes, insurance, utilities, maintenance, and management fees.

Understanding NOI is essential for investors because it provides a clear picture of a property’s operating cash flow. It helps investors compare different properties, assess their potential returns, and determine their overall investment viability.

Here’s the formula for calculating NOI:

NOI = Total Revenue – Total Operating Expenses

For example, if a rental property generates $100,000 in annual rental income and has operating expenses of $40,000, the NOI would be $60,000.

Calculating Your Cash Flow Before and After Financing

Before you dive into a rental property investment, it’s crucial to understand the financial implications of both purchasing and owning the property. This includes assessing your cash flow, which is the difference between your income and expenses. To properly evaluate cash flow, you’ll need to analyze the situation both before and after financing.

Calculating Cash Flow Before Financing

This calculation helps you understand the property’s inherent profitability without considering the cost of financing. It involves subtracting estimated expenses from potential rental income.

Here’s a simplified breakdown:

- Potential Rental Income: Estimate the monthly rent you can charge based on market research and comparable properties.

- Expenses: Include property taxes, insurance, maintenance, utilities (if paid by the landlord), and any other recurring costs.

- Cash Flow Before Financing = Potential Rental Income – Expenses

Calculating Cash Flow After Financing

This calculation incorporates the cost of financing the property. It takes into account your monthly mortgage payment and its impact on your overall cash flow.

Here’s how to calculate it:

- Mortgage Payment: This includes principal and interest. Use an online mortgage calculator to get an accurate estimate.

- Cash Flow After Financing = Cash Flow Before Financing – Mortgage Payment

Key Considerations

Remember, these calculations are estimates, and actual cash flow may vary. Additionally, consider factors like vacancy periods and capital expenditures (major repairs) when making your calculations. It’s crucial to be realistic about potential expenses and income fluctuations.

Analyzing Key Cash Flow Metrics (Cap Rate, Cash-on-Cash Return)

Understanding how to analyze the cash flow of a rental property is critical for any investor. Two key metrics that are essential to evaluate are the capitalization rate (cap rate) and the cash-on-cash return.

The cap rate is a simple way to measure the potential return on an investment property. It represents the annual net operating income (NOI) as a percentage of the property’s purchase price. The formula is:

Cap Rate = Net Operating Income / Purchase Price

For example, if a property generates $50,000 in NOI annually and has a purchase price of $500,000, the cap rate would be 10%. A higher cap rate typically indicates a more profitable investment. It’s important to note that cap rate does not account for financing costs, such as mortgage payments.

The cash-on-cash return provides a more complete picture of your actual return by factoring in your down payment and financing costs. It is calculated as follows:

Cash-on-Cash Return = Annual Cash Flow / Total Cash Invested

Let’s say you put down $100,000 on the same $500,000 property, and your annual cash flow is $20,000 after accounting for mortgage payments and operating expenses. Your cash-on-cash return would be 20% ($20,000 / $100,000). The higher the cash-on-cash return, the greater your return on your invested capital.

By analyzing these two important metrics, you can gain a better understanding of the potential profitability of a rental property and make more informed investment decisions.

Factors Affecting Rental Property Cash Flow

Rental property cash flow is a crucial metric for investors, representing the profitability of a rental property. It’s the difference between the income generated from rent and the expenses associated with owning and operating the property. Understanding the factors influencing cash flow is paramount in making informed investment decisions. Let’s delve into the key factors that can impact the profitability of your rental property.

Rental Income: The amount of rent you can charge is the primary driver of your cash flow. Factors such as location, property size, amenities, and market conditions all contribute to the rental income potential. Competitive market analysis is essential to determine a fair market rent that attracts tenants while maximizing your profits.

Operating Expenses: These expenses are directly tied to the operation of your rental property and can significantly impact cash flow. Key operating expenses include:

- Property Taxes: Local property taxes can vary significantly and are a major expense for landlords.

- Insurance: Insurance premiums, covering liability and property damage, are crucial for protecting your investment.

- Utilities: Depending on your rental agreement, you may be responsible for utilities such as water, sewer, garbage, and electricity.

- Maintenance and Repairs: Unexpected repairs and regular maintenance can eat into your profits. Setting aside a reserve for these costs is crucial.

- Property Management Fees: If you hire a property manager, their fees will be a significant expense.

- Vacancy Costs: Periods when the property is vacant can result in lost rental income. Understanding your local vacancy rates and implementing strategies to minimize vacancies is essential.

Financing Costs: If you’ve financed your rental property, mortgage payments, including principal and interest, will be a significant expense. Interest rates and loan terms can impact your cash flow.

Capital Expenses: These are large, infrequent expenses associated with significant upgrades or improvements to the property, such as roof replacement or major renovations. While these expenses are not regular, they can significantly affect your cash flow if not planned for.

Market Conditions: The economic climate and local real estate market play a crucial role in rental property cash flow. Factors such as employment rates, population growth, and rental demand all influence the market’s ability to support stable rental income.

Strategies for Increasing Rental Income

Once you’ve mastered the art of calculating rental property cash flow, the next step is to find ways to increase that income. There are a number of strategies you can employ to boost your rental income, and we’ll explore some of the most effective ones below.

1. Raise Rent Regularly: This is perhaps the most obvious way to increase rental income. However, ensure that rent increases are reasonable and in line with market rates. Consider using a professional property management company to help you determine appropriate rent amounts.

2. Offer Value-Added Amenities: Amenities can attract higher-quality tenants who are willing to pay more. These can include things like in-unit laundry, upgraded appliances, or access to a fitness center or community space.

3. Reduce Operating Expenses: Even small savings in operating expenses can significantly impact your bottom line. Explore cost-cutting measures like negotiating better rates with utilities or using energy-efficient appliances. Regular maintenance can also help prevent costly repairs in the future.

4. Short-Term Rentals: Consider utilizing platforms like Airbnb or VRBO for short-term rentals, especially if your property is located in a popular tourist destination. This can generate higher rental income, but remember to factor in additional costs like cleaning fees and increased wear and tear.

5. Offer Tenant Incentives: Attracting and retaining good tenants can be valuable. Incentives like a month of free rent for signing a long-term lease or offering a rent discount for timely rent payments can be appealing to potential tenants.

6. Upgrade Your Property: Significant renovations, like adding a bathroom or expanding living space, can increase your rental income substantially. However, it’s crucial to ensure the upgrades are in line with market demand and add real value to the property.

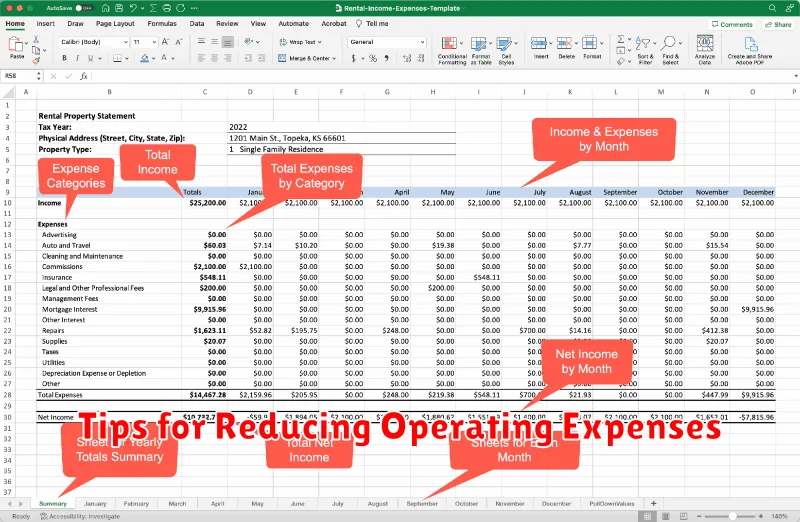

Tips for Reducing Operating Expenses

Operating expenses are the costs associated with maintaining and running a rental property. While you can’t eliminate all of these expenses, there are definitely ways to keep them in check. Here are a few tips for reducing operating expenses:

Negotiate with vendors: Don’t be afraid to negotiate with vendors like landscapers, plumbers, and electricians. Get multiple quotes and ask for discounts for paying upfront. Be sure to research the market to find the best rates and service.

Choose energy-efficient appliances: Energy-efficient appliances, such as refrigerators and water heaters, can save you money on your utility bills in the long run. Look for appliances with the Energy Star label to ensure they meet energy-efficiency standards.

Promote tenant retention: Keeping your current tenants happy and satisfied can save you money on marketing and vacancy costs. Offer rent incentives, maintain the property well, and be responsive to tenant requests.

Be aware of tax deductions: Take advantage of tax deductions for expenses related to your rental property. This can help offset your operating expenses and improve your cash flow.

Automate tasks: Utilize online tools and software to automate tasks like rent collection, tenant screening, and accounting. This can save you time and reduce the risk of errors.

Use technology wisely: Investing in smart home technology like programmable thermostats and security systems can increase your property’s value and reduce your operating expenses.

Shop around for insurance: Regularly compare insurance quotes from different providers to ensure you’re getting the best rate for your coverage.

By implementing these tips, you can reduce your operating expenses and improve your rental property’s cash flow.

The Impact of Vacancy Rates on Cash Flow

Vacancy rates are a crucial factor in determining the profitability of a rental property. Vacancy rate refers to the percentage of time a rental unit remains unoccupied. A high vacancy rate directly impacts cash flow by reducing rental income. Even a short period of vacancy can significantly affect your overall financial performance.

For example, let’s say you have a rental property that generates $1,000 per month in rent. If the vacancy rate is 5%, you will lose $50 in rental income each month. Over a year, this equates to a loss of $600. This loss in rental income can have a significant impact on your overall cash flow and profitability.

There are several factors that can contribute to higher vacancy rates. These include:

- Location: Properties in less desirable areas may experience higher vacancy rates due to lower demand.

- Property Condition: Poorly maintained or outdated properties can be harder to rent.

- Rental Rates: Pricing your rental unit too high can make it less competitive and lead to longer vacancy periods.

- Seasonality: Certain areas experience seasonal fluctuations in demand, which can lead to higher vacancy rates during specific months.

- Competition: Increased competition from other rental properties in the area can also drive up vacancy rates.

To mitigate the impact of vacancy rates on cash flow, landlords can implement strategies such as:

- Effective Marketing: Utilizing online platforms and other marketing channels to reach a wider audience and attract potential tenants.

- Fast Tenant Screening: Processing applications quickly and efficiently to minimize vacancy periods.

- Competitive Pricing: Conducting thorough market research to determine the optimal rental rate.

- Property Maintenance: Keeping the property in excellent condition to attract and retain tenants.

- Building a Strong Tenant Relationship: Providing excellent customer service and addressing tenant concerns promptly can help reduce tenant turnover.

By proactively addressing these factors and implementing effective strategies, landlords can minimize vacancy rates and protect their rental property cash flow.

Using Technology for Cash Flow Analysis and Management

Gone are the days of spreadsheets and calculators when it comes to rental property cash flow analysis. Today, investors have access to a plethora of technology solutions that streamline the process, making it more efficient and insightful.

These tools range from property management software that automate rent collection, track expenses, and generate reports, to online calculators and financial modeling tools that allow for detailed analysis of different investment scenarios. By leveraging these technologies, investors can gain a deeper understanding of their cash flow, identify potential areas for improvement, and make more informed decisions.

One of the most significant benefits of using technology is the ability to automate repetitive tasks. For example, property management software can automatically send out invoices, track payments, and generate financial reports. This frees up time for investors to focus on other aspects of their business, such as marketing, tenant relations, or acquiring new properties.

Furthermore, technology provides access to real-time data, allowing investors to monitor their cash flow in real-time and make adjustments as needed. This real-time visibility helps to identify potential issues before they escalate, allowing for proactive management and maximizing profitability.

In conclusion, using technology for cash flow analysis and management is essential for any rental property investor looking to optimize their returns and streamline their operations. By embracing these tools, investors can unlock a world of efficiency, accuracy, and insights that ultimately lead to better decision-making and increased financial success.

Importance of Regular Cash Flow Projections

Regular cash flow projections are crucial for rental property investors. They provide a roadmap for your financial future, allowing you to understand the potential profitability of your investment and identify potential financial challenges. By creating regular cash flow projections, you gain a comprehensive view of your income and expenses, helping you make informed decisions regarding your investment.

Accurate Projections: Cash flow projections provide a clear picture of your expected income and expenses. By analyzing historical data and considering market trends, you can create realistic projections that guide your financial planning. This helps you avoid surprises and ensures you have a strong financial foundation for your rental property.

Financial Planning and Decision Making: Cash flow projections are essential for making informed investment decisions. They help you determine the feasibility of purchasing a specific property, evaluate financing options, and make strategic decisions about rental rates, maintenance costs, and other key factors that influence your cash flow.

Identifying Potential Challenges: By examining your cash flow projections, you can anticipate potential challenges such as seasonal fluctuations in rental income, rising operating expenses, or unexpected repairs. This allows you to proactively plan for these events and mitigate their impact on your financial stability.

Tracking Your Progress: Regular cash flow projections allow you to track your financial progress over time and measure your investment’s performance. By comparing actual cash flow against your projections, you can identify areas for improvement and make adjustments to your investment strategy to optimize your returns.

Common Mistakes to Avoid in Cash Flow Analysis

Cash flow analysis is crucial for successful rental property investing. However, many investors make common mistakes that can lead to inaccurate projections and poor decision-making. By avoiding these pitfalls, you can ensure a more accurate and reliable assessment of your potential rental property’s profitability. Here are some common mistakes to watch out for:

1. Overestimating Rental Income: One common mistake is overestimating potential rental income. It’s essential to research realistic rental rates for comparable properties in the area and factor in vacancy periods. Don’t assume you’ll always have tenants or that you can charge top dollar.

2. Underestimating Expenses: Expenses are just as important as income in cash flow analysis. Many investors underestimate costs like maintenance, repairs, property taxes, insurance, and management fees. Be sure to factor in these costs, including potential for unexpected repairs, to get a realistic picture of your expenses.

3. Ignoring Vacancy Rates: Vacancy periods are inevitable in rental property ownership. It’s crucial to account for vacancy rates when calculating cash flow. A conservative vacancy rate of 5% to 10% is often recommended, but research local market conditions to determine an appropriate rate.

4. Neglecting Capital Expenditures: Capital expenditures (CapEx) are major expenses for replacing or upgrading major systems or components of a property. Don’t forget to include a line item for CapEx in your cash flow analysis. It’s essential to plan for future expenses, such as roof replacements or HVAC upgrades, to ensure the property’s longevity and profitability.

5. Failing to Account for Interest Rates: Interest rates can significantly impact your cash flow. Don’t forget to consider the interest on your mortgage and other debt when calculating your net operating income (NOI). A rise in interest rates can affect your profitability and ability to make payments.

6. Ignoring the Time Value of Money: Money has a time value. Your cash flow analysis should reflect this principle. Be sure to consider the future value of your investments and the potential impact of inflation on your returns.

By avoiding these common mistakes, you can improve the accuracy and reliability of your cash flow analysis and make informed investment decisions. Remember, a thorough and realistic cash flow analysis is essential for maximizing your rental property’s profitability and achieving your financial goals.

Expert Insights for Optimizing Your Rental Property’s Cash Flow

Rental property cash flow is the lifeblood of your investment. It’s the difference between your rental income and your expenses, and it determines how much money you’re actually making. To maximize your profits, it’s crucial to understand the intricacies of cash flow and implement strategies to optimize it. Here are some expert insights to help you:

1. Precisely Calculate Your Expenses: Begin by meticulously calculating all your rental property expenses. This includes mortgage payments, property taxes, insurance, maintenance, utilities, and management fees. Many investors underestimate the true cost of ownership, leading to inaccurate cash flow projections. A detailed expense breakdown will provide a clearer picture of your financial obligations.

2. Optimize Rental Income: Maximize your rental income by strategically setting rent prices. Conduct thorough market research to determine the optimal rental rate for your property type and location. Consider offering incentives for longer leases, attracting reliable tenants who are more likely to pay rent on time.

3. Implement Effective Management: A well-managed rental property is more likely to generate consistent cash flow. Hiring a professional property manager can significantly reduce your workload, save you time and money, and ensure timely rent collection and maintenance. Implementing an effective tenant screening process can minimize vacancy periods and tenant-related issues, further optimizing your cash flow.

4. Prioritize Preventative Maintenance: Regular maintenance is key to preserving your property’s value and minimizing costly repairs. By addressing minor issues promptly, you can prevent them from escalating into major problems that can disrupt your rental income. Building a strong relationship with reliable contractors can streamline the maintenance process and keep your property in top condition.

5. Explore Tax Advantages: Utilize tax deductions to your advantage. Deduct mortgage interest, property taxes, insurance, depreciation, and repairs to reduce your tax liability and increase your net income. Consult with a tax professional to ensure you’re taking full advantage of all available deductions.

By following these expert insights, you can gain a deeper understanding of rental property cash flow and implement strategies to optimize it. Remember, maximizing cash flow is an ongoing process. Stay informed about market trends, analyze your expenses, and make informed decisions to ensure a steady stream of income from your rental property investment.