Imagine coming home to find your beloved home submerged in water. It’s a nightmare scenario that no homeowner wants to face, but sadly, floods are a growing threat across the globe. The devastating impacts of floods can leave you with significant financial burdens, forcing you to rebuild your life from scratch. This is where flood insurance comes in, acting as a crucial safety net to protect your haven and provide financial stability in the face of disaster.

While floods are often associated with coastal areas, they can occur anywhere, even in regions with low rainfall. Flooding can be triggered by heavy rain, overflowing rivers, storm surge, and even broken water pipes. This comprehensive guide will equip you with the knowledge you need to understand flood insurance, its benefits, and how to obtain the right coverage to safeguard your home and belongings from the financial consequences of flooding. By understanding the nuances of flood insurance, you can gain peace of mind and navigate the uncertainties of nature’s wrath with confidence.

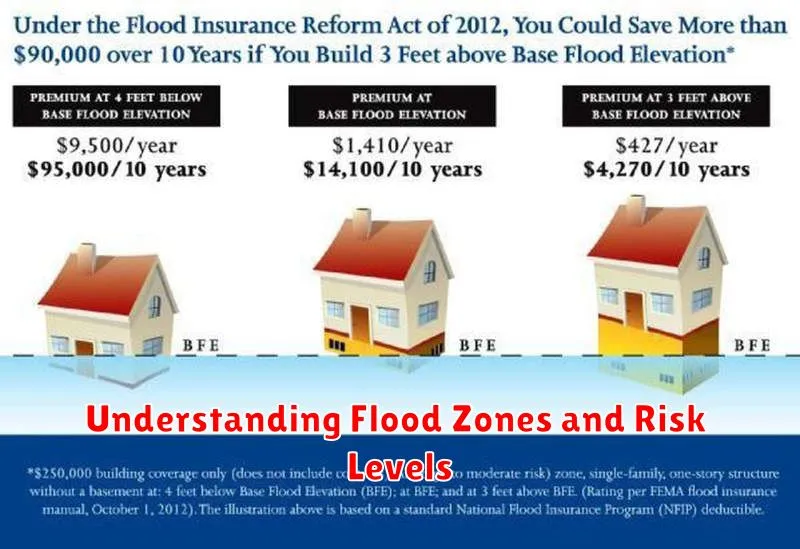

Understanding Flood Zones and Risk Levels

Understanding the risk of flooding in your area is a crucial step in protecting your home and ensuring your safety. The Federal Emergency Management Agency (FEMA) has created a comprehensive system to delineate flood zones and risk levels, offering homeowners valuable insight into their potential vulnerability.

Flood Zones, often categorized using letters like “A” and “V,” represent areas deemed at high risk of flooding. High-risk zones (like “A” zones) are generally considered to have a 1% chance of flooding in any given year. Moderate-risk zones, often labeled as “B” or “X,” are generally less prone to flooding but still face some risk. These zones may be further subdivided into different risk levels, such as “B” zones with a higher likelihood of flooding compared to “X” zones.

The Flood Insurance Rate Map (FIRM), available on FEMA’s website, provides detailed information on flood zones and risk levels. This map is a valuable tool for homeowners, as it helps them understand the potential flood hazard in their area. It’s essential to check the FIRM for your property’s specific flood zone designation. This knowledge will inform your decision-making regarding flood insurance and mitigation strategies.

Beyond these zones, flood risk levels are often assigned based on factors like elevation, proximity to water bodies, and past flood history. Some areas, although not classified as high-risk zones, might still be susceptible to flooding due to localized factors or changes in climate patterns. It’s crucial to be aware of all possible risks, even if your property doesn’t fall into a high-risk category.

Types of Flood Insurance Coverage

Flood insurance is crucial for homeowners, as it provides financial protection against the devastating impacts of flooding. The National Flood Insurance Program (NFIP), administered by FEMA, offers two main types of coverage:

Building Coverage: This type of coverage protects your home’s structure, including the foundation, walls, floors, and roof, against flood damage. It also covers attached structures like garages, porches, and decks. The maximum coverage available for buildings is $250,000.

Contents Coverage: This coverage protects your personal belongings, such as furniture, appliances, clothing, and electronics, from flood damage. The maximum coverage available for contents is $100,000. This coverage is separate from your homeowner’s insurance and can be purchased in addition to building coverage.

Beyond the NFIP, private flood insurance options are also available. These policies can offer higher coverage limits and potentially broader coverage, but they are generally more expensive.

National Flood Insurance Program (NFIP) vs. Private Flood Insurance

Choosing the right flood insurance is crucial for safeguarding your home from the devastating impacts of floods. Two primary options exist: the National Flood Insurance Program (NFIP) and private flood insurance. Understanding the key differences between these programs can help you make an informed decision tailored to your specific needs.

The NFIP, a federal program, provides flood insurance to homeowners in designated flood-prone areas. It offers standardized coverage limits and rates based on flood risk, offering a cost-effective option. However, the NFIP is known for its limitations, including restrictive coverage, potential waiting periods, and occasional backlogs in claim processing. Additionally, the NFIP has faced financial challenges in recent years, potentially impacting its long-term sustainability.

Private flood insurance, offered by various insurance companies, provides an alternative to the NFIP. Private insurers often offer more flexible coverage options, potentially including higher limits and additional protections beyond standard NFIP coverage. They may also have quicker claim processing times and more competitive rates in some regions. Nevertheless, private flood insurance premiums can be higher than NFIP premiums, and availability may be limited in certain areas.

When deciding between NFIP and private flood insurance, consider factors such as your home’s location, flood risk, desired coverage limits, and budget. If you live in a high-risk area, have a valuable home, or desire comprehensive coverage, private insurance may be worth exploring. However, if you’re on a tight budget and reside in a moderate-risk area, the NFIP might be a more suitable option. Consulting with an insurance agent can help you evaluate your options and determine the best flood insurance solution for your specific needs.

Factors Affecting Flood Insurance Premiums

Flood insurance premiums are determined by a variety of factors, including the location of your home, the flood risk in your area, and the elevation of your home. Your individual insurance policy will be based on a number of factors, all of which contribute to the overall risk of your home flooding. The factors can be grouped into two primary categories: property factors and community factors.

Property factors are related to your individual home, and include:

- Location: The location of your home is a key factor in determining your flood risk. Homes located in floodplains or near bodies of water are at a higher risk of flooding.

- Elevation: The elevation of your home is also an important factor. Homes that are built on higher ground are less likely to flood.

- Construction type: The type of construction of your home can also affect your flood risk. Homes that are built with flood-resistant materials are less likely to be damaged by flooding.

- Value of your home: The value of your home will affect how much insurance you are required to purchase.

Community factors are based on the area where your home is located, and include:

- Flood history: The history of flooding in your area is one of the most important factors that will determine your premiums. If your area has a history of frequent or severe flooding, your premiums will be higher.

- Flood mitigation efforts: If your community has implemented flood mitigation efforts, such as levees or floodwalls, your premiums may be lower.

- Flood zone: The flood zone that your home is located in is another key factor in determining your premium. Homes located in high-risk flood zones will have higher premiums than homes located in low-risk flood zones.

It’s important to note that flood insurance premiums can vary significantly from one homeowner to the next, even within the same community. It’s always a good idea to get quotes from multiple insurers to compare premiums and find the best coverage for your needs. By understanding the factors that affect flood insurance premiums, you can make informed decisions about your insurance coverage and protect your home from the financial devastation of a flood.

Filing a Flood Insurance Claim

If your home has been affected by flooding, filing a flood insurance claim is crucial to securing the financial support you need to recover. The process can seem daunting, but following these steps can make it more manageable:

1. Contact Your Insurance Company

Immediately contact your insurance company to report the flood damage. Provide them with the necessary details, including the date and time of the flood, the extent of the damage, and any other relevant information. This will initiate the claims process.

2. Document the Damage

Take detailed photos and videos of the flood damage to your home and belongings. Document everything, from water levels to damaged furniture, appliances, and structural elements. This documentation will be crucial when supporting your claim.

3. Keep Receipts

Save all receipts for any expenses related to flood damage, including temporary housing, repairs, and replacement costs. This documentation will be essential for reimbursement. You should also retain receipts from your previous homeowner’s insurance policy.

4. Understand Your Policy

Review your flood insurance policy thoroughly to understand your coverage limits, deductibles, and any specific requirements for filing a claim. Knowing your policy details will help you navigate the process efficiently.

5. Prepare for the Insurance Adjuster

When the insurance adjuster arrives, be prepared to provide them with all relevant information, including your policy details, documentation of the damage, and any receipts. Cooperate with the adjuster and answer all their questions truthfully and thoroughly.

6. Stay Informed

Follow up with your insurance company regularly to check on the status of your claim. Stay informed about any deadlines or required documents. Prompt communication is key to a smooth and timely claims process.

7. Negotiate Settlement

If you disagree with the initial settlement offer, be prepared to negotiate. Be assertive and provide supporting documentation to justify your requested amount. You can also consult with an insurance attorney if needed.

Filing a flood insurance claim can be stressful, but by taking these steps, you can increase your chances of a successful outcome. Remember to document everything, understand your policy, and communicate effectively with your insurance company. This will help you navigate the process and receive the financial support you need to recover from the flood.

Flood Insurance Requirements for Mortgages

Navigating the world of mortgages can be complex, and understanding flood insurance requirements is crucial for protecting your investment. The National Flood Insurance Program (NFIP) mandates flood insurance for properties located in designated flood zones. When you apply for a mortgage on a property situated in a flood zone, your lender will likely require you to secure flood insurance as a condition of the loan.

If your property falls within a flood zone, your mortgage lender will typically require you to obtain a flood insurance policy. This policy helps cover losses associated with floods, such as damage to the structure, contents, and other eligible expenses. The specific requirements will vary based on the lender’s policies, the property’s location, and the type of mortgage.

It’s important to be aware of the flood insurance requirements associated with your mortgage. Your lender will provide you with detailed information and guidance on the necessary coverage. If you’re unsure about your property’s flood zone status, your lender or local floodplain administrator can assist you. Understanding these requirements helps you avoid potential financial risks and ensures your mortgage loan is protected in the event of a flood.

Tips for Reducing Flood Risks and Premiums

Flooding is a significant concern for homeowners, and minimizing your risk can lead to lower insurance premiums. Here are some practical tips to reduce your flood vulnerability and potentially save money on your insurance:

Elevate your home: Raising your home above the anticipated flood level can significantly reduce flood damage. Consult with a professional to determine the appropriate elevation for your area.

Install flood vents: These vents allow floodwater to enter your crawlspace or basement, reducing hydrostatic pressure and potential structural damage.

Waterproof your basement: Applying waterproof coatings and sealing cracks can prevent water from seeping in and causing damage.

Install a sump pump: A sump pump can help remove excess water from your basement, preventing flooding during heavy rainfall.

Landscaping for flood mitigation: Planting trees and shrubs that absorb excess water can help reduce runoff and flooding around your home.

Clean gutters and downspouts regularly: Ensuring that your gutters and downspouts are clear of debris prevents water buildup and potential flooding.

Learn about your flood risk: Understanding your property’s flood risk is crucial. Check FEMA flood maps and consider consulting with a professional to assess your individual risk.

By taking proactive measures to mitigate flood risks, you can significantly reduce your insurance premiums and protect your home from potential damage.

Importance of Flood Insurance for Home Equity

Flood insurance is not just about protecting your physical belongings; it’s a crucial safeguard for your home equity. Home equity is the difference between your home’s market value and the outstanding balance on your mortgage. In the event of a flood, the damage can significantly decrease your home’s value, impacting your equity. Without flood insurance, you could be left with significant financial burden to rebuild or repair your home, potentially eroding your equity and jeopardizing your financial security.

Flood insurance can protect your home equity in several ways:

- Financial Relief: Flood insurance provides financial assistance to cover repair or rebuild costs, minimizing the financial impact of a flood and preserving your home equity.

- Avoiding Debt: Without flood insurance, you may need to take on additional debt to cover repair or rebuild costs, potentially putting your financial future at risk and impacting your equity.

- Maintaining Value: Flood insurance helps ensure your home’s value doesn’t decline drastically after a flood, protecting your equity and allowing you to sell your home at a fair price if you choose to.

In essence, flood insurance acts as a financial safety net, protecting your hard-earned home equity and providing peace of mind knowing your investment is protected. By securing flood insurance, you can confidently navigate the uncertainties of floods while safeguarding your financial well-being and the value of your home.

Myths and Misconceptions About Flood Insurance

Flood insurance is a crucial part of protecting your home, but there are many myths and misconceptions surrounding it that can deter homeowners from getting the coverage they need. Let’s debunk some common ones:

Myth 1: Flood insurance is only for people living near water.

Reality: While homes in coastal areas are at higher risk, floods can occur anywhere, even in areas considered “high ground.” Flash floods, heavy rains, and overflowing rivers can all lead to flooding, regardless of proximity to large bodies of water.

Myth 2: My homeowner’s insurance covers flood damage.

Reality: Standard homeowner’s insurance policies do not cover flood damage. You need a separate flood insurance policy for this type of protection.

Myth 3: I can’t afford flood insurance.

Reality: The cost of flood insurance can vary based on your home’s location and risk factors, but it’s often more affordable than you think. Plus, the financial burden of rebuilding a flood-damaged home can be devastating.

Myth 4: I don’t need flood insurance because I’m in a low-risk area.

Reality: Even areas deemed “low-risk” can experience flooding. It’s crucial to consider your individual risk factors and consult with an insurance agent to determine if flood insurance is right for you.

Myth 5: I’m waiting for a flood to happen before I buy insurance.

Reality: Flood insurance has a 30-day waiting period before coverage begins, so waiting until after a flood occurs is too late.

Understanding the truth behind these myths can help you make informed decisions about protecting your home from the devastating effects of floods. Remember, it’s always better to be safe than sorry.

Finding Affordable and Comprehensive Coverage

Navigating the world of flood insurance can feel overwhelming, especially when seeking affordable and comprehensive coverage. But don’t worry, understanding your options and making informed choices is key.

First, consider the National Flood Insurance Program (NFIP). It offers standardized coverage, making it a reliable option for many homeowners. While it may not be the cheapest, it provides a solid foundation.

Second, explore private flood insurance. These policies can offer unique benefits, such as higher coverage limits and potential cost savings. But remember to compare carefully.

Third, look into community-based flood mitigation programs. These initiatives can help reduce your risk and, in turn, lower your insurance premiums. They might offer things like discounts or financial assistance for floodproofing measures.

Finally, don’t hesitate to seek professional guidance. Consult with an insurance broker or agent to receive tailored recommendations and ensure you choose a plan that suits your specific needs and budget. Remember, a little research and careful planning can go a long way in finding the best flood insurance solution for your home.