Choosing the right mortgage is a crucial decision that significantly impacts your financial future. Two popular options are fixed-rate mortgages and adjustable-rate mortgages (ARMs). While both offer advantages, understanding their key differences and how they align with your individual financial goals is essential. This article will delve into the intricacies of fixed and adjustable mortgages, comparing their features, risks, and potential benefits to help you make an informed decision.

For many homeowners, predictability and stability are paramount when it comes to their mortgage payments. A fixed-rate mortgage provides this peace of mind by locking in your interest rate for the entire loan term, shielding you from potential future interest rate fluctuations. On the other hand, adjustable-rate mortgages offer a lower initial interest rate that can save you money in the short term, but they come with the risk of higher payments down the line as the rate adjusts. By understanding the pros and cons of each type, you can determine which option aligns with your financial situation and long-term objectives.

Understanding Mortgage Basics and Interest Rates

A mortgage is a loan you take out to purchase a home. The lender (usually a bank or mortgage company) provides you with the funds to buy the property, and you agree to repay the loan over a set period of time, typically 15 or 30 years.

The interest rate is the cost of borrowing money. It is expressed as a percentage of the loan amount and is typically calculated monthly. The higher the interest rate, the more you will pay in interest over the life of the loan.

Fixed-rate mortgages have an interest rate that stays the same for the entire loan term. This means your monthly payments will remain consistent for the duration of the loan. Adjustable-rate mortgages (ARMs) have an interest rate that can change periodically based on market conditions. This can result in lower monthly payments initially but higher payments later on if interest rates rise.

Understanding these fundamental concepts is essential when deciding between a fixed-rate and an adjustable-rate mortgage. It allows you to choose the option that best aligns with your individual financial goals and risk tolerance.

Fixed-Rate Mortgages: Predictability and Stability

For homeowners seeking financial predictability and stability, fixed-rate mortgages offer a comforting certainty. With a fixed-rate mortgage, your interest rate remains constant throughout the loan term, regardless of fluctuations in the broader market. This fixed interest rate translates into consistent monthly payments, allowing you to budget accurately and avoid surprises. Knowing exactly how much you’ll be paying each month instills a sense of control and peace of mind, especially during times of economic uncertainty.

Beyond predictable payments, fixed-rate mortgages provide financial stability. Since your interest rate stays the same, you’re shielded from the risk of rising interest rates that could significantly increase your monthly payments. This stability allows you to focus on other financial goals without worrying about unexpected housing costs. Whether you’re saving for retirement, your children’s education, or a future home improvement project, a fixed-rate mortgage provides a solid foundation for your financial planning.

Adjustable-Rate Mortgages (ARMs): Flexibility and Potential Savings

Adjustable-rate mortgages (ARMs) offer a different approach to home financing compared to fixed-rate mortgages. Instead of locking in a specific interest rate for the entire loan term, ARMs feature an initial fixed-rate period, typically ranging from 5 to 10 years. After this period, the interest rate adjusts periodically, usually every year or six months, based on a predetermined index like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR).

The flexibility of ARMs can be appealing to borrowers who anticipate changes in interest rates or plan to sell their home before the fixed-rate period ends. If interest rates decline, you’ll benefit from lower monthly payments. However, if rates rise, your payments could increase, potentially putting a strain on your budget.

ARMs often come with a lower initial interest rate compared to fixed-rate mortgages, making them attractive to borrowers looking for immediate affordability. This lower rate can translate to potential savings during the fixed-rate period. Additionally, some ARMs include interest rate caps that limit how much the rate can increase in a single adjustment period or over the life of the loan.

However, the potential for higher interest rates later on is a significant risk factor to consider. You should thoroughly analyze your financial situation, your anticipated future income, and your homeownership timeline before deciding if an ARM aligns with your goals.

How ARM Interest Rates are Determined

Adjustable-rate mortgages (ARMs) feature interest rates that change periodically over the life of the loan, based on a specific index. This index is usually tied to a benchmark like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). Understanding how these rates are determined is crucial when considering an ARM, as it directly affects your monthly payments.

Here’s a breakdown of the factors influencing ARM interest rates:

- Index: As mentioned, the index acts as the base for your ARM’s interest rate. It reflects the general cost of borrowing in the financial markets, providing a dynamic benchmark.

- Margin: This is a fixed percentage added to the index. It represents the lender’s profit margin and remains constant throughout the loan term.

- Initial Interest Rate: The starting rate for an ARM is typically lower than fixed-rate mortgages. It’s determined by combining the index, margin, and any introductory rate adjustments offered by the lender.

- Adjustment Frequency: This specifies how often the ARM’s interest rate can change, typically annually or every six months. It’s important to note that adjustments aren’t guaranteed to be upward or downward; they’re based on market fluctuations.

- Interest Rate Caps: These limits how much the interest rate can increase or decrease during an adjustment period, providing some protection against drastic fluctuations. Lenders often impose caps on both the overall rate increase and the amount of change per adjustment period.

When considering an ARM, it’s essential to carefully analyze these factors. The combination of index, margin, initial interest rate, and adjustment frequency, along with the interest rate caps, will ultimately determine your loan’s overall cost. It’s prudent to seek professional financial advice and understand your financial goals before making a decision about whether an ARM is right for you.

Caps and Adjustments on Adjustable Rates

Adjustable-rate mortgages (ARMs) are known for their initial lower interest rates, which can be appealing to borrowers. However, understanding the potential for interest rate adjustments is crucial before committing to an ARM. Caps and adjustment periods play a significant role in how your interest rate and monthly payments can change over the life of the loan.

Caps act as limits on how much your interest rate can fluctuate. There are two main types of caps:

- Periodic caps limit how much your interest rate can change each time it adjusts.

- Lifetime caps limit the total amount your interest rate can rise over the entire loan term.

The adjustment period determines how frequently your interest rate can be adjusted. Common adjustment periods are one year, five years, or even longer. Each time the interest rate is adjusted, it will typically be tied to a benchmark index, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR).

It’s essential to carefully analyze the caps and adjustment periods of an ARM before making a decision. If interest rates are expected to rise significantly, the potential for high adjustments could make an ARM less favorable than a fixed-rate mortgage. However, if you anticipate keeping your home for a shorter period or believe interest rates will remain low, an ARM might be a suitable option.

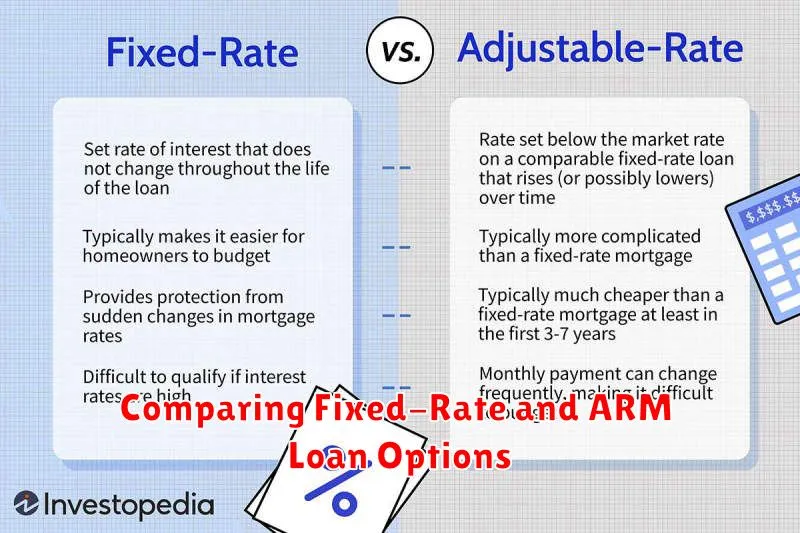

Comparing Fixed-Rate and ARM Loan Options

Choosing between a fixed-rate and an adjustable-rate mortgage (ARM) is a critical decision when buying a home. Understanding the key differences between these loan options is essential to determine which one best aligns with your financial goals and risk tolerance.

Fixed-rate mortgages offer predictable monthly payments for the entire loan term, typically 15 or 30 years. This stability is appealing to many homeowners as it allows them to budget effectively and avoid surprises in their housing costs. However, fixed-rate mortgages generally come with higher initial interest rates compared to ARMs.

Adjustable-rate mortgages, on the other hand, have interest rates that fluctuate over the life of the loan, typically tied to an index like the London Interbank Offered Rate (LIBOR). This means your monthly payments could increase or decrease based on changes in the index. While ARMs often start with lower interest rates than fixed-rate mortgages, they present more uncertainty in terms of long-term costs.

Here’s a breakdown of key factors to consider when choosing between fixed-rate and ARM loans:

- Your financial outlook: If you anticipate your income potentially increasing in the future, an ARM might be a good option as you could benefit from lower initial payments. However, if you prefer predictable monthly payments and stability, a fixed-rate mortgage is the safer choice.

- Your risk tolerance: ARMs carry higher risk due to fluctuating interest rates. If you are risk-averse, a fixed-rate mortgage is recommended. However, if you’re comfortable with some potential uncertainty, an ARM could provide initial savings.

- Your loan term: The length of your mortgage term can significantly impact the overall cost. Fixed-rate mortgages are typically offered for 15 or 30 years, while ARMs often have shorter initial fixed-rate periods before the interest rate becomes adjustable.

- Current interest rate environment: If interest rates are expected to rise in the future, a fixed-rate mortgage might be more advantageous. However, if rates are anticipated to remain low or potentially decrease, an ARM could be a better option.

Ultimately, the best choice between a fixed-rate and an ARM depends on your individual circumstances and financial goals. It’s essential to consult with a mortgage lender and carefully evaluate all the available options before making a decision.

Factors to Consider When Choosing a Mortgage Type

Navigating the world of mortgages can be overwhelming, especially when faced with the decision between a fixed-rate and an adjustable-rate mortgage (ARM). While both options offer distinct advantages, the choice ultimately boils down to your individual financial goals and risk tolerance. To make an informed decision, it’s crucial to consider the following factors:

1. Your Financial Goals:

- Long-term Stability: If you prioritize predictable monthly payments and a fixed interest rate for the life of the loan, a fixed-rate mortgage might be more suitable. You’ll know exactly how much you’ll be paying each month, providing peace of mind and allowing you to budget effectively.

- Lower Initial Payments: ARMs often offer lower initial interest rates compared to fixed-rate mortgages. This can be appealing if you’re looking to reduce your monthly payments in the early years of your mortgage.

- Potential for Lower Overall Costs: If you anticipate staying in your home for a shorter period or believe interest rates will decline in the future, an ARM could potentially save you money on interest over the life of the loan. However, it’s crucial to consider the risk of higher interest rates in the future.

2. Interest Rate Volatility:

- Market Fluctuations: ARMs are tied to a benchmark interest rate, which can fluctuate over time. While this could lead to lower initial payments, it also carries the risk of higher payments if interest rates rise. If you’re concerned about unpredictable interest rate swings, a fixed-rate mortgage might provide greater certainty.

- Interest Rate Caps: ARMs typically have caps on how much the interest rate can adjust each period and over the life of the loan. Understanding these caps is vital to assessing potential risks and benefits.

3. Your Time Horizon:

- Long-Term Residence: If you plan to stay in your home for an extended period, a fixed-rate mortgage may be a more conservative choice, offering stability and predictability. It protects you from potential interest rate increases that could significantly impact your monthly payments.

- Short-Term Residence: For those anticipating moving within a few years, an ARM could be a viable option, potentially offering lower initial payments. However, it’s crucial to factor in the possibility of interest rate adjustments and any associated costs if you decide to refinance or sell your home before the introductory period ends.

4. Your Risk Tolerance:

- Risk-Averse: If you prefer predictable payments and want to avoid potential surprises from rising interest rates, a fixed-rate mortgage might be a more comfortable option. It offers stability and helps you budget effectively for the long term.

- Risk-Tolerant: If you’re willing to accept potential fluctuations in your monthly payments for the possibility of lower overall interest costs, an ARM could be a suitable choice. However, it’s essential to understand the potential risks involved and carefully consider your financial situation.

By considering these factors and consulting with a financial advisor, you can choose the mortgage type that best aligns with your financial goals and risk tolerance, ensuring a smooth and successful homeownership journey.

Market Conditions and Interest Rate Trends

The decision between a fixed-rate mortgage and an adjustable-rate mortgage hinges heavily on prevailing market conditions and the trajectory of interest rates. In a period of rising interest rates, as we’ve seen in recent years, a fixed-rate mortgage can offer significant peace of mind. Locking in a specific rate protects you from potential future increases, allowing you to budget confidently over the long term.

However, if interest rates are expected to fall, an adjustable-rate mortgage (ARM) may present a more advantageous option. Initially, ARMs typically offer lower interest rates than fixed-rate mortgages, resulting in lower monthly payments. If rates decline, your payment may stay low or even decrease with subsequent adjustments.

However, ARMs come with inherent risks. If interest rates rise, your monthly payments could increase significantly, making it harder to manage your budget. Furthermore, interest rate caps on ARMs limit how much the rate can increase in a given adjustment period, but they do not guarantee that your payments will remain affordable.

Your Financial Situation and Risk Tolerance

Before diving into the specifics of fixed versus adjustable-rate mortgages (ARMs), it’s crucial to assess your financial situation and risk tolerance. This foundation will guide you towards a mortgage that aligns with your goals and financial capacity.

Financial Situation: This encompasses your income, debt, savings, and overall financial stability.

- Income: A steady income stream provides predictable cash flow to manage mortgage payments.

- Debt: Existing debt commitments, such as credit card or student loan balances, can impact your borrowing power.

- Savings: A healthy emergency fund and down payment reserves offer a safety net and demonstrate financial preparedness.

Risk Tolerance: This refers to your comfort level with potential fluctuations in interest rates and mortgage payments.

- Risk-Averse: If you prefer predictability and stability, a fixed-rate mortgage offers consistent payments, shielding you from rate changes.

- Risk-Tolerant: If you’re comfortable with potential fluctuations and are confident in your financial outlook, an ARM could be a good fit, potentially offering lower initial rates.

Evaluating these aspects sets the stage for a well-informed decision about whether a fixed or adjustable-rate mortgage aligns with your financial goals.

Long-Term vs. Short-Term Homeownership Plans

When choosing between a fixed and adjustable mortgage rate, it’s crucial to consider your long-term and short-term homeownership plans. If you envision yourself living in your home for a considerable amount of time, a fixed-rate mortgage may be a good fit. This option provides predictable monthly payments, shielding you from fluctuating interest rates and offering a sense of financial security.

However, if you’re planning to move within a shorter timeframe, an adjustable-rate mortgage could be more advantageous. Initially, you may benefit from lower interest rates, potentially allowing you to purchase a more expensive home or make larger down payments. But remember, rates can change over time, potentially leading to higher monthly payments if you stay in the home longer than anticipated.

Making an Informed Decision for Your Mortgage

Choosing the right mortgage is a crucial decision that can significantly impact your finances for years to come. Two common options are fixed-rate mortgages and adjustable-rate mortgages (ARMs), each with its own advantages and disadvantages. To make an informed choice that aligns with your financial goals, it’s essential to understand the key differences and consider your individual circumstances.

Fixed-Rate Mortgages offer a predictable monthly payment for the entire loan term. This stability provides peace of mind and allows you to budget effectively. However, fixed-rate mortgages typically come with a slightly higher initial interest rate compared to ARMs.

Adjustable-Rate Mortgages (ARMs) start with a lower introductory interest rate, often making them more affordable in the early years of the loan. However, the interest rate can adjust periodically based on market conditions, potentially leading to higher monthly payments over time.

To determine the best option for you, consider factors such as your financial outlook, risk tolerance, and anticipated homeownership timeline. If you prefer predictable payments and long-term stability, a fixed-rate mortgage may be a suitable choice. If you’re looking for lower initial payments and anticipate a shorter homeownership period, an ARM might be a better fit.

Ultimately, the best mortgage choice depends on your individual circumstances. Consult with a qualified mortgage professional to explore your options and determine the best path toward achieving your financial goals.