Are you a homeowner or a renter? This is a question that many people ask themselves when it comes to insurance. While both homeowners and renters need to protect their property and belongings, the type of insurance they need will differ. Homeowners insurance is designed to protect the structure of your home, as well as your personal belongings, from a variety of perils, such as fire, theft, and natural disasters. Renters insurance, on the other hand, is designed to protect your personal belongings in case of a covered loss. It does not cover the structure of the building you live in.

So, which type of insurance is right for you? This depends on a variety of factors, including your individual needs and circumstances. If you’re a homeowner, you’ll need homeowners insurance to protect your investment. If you’re a renter, you’ll need renters insurance to protect your belongings. Read on to learn more about the differences between homeowners insurance and renters insurance and which type of coverage is right for you.

Understanding the Basics of Homeowners Insurance

Homeowners insurance is a vital component of responsible homeownership. It provides financial protection against various risks that could damage your property or possessions, leaving you with significant financial burdens. Understanding the fundamental aspects of homeowners insurance is crucial for making informed decisions about your coverage and ensuring adequate protection for your investment.

Homeowners insurance typically covers three primary areas:

- Dwelling Coverage: This covers the physical structure of your home, including the roof, walls, plumbing, and electrical systems. It protects you from damage caused by events like fires, storms, vandalism, or other covered perils.

- Personal Property Coverage: This portion covers your belongings within your home, such as furniture, electronics, clothing, and jewelry. The coverage amount is typically based on the actual cash value or replacement cost of your possessions.

- Liability Coverage: This protects you if someone is injured on your property or if you accidentally cause damage to someone else’s property. It covers legal expenses and any settlements or judgments against you.

In addition to these core components, homeowners insurance may offer optional coverage for various events, such as floods, earthquakes, or specific perils like sewer backups or identity theft. It’s crucial to carefully evaluate your needs and choose a policy that offers adequate protection for your specific situation.

When considering homeowners insurance, factors like the age and value of your home, your location, and the level of coverage you desire all play a role in determining the premium. It’s highly advisable to consult with an insurance agent to discuss your individual requirements and obtain personalized recommendations.

What Does Homeowners Insurance Cover?

Homeowners insurance is designed to protect your biggest investment: your home. It covers losses from various events, providing financial support in case of unexpected incidents. The exact coverage can vary depending on your policy and state, but generally, it includes:

Dwelling Coverage: This protects the physical structure of your home, including the roof, walls, foundation, and built-in appliances, against perils like fire, lightning, windstorms, hail, and vandalism.

Other Structures Coverage: This extends coverage to detached structures on your property, such as sheds, garages, and fences, against similar perils.

Personal Property Coverage: This protects your belongings within your home, including furniture, clothing, electronics, and other personal items, against perils like theft, fire, and natural disasters.

Liability Coverage: This protects you if someone gets injured on your property or if you accidentally cause damage to someone else’s property. This can cover medical expenses, legal defense costs, and settlements.

Additional Living Expenses Coverage: This helps cover temporary living expenses, such as hotel stays or rental costs, if your home is uninhabitable due to a covered peril.

Remember, homeowners insurance policies often come with deductibles, which is the amount you pay out-of-pocket before insurance coverage kicks in. Understanding your policy and its specifics, including coverage limits and exclusions, is crucial to ensuring you have adequate protection.

Types of Homeowners Insurance Policies

Homeowners insurance policies are designed to protect your home and belongings from a variety of risks, such as fire, theft, and natural disasters. There are several different types of policies available, each with its own set of coverage options and premiums. Here are some of the most common types:

HO-3: Special Form

The most comprehensive homeowners insurance policy, the HO-3, provides coverage for all direct physical losses to your home and belongings, unless specifically excluded. It typically covers damage from perils such as fire, windstorm, hail, and vandalism. The HO-3 policy also offers liability coverage, protecting you financially if someone is injured on your property.

HO-5: Comprehensive Form

The HO-5 policy is similar to the HO-3 but offers even broader coverage, insuring against all risks, except those specifically excluded. This means that it protects your home and belongings from virtually any type of damage, including those caused by wear and tear or negligence. HO-5 policies are more expensive than HO-3 policies due to their extensive coverage.

HO-8: Older Homes Coverage

Designed for older homes, the HO-8 policy provides coverage on an “actual cash value” basis. This means that you’ll receive the fair market value of your home and belongings, minus depreciation, in the event of a loss. While it offers less coverage than HO-3 and HO-5 policies, it can be a more affordable option for older homes with unique or valuable features.

HO-6: Condominium Unit Coverage

Condominium owners often purchase an HO-6 policy to protect their personal belongings and the interior of their unit. It typically covers personal property, liability, and some structural damage. However, it’s important to note that the condo association’s master policy covers the common areas and exterior of the building.

HO-4: Renters Insurance

While technically not a homeowners insurance policy, HO-4 provides coverage for renters. It protects your personal belongings against damage or loss and also offers liability coverage in case someone is injured in your rental unit. This type of insurance is crucial for renters, as their landlords’ policies typically don’t cover their personal property.

Choosing the right homeowners insurance policy for your needs can be challenging. It’s essential to understand the different types of coverage options available and select a policy that best protects your home and belongings. Consulting with a qualified insurance agent can help you determine the right policy for your unique circumstances.

Factors Affecting Homeowners Insurance Premiums

Homeowners insurance premiums are calculated based on a variety of factors. These factors are used to assess the risk of your home being damaged or destroyed. The higher the risk, the higher your premium will be. Here are some of the key factors that affect your homeowners insurance premium:

Location: Your home’s location plays a significant role in determining your premium. Areas with higher risk of natural disasters, such as earthquakes, hurricanes, or wildfires, tend to have higher premiums.

Home Value: The value of your home is a major factor in determining your premium. The more valuable your home is, the more it will cost to insure.

Coverage Amount: The amount of coverage you choose will also affect your premium. The higher the coverage amount, the higher the premium.

Deductible: Your deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to a lower premium.

Home Features: The features of your home, such as the age, construction materials, and security features, can also affect your premium. For example, a home with a newer roof or a security system may receive a lower premium.

Credit Score: Your credit score may be used to determine your insurance premium in some states. This is because insurers have found a correlation between credit score and claims history.

Claims History: Your past claims history is another important factor. If you have a history of filing claims, you’re likely to have a higher premium.

It’s important to understand these factors and how they can affect your homeowners insurance premiums. By understanding these factors, you can make informed decisions about your coverage and potentially lower your premium.

Delving into Renters Insurance

Renters insurance is a crucial investment for anyone renting an apartment, condo, or house. It provides financial protection against unexpected events that can damage your belongings and disrupt your life. While your landlord’s insurance covers the building itself, it doesn’t cover your personal possessions. Renters insurance bridges this gap, safeguarding your valuables from potential losses.

Here’s a breakdown of what renters insurance typically covers:

- Personal property coverage: This covers your belongings, such as furniture, electronics, clothing, and jewelry, against damage or theft. The coverage amount is usually based on an actual cash value or replacement cost basis.

- Liability coverage: This protects you if someone is injured on your property or you accidentally damage someone else’s property. It provides legal defense and financial compensation for any claims against you.

- Additional living expenses: If your apartment becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing, food, and other essential expenses while you’re displaced.

- Medical payments coverage: This provides coverage for medical expenses if someone is injured on your property, regardless of who is at fault.

The cost of renters insurance is relatively affordable, typically ranging from $10 to $30 per month, depending on factors like your location, coverage limits, and the value of your belongings. To determine the right coverage for your needs, consider the value of your possessions, the level of risk in your area, and your budget.

While it might seem like an unnecessary expense, renters insurance offers peace of mind knowing you’re financially protected in case of unforeseen events. By investing in renters insurance, you’re taking a proactive step to protect your assets and avoid potential financial hardship.

Coverage Provided by Renters Insurance

Renters insurance is a crucial aspect of protecting your belongings and financial well-being while renting a property. It provides coverage for various losses and damages that can occur within your rented dwelling. Unlike homeowners insurance, which covers the structure itself, renters insurance focuses on the contents of your apartment or house.

Here are some key aspects of coverage provided by renters insurance:

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and other personal items, against damage or theft. It typically includes coverage for both actual cash value (ACV) and replacement cost value (RCV).

- Liability Coverage: If you are held liable for injuries or damages to others, such as a guest tripping and falling in your apartment, liability coverage protects you against financial losses. It often provides legal defense and covers medical expenses or property damage claims.

- Loss of Use Coverage: In the event of a covered loss, such as a fire, that forces you to live elsewhere temporarily, this coverage reimburses you for additional living expenses, like hotel stays or meals.

- Personal Liability Coverage: This coverage extends to your personal actions outside your rented dwelling, such as if you accidentally injure someone while walking your dog.

- Medical Payments Coverage: This coverage helps pay for medical expenses for guests who are injured on your property, regardless of fault.

It’s essential to note that the specific coverage details and limits may vary depending on your chosen insurance policy. Therefore, it’s crucial to thoroughly review your policy document and understand its terms and conditions.

Exclusions in Renters Insurance Policies

While renters insurance offers crucial protection for your belongings, it’s essential to understand its limitations. Policies typically exclude coverage for certain events, situations, or items. This means that if your property is damaged or lost due to an excluded cause, you won’t receive compensation from your insurer.

Here are some common exclusions in renters insurance policies:

- Acts of war, terrorism, and nuclear disasters: These events are generally considered beyond the scope of standard insurance coverage.

- Damage caused by negligence: If your property is damaged due to your own negligence, such as leaving a window open during a storm, your insurance may not cover the loss.

- Earthquakes and floods: These natural disasters typically require separate coverage, often through specialized policies.

- Certain types of property: Some items, such as cash, jewelry, and valuable collections, may have specific coverage limitations or require additional endorsements.

- Certain types of damage: Damage caused by pests, mold, or gradual wear and tear is often excluded.

It’s important to carefully review your policy and understand the specific exclusions it contains. Consult with your insurance agent to discuss any concerns or to explore options for additional coverage.

Choosing the Right Coverage Limits for Your Needs

Once you’ve decided whether homeowners or renters insurance is right for you, it’s time to think about coverage limits. This refers to the maximum amount your insurance company will pay for covered losses. Choosing the right limits is crucial to ensure you have enough protection in case of an unexpected event.

Here are some key factors to consider when determining your coverage limits:

- Replacement Cost vs. Actual Cash Value: Replacement cost coverage pays to rebuild or replace damaged property at its current market value, while actual cash value takes depreciation into account. Replacement cost is generally more expensive but offers better protection.

- Dwelling Coverage: This covers the structure of your home or the building you rent. Determine the cost to rebuild or repair your home based on current construction costs and adjust your coverage accordingly.

- Personal Property Coverage: This protects your belongings inside your home or apartment. Consider the value of your furniture, electronics, clothing, and other possessions. Remember, coverage limits may apply to specific items, so it’s crucial to review these details with your insurer.

- Liability Coverage: This protects you if someone is injured on your property or you accidentally damage someone else’s property. Consider the potential risks associated with your lifestyle and choose limits that provide adequate coverage for potential liability claims.

It’s essential to consult with an insurance agent to understand your individual needs and determine the appropriate coverage limits for your situation. They can help you tailor your policy to ensure you have the right protection for your property and belongings.

Comparing Homeowners and Renters Insurance Costs

When comparing homeowners and renters insurance costs, several factors come into play. Homeowners insurance typically costs more than renters insurance due to the coverage it provides. It protects not only your personal belongings but also the structure of the home itself. This includes coverage for damages caused by fire, theft, natural disasters, and other perils.

Renters insurance, on the other hand, focuses on your personal possessions. It covers losses due to fire, theft, vandalism, and other events. However, it doesn’t protect the building itself. This makes it a more affordable option for tenants.

Here’s a breakdown of key cost-influencing factors:

- Location: Areas prone to natural disasters, such as earthquakes or hurricanes, will have higher premiums.

- Home Value: For homeowners insurance, the value of your home directly impacts the cost. Higher value homes mean higher premiums.

- Coverage Amount: Choosing higher coverage limits for both homeowners and renters insurance will lead to higher premiums.

- Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim but results in lower premiums.

- Insurance Company: Different insurance companies have varying pricing structures and discounts. It’s essential to compare quotes from multiple providers.

Ultimately, the cost of your insurance policy depends on your specific needs and circumstances. It’s crucial to assess your risks and choose coverage that aligns with your budget and the value of your belongings.

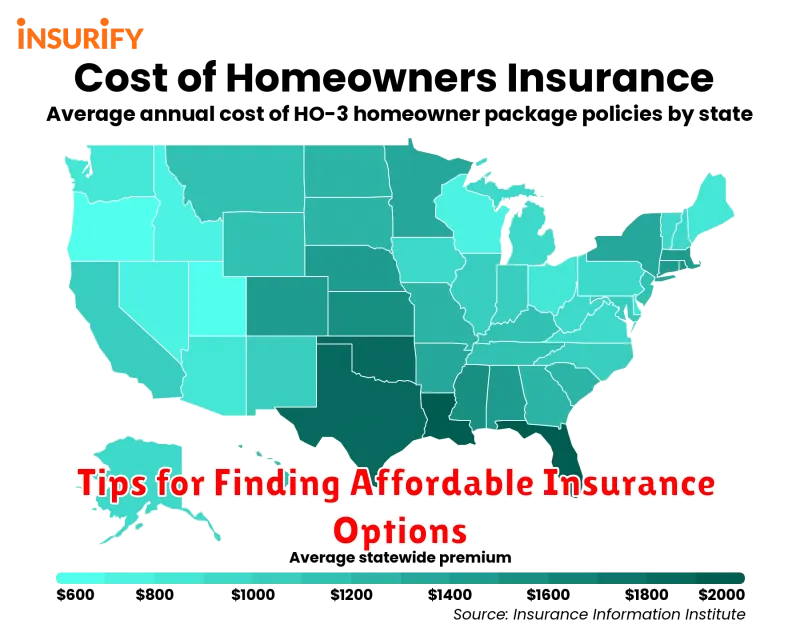

Tips for Finding Affordable Insurance Options

Finding the right insurance coverage at an affordable price can feel like a daunting task. But don’t worry, with a little research and smart shopping, you can find a policy that protects your belongings and fits your budget. Here are some tips to help you get started:

1. Shop Around and Compare Quotes: Don’t settle for the first quote you get. Compare quotes from multiple insurance providers to find the best rates. You can use online comparison tools or contact insurance agents directly.

2. Consider Bundling Policies: Bundling your homeowners or renters insurance with other policies, such as auto insurance, can often result in significant discounts. Ask your insurer about potential savings.

3. Increase Your Deductible: Choosing a higher deductible can lower your monthly premiums. However, be sure you can afford to pay the deductible in case of a claim.

4. Improve Your Home Security: Installing security systems, smoke detectors, and other safety features can make your home less risky and qualify you for discounts on your insurance.

5. Ask About Discounts: Many insurers offer discounts for things like being a good driver, having a good credit score, or being a loyal customer. Be sure to ask about all available discounts.

6. Negotiate Your Premium: Once you’ve found a policy you like, don’t be afraid to negotiate your premium. Explain your situation and see if the insurer is willing to work with you.

By following these tips, you can increase your chances of finding affordable and comprehensive insurance coverage that meets your needs.

Making an Informed Decision for Your Property Protection

When it comes to protecting your property and belongings, choosing the right insurance is crucial. Two common options are homeowners insurance and renters insurance, but they differ in coverage and protection. Understanding these differences is essential for making an informed decision that aligns with your specific needs.

Homeowners insurance primarily protects the structure of your house and your personal belongings from various risks, including fire, theft, and natural disasters. It also provides liability coverage if someone gets injured on your property. On the other hand, renters insurance focuses on protecting your personal belongings within your rental unit. It typically covers damage or loss due to fire, theft, vandalism, and some natural disasters. While it doesn’t protect the structure of the building itself, renters insurance provides liability coverage for incidents occurring within your rented space.

Ultimately, the best choice depends on your unique situation. If you own a home, homeowners insurance is essential. If you rent, renters insurance offers valuable protection for your belongings. Consider factors such as the value of your possessions, the risk of potential damage, and your budget to make an informed decision. Consulting with an insurance agent can provide personalized guidance and help you choose the policy that best suits your needs.