Are you considering investing in real estate but unsure which strategy to pursue? The real estate market offers a variety of investment options, and two of the most popular are short-term and long-term investing. While both approaches have their merits, understanding the key differences and considerations is crucial for making an informed decision that aligns with your financial goals and risk tolerance.

This article will delve into the intricacies of both short-term and long-term real estate investing, highlighting the pros and cons of each strategy. We’ll explore the potential returns, risks, and factors to consider when deciding which path is right for you. Whether you’re a seasoned investor or a first-timer, this comprehensive guide will equip you with the knowledge to make an informed choice and embark on a successful real estate investment journey.

Defining Short-Term and Long-Term Real Estate Investments

Real estate investing can be broken down into two main categories: short-term and long-term. The distinction lies primarily in the investor’s intended holding period for the property.

Short-term real estate investments involve holding a property for a shorter duration, typically less than a year. This often involves strategies like:

- Flipping: Purchasing properties, making necessary renovations, and then reselling them for a profit within a short timeframe.

- Wholesaling: Identifying undervalued properties, putting them under contract, and then selling the contract to another investor.

- Short-term rentals: Renting out properties for short periods, such as through platforms like Airbnb.

Long-term real estate investments focus on holding properties for extended periods, often several years or even decades. Common strategies include:

- Buy-and-hold: Purchasing properties with the intent of renting them out and generating passive income over time.

- Rental property development: Constructing or acquiring multi-unit properties for rental purposes, aiming for consistent cash flow and appreciation.

- Land investment: Acquiring undeveloped land for future development or potential appreciation.

Pros and Cons of Short-Term Real Estate Strategies

Short-term real estate investing involves holding properties for a shorter period, typically less than a year. This strategy aims to generate quick profits through flipping, renting, or short-term rentals. While it offers potential for high returns, it also comes with significant risks.

Pros:

- Faster Returns: Short-term strategies can yield quicker profits compared to long-term investments.

- Flexibility: Investors can adapt to market changes and capitalize on opportunities more easily.

- Active Income: Short-term rentals provide regular income streams, allowing for consistent cash flow.

Cons:

- Higher Risk: Short-term strategies are more sensitive to market fluctuations, making them riskier than long-term investments.

- Increased Costs: Frequent renovations, marketing, and tenant turnover can result in higher expenses.

- Time Commitment: Managing short-term rentals demands significant time and effort, requiring active involvement.

Short-term real estate strategies can be lucrative, but they require careful planning, market knowledge, and a higher risk tolerance. It’s essential to weigh the potential rewards against the risks involved before committing to this approach.

Flipping Properties for Profit: A Short-Term Approach

Flipping properties, also known as house flipping, is a popular short-term real estate investment strategy. It involves purchasing undervalued properties, making necessary improvements, and then reselling them for a profit within a short timeframe. This approach typically involves holding the property for a few months to a year before listing it for sale.

The success of flipping properties hinges on a few key factors:

- Identifying undervalued properties: Finding properties with good potential for appreciation after renovations is crucial. This often involves looking for fixer-uppers, foreclosures, or properties in up-and-coming neighborhoods.

- Effective renovation planning: A well-thought-out renovation strategy that considers market trends and budget constraints is essential. It should prioritize improvements that increase the property’s appeal and market value.

- Timely execution: Flipping properties requires efficient project management to keep renovations on schedule and within budget. Delays can significantly impact profitability.

- Strong marketing and sales skills: Presenting the renovated property effectively to attract potential buyers is vital. This often involves professional photography, compelling descriptions, and effective marketing strategies.

While flipping properties can offer quick returns, it also comes with risks. These include:

- Unexpected costs: Renovation projects often encounter unforeseen expenses that can eat into profits.

- Market fluctuations: Changes in market conditions can affect resale value, potentially impacting profitability.

- Time constraints: Holding properties for too long can increase holding costs and reduce profits.

Flipping properties can be a rewarding short-term investment strategy for those who have the skills, resources, and risk tolerance. It requires careful planning, execution, and a deep understanding of the local real estate market.

Generating Cash Flow with Short-Term Rentals

Short-term rentals, like those offered through platforms like Airbnb and Vrbo, can be a great way to generate significant cash flow. By renting out your property for short periods, you can earn more per night than you would with a long-term lease. This can be especially attractive if you are looking to maximize your ROI.

One of the biggest advantages of short-term rentals is the flexibility they offer. You can choose to rent out your property for as long or as short as you like, making it an ideal option for those with busy schedules or who want to try out real estate investing without committing to a long-term lease.

Furthermore, short-term rentals can be a great way to diversify your income stream. If you have a property that is not being fully utilized, you can rent it out on a short-term basis and earn extra income. This can be particularly helpful if you are looking to supplement your income or pay off debt.

Advantages of Long-Term Real Estate Investments

Long-term real estate investing offers a variety of advantages for those willing to hold onto their properties for an extended period. One of the most significant benefits is the potential for appreciation. Over time, real estate values tend to increase, particularly in areas with strong economic growth. This appreciation can translate into substantial profits when you eventually sell your property.

Another major advantage is the potential for passive income. By renting out your property, you can generate a steady stream of rental income that can help cover your expenses and build wealth over time. This passive income can be particularly attractive for those seeking to diversify their income streams.

Long-term real estate investments also offer significant tax advantages. For example, you can deduct certain expenses related to your property, such as mortgage interest and property taxes, which can help reduce your overall tax liability. Additionally, you may be able to benefit from tax-deferred exchanges or other tax-saving strategies.

Furthermore, long-term real estate investments provide stability and security. Unlike other investments that can fluctuate significantly in value, real estate tends to be a more stable asset class. This stability can be particularly appealing during times of economic uncertainty.

Last but not least, long-term real estate investments can provide a sense of control and ownership. By owning your own property, you have the ability to make decisions about its use and future. This control can be both empowering and satisfying.

Building Wealth Through Appreciation: A Long-Term Perspective

The long-term approach to real estate investing focuses on building wealth through property appreciation. This strategy involves buying properties in promising locations and holding them for an extended period, allowing for gradual increases in value. Patience is key, as long-term investors understand that substantial gains often take years to materialize.

One of the main advantages of this strategy is its potential for significant capital appreciation. As property values rise over time, long-term investors can reap the rewards of owning appreciating assets. Furthermore, this approach offers a stable and predictable income stream through rental income, which can be reinvested back into the property or used for other financial goals.

However, it’s important to consider the time commitment involved. Long-term investing requires a patient approach and the ability to weather market fluctuations. Market conditions can shift, and appreciation may not always be linear. But for those willing to commit to the long game, this strategy can offer substantial financial rewards and a solid foundation for building long-term wealth.

Passive Income Streams from Rental Properties

When it comes to real estate investing, there are two main strategies: short-term rentals and long-term rentals. Short-term rentals, such as those listed on Airbnb or VRBO, are typically rented for less than 30 days, while long-term rentals are leased for a longer period, usually 6 months to a year or more. Both strategies offer potential for passive income, but they also have unique advantages and disadvantages.

One of the key advantages of short-term rentals is the potential for higher rental income. Short-term rentals can be priced at a premium compared to long-term rentals, especially in popular tourist destinations. You can also generate additional income through amenities, such as cleaning fees, parking fees, and extra services. Short-term rentals can also provide greater flexibility and control over your property, as you can choose your own rental periods and guests.

On the other hand, long-term rentals offer the advantage of stability and predictable income. Once a tenant is in place, you can expect a steady stream of rental payments for the duration of their lease. Long-term rentals also typically involve lower operating costs and maintenance needs compared to short-term rentals, as tenants are responsible for daily upkeep. Additionally, long-term rentals can offer tax advantages, such as deductions for depreciation and mortgage interest.

Ultimately, the best strategy for you will depend on your individual circumstances and goals. If you’re looking for the potential for higher rental income and greater flexibility, short-term rentals may be a good option. However, if you prefer stability, predictability, and lower operating costs, long-term rentals may be a better choice.

Mitigating Risks in Long-Term Real Estate Holdings

While long-term real estate investing offers the potential for significant returns, it also comes with inherent risks. To mitigate these risks and ensure a successful investment, it’s crucial to implement strategies that minimize potential downsides.

One key aspect is diversification. By spreading your investments across multiple properties or geographic locations, you can reduce the impact of market fluctuations or unforeseen events in a single area. Another important factor is thorough due diligence. This involves carefully researching the property’s condition, rental market, and local economy before purchasing.

Furthermore, consistent maintenance is vital to preserving the value of your investment. Regularly addressing repairs and updating the property keeps it attractive to tenants and maximizes its lifespan. Building a strong tenant base through effective screening and management is essential to ensuring consistent cash flow and minimizing vacancy periods.

Finally, it’s wise to maintain a healthy financial buffer for unforeseen circumstances. This could include covering unexpected repairs, mortgage payments during periods of low occupancy, or market downturns. By taking these proactive steps, you can significantly reduce the risks associated with long-term real estate investments and enhance your chances of success.

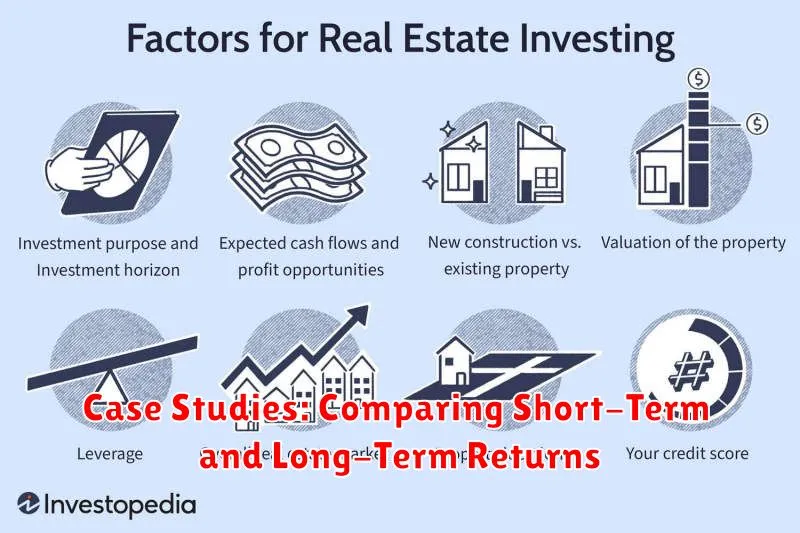

Factors to Consider When Choosing an Investment Time Horizon

When embarking on a real estate investment journey, one of the most crucial decisions you’ll face is determining your investment time horizon. This refers to the period you anticipate holding onto your investment before selling or reaping its benefits. Your time horizon plays a pivotal role in shaping your investment strategy, influencing factors like property selection, financing options, and risk tolerance.

Several key considerations come into play when choosing your investment time horizon:

- Personal Financial Goals: Are you seeking short-term income generation, such as rental income, or aiming for long-term wealth building through appreciation?

- Risk Tolerance: Short-term investments often carry higher risk, but also the potential for quicker returns. Long-term investments tend to be less volatile, providing steadier growth.

- Market Trends: Understanding the current real estate market conditions is crucial. If the market is experiencing a boom, short-term investments might be favorable. However, if the market is sluggish, a longer-term approach might be more prudent.

- Financial Situation: Your current financial situation, including your cash flow, debt levels, and available capital, will influence the feasibility of your chosen time horizon.

- Time Commitment: Short-term investments often require more active management, whereas long-term investments may allow for a more passive approach.

Ultimately, the most appropriate investment time horizon depends on your individual circumstances, goals, and risk appetite. Carefully assessing these factors will help you make an informed decision that aligns with your investment strategy and financial aspirations.

Market Conditions and Their Impact on Investment Strategies

The real estate market is constantly in flux, influenced by a complex interplay of economic, social, and political factors. Understanding these market conditions is crucial for investors, as they directly impact the viability and potential returns of different investment strategies.

Interest rates are a major driver of real estate investment. When rates are low, borrowing becomes cheaper, making it more attractive for investors to purchase property. Conversely, rising interest rates increase borrowing costs and can slow down market activity.

Economic growth also plays a significant role. A robust economy typically translates to higher demand for housing, pushing prices up. Conversely, economic downturns can lead to market stagnation or even price declines.

Inflation impacts the cost of materials, labor, and overall expenses associated with real estate. High inflation can erode the purchasing power of investors and make it more challenging to generate positive returns.

Government policies, such as tax incentives or regulations, can influence market dynamics. For instance, changes in property taxes or zoning laws can affect investment opportunities and property values.

The specific market conditions prevalent in a particular region also matter. Local demographics, job market trends, and infrastructure developments can all impact demand and pricing in a given area.

By carefully analyzing market conditions and their potential impact on investment strategies, investors can make more informed decisions, mitigating risks and maximizing potential returns.

Aligning Your Investment Goals with Your Time Horizon

A core principle in investing, regardless of the asset class, is aligning your investment goals with your time horizon. In real estate, this concept is especially relevant, as it guides your choice between short-term and long-term strategies.

Short-term real estate investing often involves quick turnarounds, like fix-and-flips or house flipping. These strategies aim for rapid capital appreciation, seeking to buy properties, renovate them, and sell them within a short period (usually under a year). They’re typically suited for investors with a shorter time horizon who seek immediate returns and are comfortable with higher risks.

On the other hand, long-term real estate investing focuses on building wealth over time. This strategy involves holding properties for extended periods (5+ years) and reaping the benefits of appreciation, rental income, and potential tax advantages. Long-term investors are often more risk-averse and prioritize steady, consistent growth over quick profits. Their time horizon allows them to navigate market fluctuations and ride out short-term downturns.

Ultimately, the right strategy hinges on your individual circumstances and investment goals. If you’re looking for quick returns and aren’t afraid of volatility, short-term strategies might be a good fit. However, if you prioritize consistent, long-term wealth accumulation and have a longer time horizon, long-term investing could be the better choice.

Case Studies: Comparing Short-Term and Long-Term Returns

To better illustrate the potential returns of short-term versus long-term real estate investing, let’s analyze some real-world case studies.

Short-Term Flip Case Study: A savvy investor purchased a distressed property for $150,000. After investing $20,000 in renovations and holding the property for 6 months, they sold it for $200,000, generating a profit of $30,000. This scenario showcases a high rate of return within a short period, but it’s essential to note that it requires significant upfront capital and expertise in finding and renovating properties.

Long-Term Rental Case Study: Another investor purchased a rental property for $250,000 with a down payment of $50,000. The property generated $2,000 per month in rental income, covering mortgage payments, property taxes, and maintenance expenses. After five years, the property’s value appreciated by 20% to $300,000. This demonstrates the potential for consistent cash flow and long-term capital appreciation, though the return on investment is slower compared to a short-term flip.

These examples highlight the different characteristics of each strategy: short-term investments tend to offer higher returns within a shorter timeframe but demand greater effort and risk, while long-term strategies provide steady cash flow and potential for gradual wealth accumulation.