Looking to unlock significant tax advantages on your real estate investments? The 1031 Exchange, also known as a “like-kind exchange,” offers a powerful strategy to defer capital gains taxes, allowing you to reinvest your proceeds into new properties and grow your portfolio. However, navigating this complex process can be tricky. Whether you’re a seasoned investor or just starting your journey, understanding the nuances of a 1031 Exchange is crucial for making informed decisions and maximizing your returns.

This comprehensive guide will demystify the 1031 Exchange, explaining its intricacies, key requirements, and potential benefits. We’ll delve into the mechanics of the exchange, explore different types of exchanges, and offer practical tips for successful implementation. Our goal is to equip you with the knowledge to confidently leverage this powerful tool to enhance your real estate investment strategy and achieve your financial goals.

Understanding the Basics of a 1031 Exchange

A 1031 exchange, formally known as a “like-kind exchange,” is a powerful tax-deferral strategy employed by real estate investors. It enables you to exchange one investment property for another, deferring capital gains taxes until you ultimately sell the replacement property. This strategy can be particularly beneficial in maximizing your returns and fostering long-term wealth accumulation in real estate.

The cornerstone of a 1031 exchange lies in the “like-kind” requirement. This essentially means that the properties involved in the exchange must be of the same nature or character. For instance, you can exchange an apartment building for an office building, or a retail property for a commercial warehouse, as they are all categorized as business real estate. However, you cannot exchange a rental property for a personal residence, as they fall under different categories.

The beauty of a 1031 exchange lies in its ability to defer capital gains taxes. Instead of paying taxes on the profit realized from selling your original property, you can reinvest that profit into a new, “like-kind” property, thereby deferring tax liability. This allows you to continue growing your real estate portfolio without immediate tax consequences.

It’s crucial to note that the 1031 exchange is a complex transaction with strict timelines and procedures. The exchange must be executed under the watchful eye of a qualified intermediary who acts as a neutral third party to facilitate the transaction. The IRS mandates specific steps and requirements that must be followed diligently to ensure the exchange qualifies for tax deferral.

Eligibility Criteria for a Successful 1031 Exchange

The 1031 exchange, also known as a “like-kind” exchange, is a powerful tool for property investors to defer capital gains taxes when selling and reinvesting in similar properties. However, not all property transactions qualify for this tax advantage. To ensure a successful 1031 exchange, you must meet specific eligibility criteria.

1. The “Like-Kind” Requirement: The most fundamental requirement is that the properties exchanged must be of “like-kind.” This means the properties should be of the same nature or character, typically within the real estate industry. For instance, an apartment building can be exchanged for a commercial office space, but not for a residential home or stocks.

2. Qualified Property Types: While the 1031 exchange applies to a wide range of real estate, certain property types are excluded. These include:

- Personal residences (unless used as rental properties)

- Property used for personal use (like a vacation home)

- Stocks, bonds, and other securities

- Tangible personal property, such as machinery or equipment

3. Timing Requirements: The 1031 exchange has strict timelines. The “identification” period, where you must identify potential replacement properties, is limited to 45 days after selling the relinquished property. You then have 180 days from the sale to actually acquire the replacement property.

4. Investment Intent: The IRS scrutinizes whether the 1031 exchange is primarily for investment purposes. If the intent is to simply sell the property for a profit or use the proceeds for personal expenses, the exchange may not qualify.

5. Proper Documentation: Accurate documentation is crucial for a successful 1031 exchange. This includes an exchange agreement, a qualified intermediary, and proper reporting for tax purposes.

Understanding these eligibility criteria is vital for property investors considering a 1031 exchange. It’s recommended to consult with a tax advisor or a qualified professional to ensure compliance and maximize the benefits of this tax-deferred strategy.

Identifying Like-Kind Properties for Your Exchange

A crucial element of a successful 1031 exchange is identifying suitable like-kind properties. These are properties that meet the IRS criteria for deferring capital gains taxes when you sell your investment property. Understanding the definition of like-kind properties and exploring various options is essential for maximizing your exchange benefits.

The IRS defines “like-kind” as properties that share similar characteristics, primarily in terms of their use and nature. This means that a commercial property can be exchanged for another commercial property, a rental property for a different rental property, and so on. The exact requirements can vary depending on the type of property involved.

Consider these key factors when identifying like-kind properties:

- Location: While geographic proximity isn’t mandatory, investing in a location that aligns with your investment goals is important.

- Property Type: You can exchange a single-family rental for a multifamily complex, a warehouse for a retail space, or a vacant lot for an industrial property, as long as they serve similar purposes.

- Value: The new property must be equal to or greater in value than the relinquished property, plus any additional cash paid.

- Investment Potential: Research the market and potential for appreciation or rental income in the new property.

Remember that identifying like-kind properties is just one part of the 1031 exchange process. You’ll also need to work with a qualified intermediary to ensure the exchange is completed correctly. Seeking professional guidance can help you navigate the complexities of a 1031 exchange and make informed decisions about your investment strategy.

Timeline and Deadlines You Need to Be Aware Of

The 1031 exchange is a powerful tax-deferral strategy for investors, but it comes with specific timelines and deadlines that must be met to avoid potential tax liabilities. Let’s break down the critical steps and deadlines involved in a successful 1031 exchange:

Identify a Replacement Property

You must identify a replacement property within 45 days of selling your relinquished property. This identification period is crucial, allowing you to explore potential properties and make an informed decision.

Closing on the Replacement Property

The next crucial step is to close on the replacement property within 180 days of selling your relinquished property. This deadline is strict and requires meticulous planning to ensure timely completion of the transaction.

Timing Considerations

It’s essential to remember that the clock starts ticking from the moment you sell your relinquished property. This means that the identification and closing periods are separate and independent of each other. Careful planning is key to ensuring you meet these deadlines.

Benefits of Utilizing a 1031 Exchange

A 1031 exchange, also known as a like-kind exchange, is a powerful tool for property investors looking to defer capital gains taxes. This strategy allows you to sell an investment property and reinvest the proceeds into a new, like-kind property without having to pay capital gains taxes at the time of the sale. This deferral of taxes can significantly boost your returns and accelerate your wealth-building journey.

Here are some of the key benefits of utilizing a 1031 exchange:

Tax Deferral

The primary advantage of a 1031 exchange is its ability to defer capital gains taxes. Instead of paying taxes on the sale of your investment property, you can reinvest the proceeds into a new property, allowing you to grow your wealth tax-free. This deferral can lead to substantial savings over time, as the amount of deferred taxes compounds with each subsequent exchange.

Increased Purchasing Power

By deferring capital gains taxes, you gain access to more capital, which can be used to purchase a larger or more valuable property. This increased purchasing power allows you to scale your investment portfolio faster and unlock new opportunities.

Continuous Investment Growth

The 1031 exchange allows you to continue investing and building your real estate portfolio without being hampered by tax liabilities. By rolling over your capital gains, you can reinvest in properties that align with your investment goals and continue to grow your wealth steadily.

Estate Planning

A 1031 exchange can be a valuable tool for estate planning. By strategically utilizing this strategy, you can transfer ownership of your investment properties to your heirs while minimizing the tax burden on your estate. This can help protect your family’s wealth and ensure a smooth transition of assets.

Reduced Transaction Costs

Since a 1031 exchange allows you to defer capital gains taxes, you can reinvest more of your proceeds into the new property. This can reduce the overall transaction costs associated with purchasing a new property and improve your overall return on investment.

It’s important to note that a 1031 exchange requires careful planning and adherence to specific regulations. Consulting with a qualified real estate attorney or tax advisor is essential to ensure you meet all the requirements and maximize the benefits of this powerful tax-saving strategy.

Potential Drawbacks and Risks Involved

While the 1031 exchange offers significant tax advantages, it’s crucial to understand the potential drawbacks and risks involved. One key risk is the time constraint associated with completing the exchange. You have a limited timeframe to identify and acquire a replacement property, which can be challenging, especially in competitive markets. Failing to meet these deadlines can result in losing the tax deferral benefits.

Another concern is the potential for higher acquisition costs. The replacement property may be more expensive than the relinquished property, leading to a larger mortgage and higher ongoing expenses. This can impact your cash flow and overall investment returns.

It’s important to note that the IRS rules governing 1031 exchanges are complex. Navigating these regulations requires expert guidance and adherence to strict procedures. Failing to comply can result in penalties and jeopardize the tax benefits.

Furthermore, liquidity constraints are a common drawback. The 1031 exchange essentially ties up your capital in real estate, limiting access to cash for other investments or personal needs. This can be problematic if you require immediate funds for unforeseen circumstances.

Finally, market fluctuations can significantly impact the outcome of a 1031 exchange. If the value of the replacement property drops after the exchange, you could end up with a less valuable asset than the one you relinquished. This can negatively affect your long-term investment strategy.

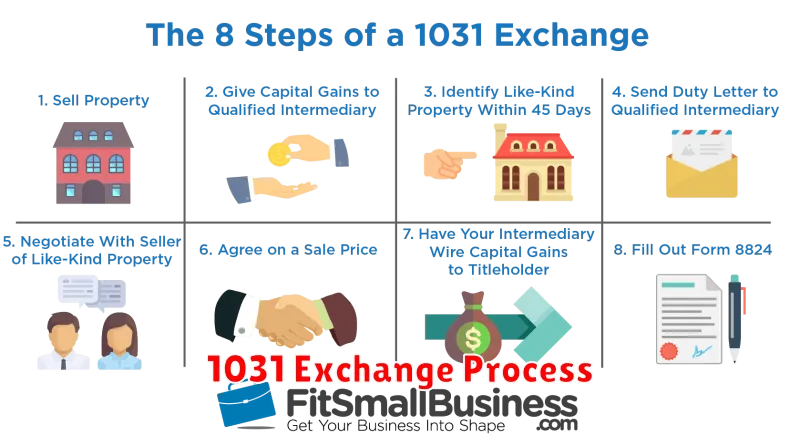

Step-by-Step Process of Executing a 1031 Exchange

A 1031 exchange, also known as a like-kind exchange, allows property investors to defer capital gains taxes when selling an investment property and reinvesting the proceeds into another qualified property. This complex process requires careful planning and execution to ensure successful tax deferral. Here’s a step-by-step guide to navigating a 1031 exchange:

1. Identify a Replacement Property: Begin by searching for a suitable replacement property that meets the “like-kind” requirement. This generally means the replacement property must be of the same nature or character as the relinquished property.

2. Engage a Qualified Intermediary: A qualified intermediary is an essential component of a 1031 exchange. They act as an independent third party, handling the exchange process and ensuring compliance with IRS regulations. Choose an intermediary with experience and a proven track record.

3. Execute a Binding Contract for the Sale of the Relinquished Property: Enter into a binding contract for the sale of your current investment property, commonly known as the “relinquished property.” This contract should include a closing date and a clear understanding of the sale terms.

4. Identify and Contract for the Replacement Property: Once you’ve found a suitable replacement property, negotiate and sign a binding contract for its purchase. This contract should include a closing date that aligns with the sale of your relinquished property.

5. Transfer Title to the Intermediary: Upon closing on the sale of the relinquished property, the proceeds are transferred to the qualified intermediary, who holds the funds in escrow.

6. Purchase the Replacement Property: The intermediary, using the funds received from the sale of the relinquished property, will then purchase the replacement property on your behalf. The closing of the replacement property purchase must occur within the 45-day identification period or 180-day exchange period to maintain tax deferral eligibility.

7. Complete the Exchange: Once the closing of the replacement property is complete, the 1031 exchange is finalized. The title to the replacement property is then transferred to you, allowing you to continue owning and managing the property.

Navigating a 1031 exchange can be complex. Consult with your tax advisor and a qualified intermediary to ensure compliance with IRS regulations and maximize tax benefits.

Choosing the Right Qualified Intermediary for Your Transaction

Navigating a 1031 exchange, a powerful tool for deferring capital gains taxes, requires expert guidance. A Qualified Intermediary (QI) acts as a crucial third party, ensuring the smooth and compliant execution of your exchange. Choosing the right QI is paramount to the success of your transaction.

Look for a QI with extensive experience in 1031 exchanges. They should be familiar with the intricate rules and regulations, ensuring your transaction adheres to IRS requirements. Consider their track record, client testimonials, and industry reputation.

Communication is vital during an exchange. Select a QI who is responsive, accessible, and provides clear explanations. They should be able to answer your questions and address your concerns throughout the process.

Fees vary among QIs. While cost is a factor, prioritize experience, expertise, and communication. Obtain detailed fee breakdowns to compare and ensure transparency.

Ultimately, your QI should be a trusted advisor, guiding you through the complexities of a 1031 exchange. Seek professional recommendations and conduct thorough research before making your decision.

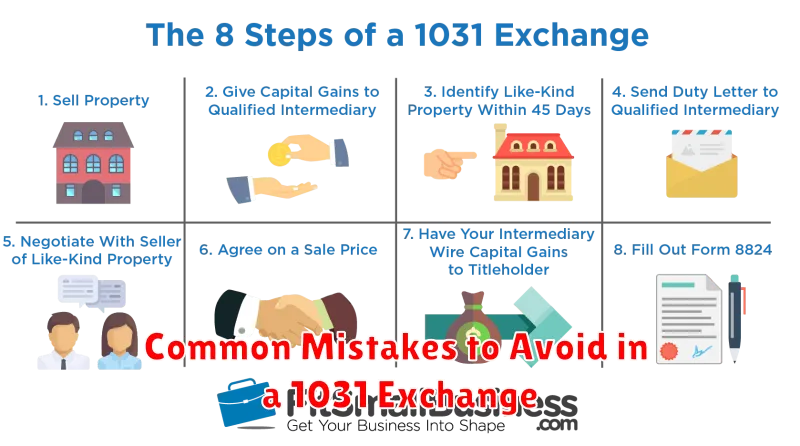

Common Mistakes to Avoid in a 1031 Exchange

A 1031 exchange, also known as a like-kind exchange, allows investors to defer capital gains taxes by exchanging one investment property for another. While this can be a powerful tool for real estate investors, several common mistakes can jeopardize your exchange and leave you liable for hefty tax burdens. Here’s a breakdown of common pitfalls to avoid:

1. Not Identifying a Replacement Property: Before selling your existing property, you must have a replacement property identified. This can be a specific property or a general description that meets the like-kind requirement. Failing to identify a replacement property can result in your exchange being disqualified.

2. Exceeding the 45-Day Identification Period: You have 45 days from the closing date of your relinquished property to identify potential replacement properties. Be sure to select properties that meet the like-kind requirements, and don’t hesitate to seek guidance from a qualified professional.

3. Missing the 180-Day Closing Deadline: Once you’ve identified your replacement property, you have 180 days to close on it. The clock starts ticking from the day you sell your relinquished property, and failure to meet this deadline could lead to taxable gains.

4. Neglecting Due Diligence: The excitement of a 1031 exchange can overshadow crucial due diligence on your potential replacement property. Conduct thorough inspections, review relevant documents, and ensure the property meets your investment goals.

5. Improper Use of Exchange Funds: You can’t directly receive or use the proceeds from the sale of your relinquished property. These funds must be held in a qualified intermediary account, and only the intermediary can be used to purchase your replacement property. Using the funds for personal expenses can jeopardize your exchange.

6. Failing to Consult with Experts: A 1031 exchange is a complex process that requires expert guidance. Work with qualified professionals, including a real estate attorney, a qualified intermediary, and a tax advisor, to ensure your exchange meets all legal requirements and avoids costly mistakes.

Tax Implications and Deferral Strategies

One of the most compelling advantages of a 1031 exchange is its ability to defer capital gains taxes. When you sell a property for a profit, you typically have to pay capital gains tax on that profit. However, with a 1031 exchange, you can defer those taxes by reinvesting the proceeds from the sale into a like-kind property. This can be a significant financial advantage, as it allows you to keep more of your investment proceeds working for you.

The deferral strategy involves using the proceeds from the sale of one property to acquire another, qualifying property within a specific timeframe. This allows you to avoid paying taxes on the capital gains until you eventually sell the replacement property. The 1031 exchange is a powerful tool for investors looking to grow their real estate portfolio without incurring immediate tax liabilities.

It’s important to note that the 1031 exchange defers, but does not eliminate, capital gains taxes. You will eventually have to pay capital gains tax when you sell the replacement property. However, the deferral can provide you with valuable time to build equity in your new property and potentially increase your overall returns.

In addition to the deferral of capital gains taxes, the 1031 exchange can also help you avoid depreciation recapture taxes. When you sell a property that you have depreciated for tax purposes, you are required to pay taxes on the depreciation recapture. However, a 1031 exchange allows you to transfer the depreciation basis to the new property, avoiding this tax liability. The ability to avoid these taxes is another key advantage of utilizing the 1031 exchange.

While the 1031 exchange offers attractive tax advantages, it’s essential to understand that it is a complex transaction with stringent requirements. There are strict deadlines and specific guidelines that must be followed. It’s highly advisable to consult with a qualified tax advisor or real estate attorney who specializes in 1031 exchanges to ensure that you comply with all applicable rules and regulations.

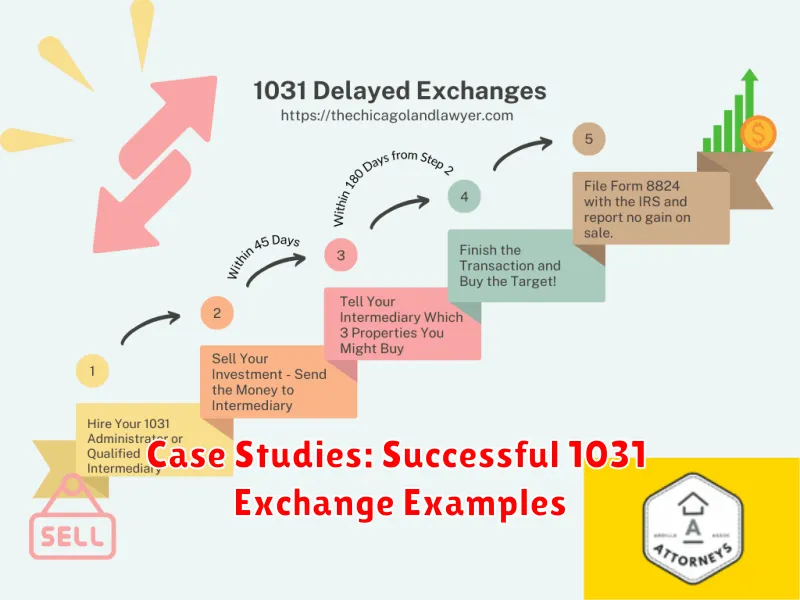

Case Studies: Successful 1031 Exchange Examples

The 1031 exchange offers a powerful strategy for property investors to defer capital gains taxes, but it can be complex. Seeing successful 1031 exchange examples in action can bring clarity and demonstrate the benefits of this strategy. Here are a few real-world examples:

Example 1: The “Upsize” Exchange

A real estate investor owned a small apartment building in a growing city. They wanted to sell the property and acquire a larger, multi-family building in a more desirable location. Using a 1031 exchange, the investor sold their apartment building and purchased the larger multi-family property within the allowed timeframe. The investor successfully deferred capital gains tax on the sale of the smaller property, allowing them to reinvest the proceeds in a larger and more lucrative asset.

Example 2: The “Diversification” Exchange

An investor owned a single-family rental property. They wanted to diversify their portfolio and invest in a commercial property. They used a 1031 exchange to sell the rental property and acquire a retail property in a thriving business district. This exchange enabled the investor to move into a new asset class and potentially generate higher rental income.

Example 3: The “Retirement Planning” Exchange

An investor owned a commercial property they intended to sell in retirement. To defer taxes and maintain a steady income stream, they opted for a 1031 exchange. They purchased a smaller, more manageable rental property that generated income without requiring as much hands-on management. This exchange helped them transition to a lower-maintenance investment strategy while still reaping the benefits of real estate ownership.

These case studies illustrate the versatility and power of the 1031 exchange. It’s a valuable tool for investors looking to optimize their real estate portfolio, manage tax liabilities, and achieve their investment goals. Understanding the process and seeking professional guidance can help you successfully navigate the complexities of this strategy.

1031 Exchanges vs. Other Investment Strategies

When it comes to property investment, the 1031 exchange offers a unique way to defer capital gains taxes. But is it always the best strategy? Let’s compare it to other popular investment approaches to see how it stacks up.

1031 Exchange Advantages:

- Tax Deferral: The primary benefit is deferring capital gains taxes. You can reinvest your profits into a new property without paying taxes until you eventually sell that property.

- Growth Potential: You can acquire a more valuable property, potentially increasing your long-term returns.

- Flexibility: You can exchange into a different type of property, location, or even a property in another state.

Other Investment Strategies:

- Selling and Paying Taxes: You can simply sell your property, pay the capital gains taxes, and invest the remaining funds. This gives you immediate liquidity but also means you lose the tax deferral advantage.

- Holding and Appreciation: Holding onto your property long-term can lead to appreciation. This strategy avoids immediate taxes but potentially limits your ability to diversify or reinvest in other opportunities.

- Debt Refinancing: Refinancing your property can provide cash flow for other investments, but it might not be the best strategy if you want to acquire a larger or more valuable property.

The Bottom Line:

The best strategy depends on your individual financial goals, risk tolerance, and time horizon. A 1031 exchange can be a powerful tool for deferring taxes and growing your wealth, but it’s important to consider the potential downsides and compare it to other options.

Consulting with a qualified tax advisor and real estate professional is essential to make informed decisions about your investment strategy.

Expert Tips for Maximizing Your 1031 Exchange

The 1031 exchange, also known as a like-kind exchange, is a powerful tool for property investors seeking to defer capital gains taxes. To make the most of this strategy, follow these expert tips:

1. Plan Ahead: The 1031 exchange process has strict timelines and requirements. Start planning early and consult with a qualified 1031 exchange intermediary. This will ensure you meet all deadlines and avoid costly mistakes.

2. Identify a Suitable Replacement Property: It’s crucial to find a like-kind property to qualify for the exchange. This doesn’t mean it has to be identical, but it must be real estate for real estate. Focus on properties that meet your investment goals and have long-term potential.

3. Consider Property Value: The replacement property should generally be of equal or greater value than the relinquished property. This will maximize your tax benefits. You can also use the 1031 exchange to “step up” into a more expensive property.

4. Negotiate Strong Terms: When purchasing the replacement property, be sure to negotiate favorable terms, including the purchase price, financing options, and closing date. Remember, your goal is to maximize your investment, not simply defer taxes.

5. Stay Organized and Document Everything: Throughout the 1031 exchange process, meticulous documentation is essential. Keep all records, including contracts, closing statements, and correspondence, in a safe place. This will help you prove compliance and avoid potential audits.

6. Engage Professional Expertise: Don’t underestimate the value of professional guidance. Work with a knowledgeable real estate attorney, accountant, and 1031 exchange intermediary to ensure you comply with all regulations and make informed decisions.